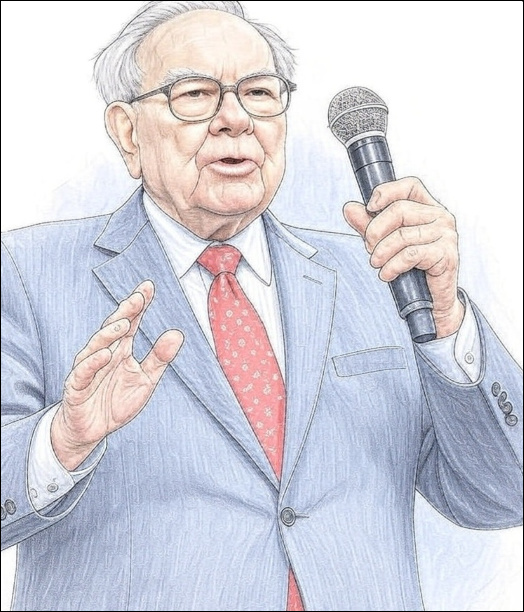

5 Investing Lessons (from a legend)

Nov 02, 2024Read time - 3 minutes / Disclaimer

If you're a fan of investing.

You know Warren Buffett.

If not...

His firm Berkshire Hathaway:

• Is the 5th largest company in the United States

• Has returned 19.8% per year on average

• Has a total gain of 5,230,000%+

In short—

He's made investors a lot.

Although investing is commonly viewed as:

• Complex

• Confusing

• Overwhelming

Buffett's known for breaking things down and sharing simple advice.

Advice that can help you avoid big blunders.

Advice that's helped me stay sane through market ups and downs.

Here's 5 lessons from the legend himself:

Lesson 1:

"Risk comes from not knowing what you're doing."

According to Buffett—

It's important to understand what you know.

And it's important to understand what you don't know.

Steering clear of things you don't know is the big idea.

Not losing money.

Buffett's well-known for only investing in things he knows.

Lesson 2:

"Be fearful when others are greedy and greedy when others are fearful."

When stocks drop 20%, 30%, or 50%—

The average person sells.

Buffett's made his fortune by doing the exact opposite.

He resists emotional selling.

He is patient and measured.

He waits for opportunity.

Lesson 3:

A personal favorite—

Buffett talks a lot about emotion and behavior.

For example:

If iPhones were half off, Apple stores would be packed.

But if stock prices drop 30%, most people sell (quickly).

Buffett stresses the importance of not making emotional investment decisions.

Lesson 4:

"The goal of non-professionals shouldn't be to pick winners, rather to own businesses bound to do well, a low-cost S&P 500 index fund will achieve this goal."

For those who don't have the time to study individual companies.

Buffett suggests investing in an S&P 500 index fund.

When buying stock, you have ownership in 1 company.

When buying an S&P 500 index fund, you have ownership in 500 companies.

Two common S&P 500 index funds are:

• Vanguard S&P 500 ETF (VOO)

• SPDR S&P 500 ETF (SPY)

Lesson 5:

"The most important investment you can make is in yourself."

Buffett's well known for being an avid reader.

He spends hours reading.

He's shared—

Making time to read, think, and learn is a big part of his success.

Conclusion

Buffett is a tremendous investor to study.

Up to 40,000 people attend his yearly conference.

I've spent many hours listening to his interviews.

They're full of gold nuggets.

For 30+ Warren Buffett interviews, check this out:

Keep building 💰

See you next week.