3 Popular Investing Accounts (which one is best...?)

May 24, 2025Read time - 3 minutes / Disclosure

The right investing account can:

- Lower your taxes.

- Boost your investments.

- Help you build wealth faster.

Unfortunately, it can be a tough decision.

Investing Choices

Financial gurus often say the wrong account can:

- Cost you time.

- Cost you money.

- Keep you at the 9-5 longer.

So how do you decide?

2025 investment account limits:

— JOHN HENRY (@thejohnhenry_) January 2, 2025

- IRA: $7,000

- FSA: $3,300

- HSA: $4,300

- 401k: $23,500

- SEP IRA: $70,000

- Simple IRA: $16,500

Let's go!

IRAs, FSAs, and other account types can be confusing.

They were for me at first.

But I knew figuring them out would help me leave 9-5 life sooner.

So — I studied them like crazy.

And set my freedom goals:

1. Go from $0 to $1M+ as quickly as possible.

2. Escape 9-5 life in my 30s or 40s (instead of my 60s).

3. Start building my ideal life.

These goals seemed impossible at first.

So I studied other people that had success.

And did my best to copy them.

Stocks and real estate helped get me to the $1M mark.

After leaving my 9-5 in 2020.

Working this little online biz part time became my new focus.

To help other people figure out investing too.

Here's 3 popular stock investing accounts to consider on your journey (plus which ones worked best for me):

Hope it's helpful.

Let's dive in:

1. The Self Directed Brokerage

Here's 4 key points:

1. Anyone can open one.

2. You can invest as much as you want.

3. You can take money out whenever you want.

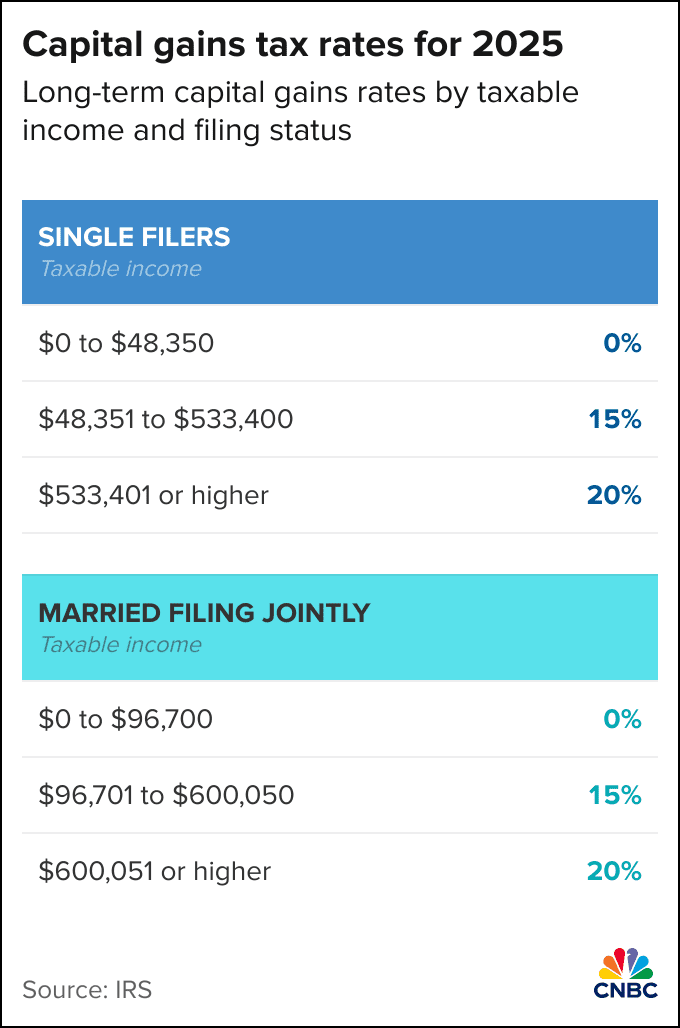

4. The government gives you special tax perks like:

- Paying lower tax rates on your profits (than income from your job).

You pay $0 on your long-term profits as a single filer if your taxable income is under $48,350 per year or $96,700 as a married couple filing jointly.

A Self Directed Brokerage's main perk is taking money out anytime you want.

2. The Roth IRA

Here's 4 key points:

1. $7,000 is the most you can deposit each year (if you're age 50+ you can deposit $8,000).

2. You can't deposit the full amount if your annual income is over:

- $150,000 if you're single.

- $236,000 if you're married.

3. You don't pay taxes when you take money out during retirement.

4. You pay a 10% penalty if you take money out before age 59 1/2 unless it's a special exception (like buying a home, a disability, etc).

A Roth IRA's main perk is not paying income tax on withdrawals in retirement.

3. The Traditional IRA

Here's 5 key points:

1. $7,000 is the most you can deposit each year (if you're age 50+ you can deposit $8,000).

2. Money you put into the account reduces your taxable income.

For example—

If you earn $70,000 per year and put $5,000 into a Traditional IRA.

You won't pay income tax on $5,000 of your income.

3. You pay tax when you take money out during retirement.

4. You pay a 10% penalty if you take money out before age 59 1/2 unless it's a special exception (like buying a home, a disability, etc).

5. The government says you must start taking money out at age 73.

A Traditional IRA's main perk is delaying your income taxes until retirement.

Photo credit: stash

One thing to remember:

- $7,000 is the most you can put into a Traditional IRA and a Roth IRA combined each year.

For example, someone might put $3,500 in the Traditional IRA + $3,500 in a Roth IRA = $7,000 total

The bottom line

Deciding which account to use can be mind boggling.

The truth is—

Most people don't know what their taxes will look like in 20 or 30 years.

Heck, most people don't know if they'll have the same job in 2 or 3 years.

The point is...

Life is unpredictable.

So you must plan for the unpredictable.

How?

The best answer I came up with was — don't put all my eggs in one basket.

Use many baskets like:

- The Self Directed Brokerage

- The Traditional IRA

AND

- The Roth IRA

Plus my retirement account at work.

Then I'd have a variety of baskets to choose from (when I needed money).

My one regret is not realizing this sooner.

And using all of these accounts when I started investing.

Hope this is useful on your investing journey.

That's all for today.

See you next Saturday.