5 Stock Investing Strategies (a full breakdown)

May 03, 2025Read time - 3.5 minutes / Disclaimer

A stock investing strategy:

- Simplifies investing.

- Gives you a roadmap.

- Helps keep you on track.

Unfortunately, picking a strategy can be confusing.

1,000s Of Stocks

The stock market is home to many companies including:

- Big companies.

- Small companies.

- Companies that go bust.

So which investing strategy do you choose?

Over the years I've found not following the crowd to be a helpful strategy.

I've had the $400 credit card payments.

And the $700 car payments.

But I eventually learned they lead to decades of 9-5 life.

Time away from family.

Time away from hobbies.

Time spent working A LOT.

So I decided to take a different path.

To change my financial habits.

Habits that allowed me to leave 9-5 life in my 30s.

Figuring out my investment strategy was a big part.

Things like:

What stocks to buy?

What funds to invest in?

The options are endless.

Here are 5 stock investing strategies I considered (also called "portfolios").

I hope this saves you hours of research on your journey to escape 9-5 life early too.

Let's dive in:

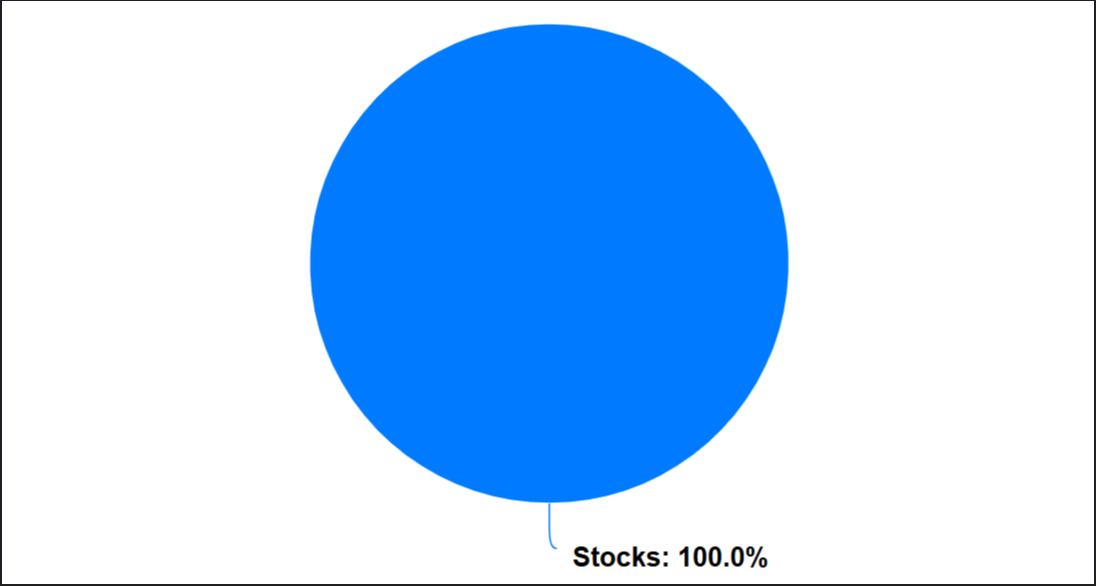

1. The S&P 500 Portfolio

This portfolio suggests picking 1 fund:

• A S&P 500 fund

Instead of buying individual stocks.

A S&P 500 fund includes the 500 largest companies in America.

For example, investing:

• 100% in the Vanguard S&P500 Fund (VOO)

Using The S&P 500 Portfolio means you pick 1 fund to invest in.

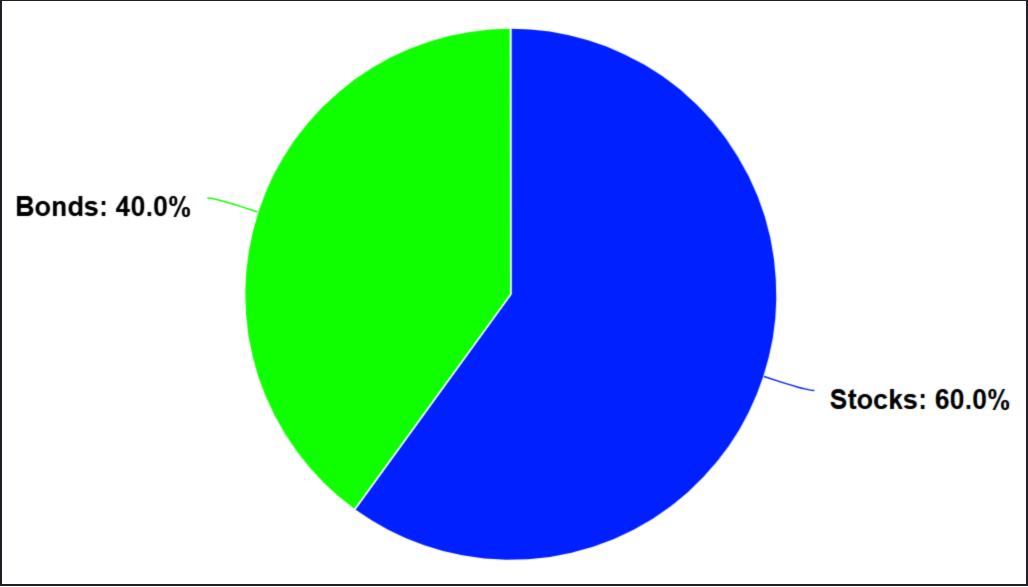

2. The 60/40 Portfolio

This portfolio suggests picking 2 funds:

• A total stock market fund

• A bond fund

A total stock market fund includes thousands of stocks.

A bond fund means you're investing in debt (acting as a lender to the government or other businesses).

For example, investing:

• 60% in the Vanguard Total Stock Market Fund (VTI)

• 40% in the Vanguard Total Bond Market Fund (BND)

Using The 60/40 Portfolio means you pick 2 funds to invest in.

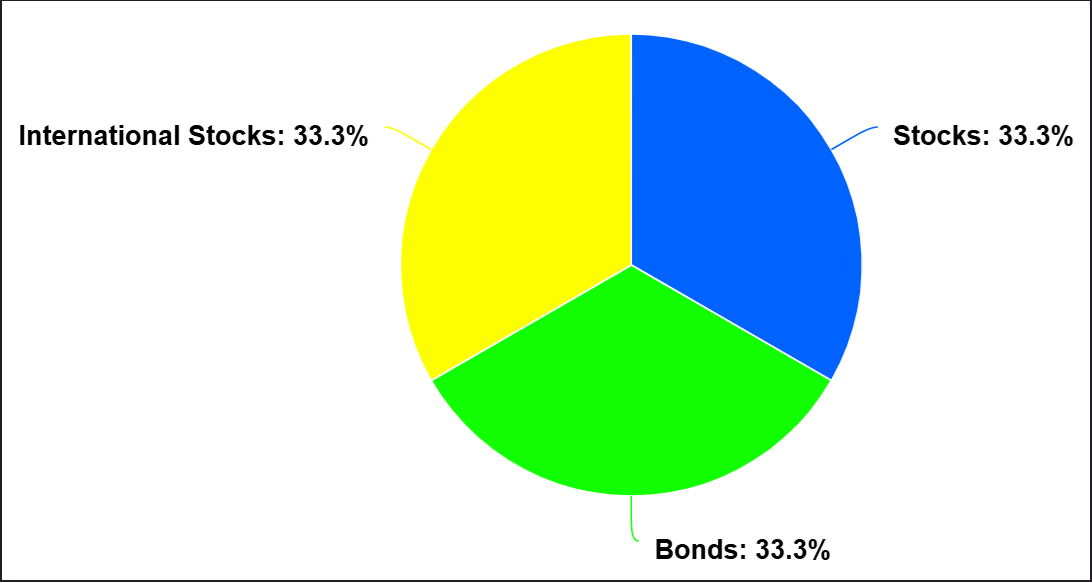

3. The Three Fund Portfolio

This portfolio suggests picking 3 funds:

• A international stock fund

• A total stock market fund

• A bond fund

The Three Fund Portfolio includes stock from hundreds or thousands of international companies, thousands of U.S. stocks, plus bonds.

For example, investing:

• 33.3% in the Vanguard Total International Fund (VXUS)

• 33.3% in the Vanguard Total Stock Market Fund (VTI)

• 33.3% in the Vanguard Total Bond Market Fund (BND)

Using The Three Fund Portfolio means you pick 3 funds to invest in.

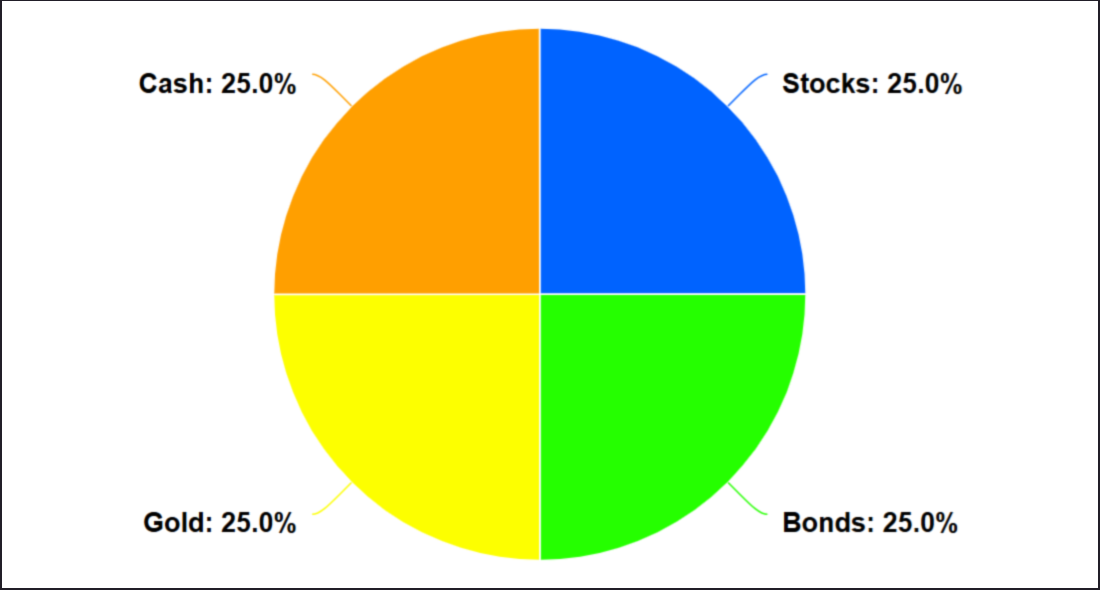

4. The Permanent Portfolio

This portfolio suggests picking 4 funds:

• A money market fund (cash)

• A total stock market fund

• A long term bond fund

• A gold fund

The Permanent Portfolio includes cash in a money market fund (similar to a savings account).

Plus thousands of U.S. stocks, long term bonds (investing in long term government or company debt), and a fund that invests in gold.

For example, investing:

• 25% in the iShares Prime Money Market Fund (PMMF)

• 25% in the Vanguard Total Stock Market Fund (VTI)

• 25% in the Vanguard Long Term Bond Fund (VGLT)

• 25% in the iShares Gold Trust Fund (IAU)

Using The Permanent Portfolio means you pick 4 funds to invest in.

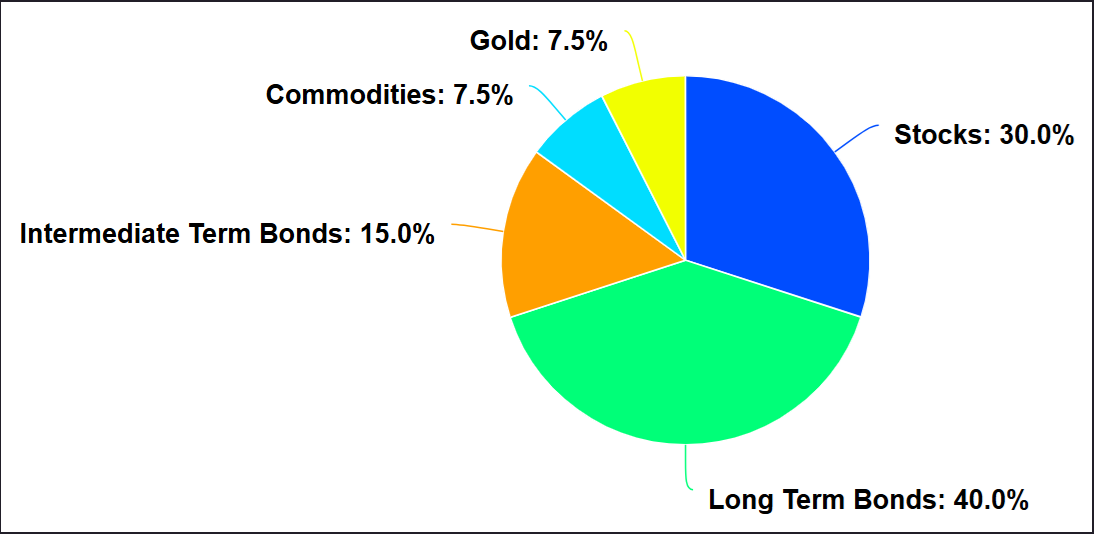

5. The All Weather Portfolio

This portfolio suggests picking 5 funds:

• A total stock market fund

• A longer term bond fund

• A intermediate bond fund

• A commodities fund

• A gold fund

The All Weather Portfolio includes thousands of stocks, long term bonds, intermediate bonds (investing in government or company debt that's not long or short term).

Plus a commodities fund (invests in silver, cows, pigs, etc) and a fund that invests in gold.

For example, investing:

• 30% in the Vanguard Total Stock Market Fund (VTI)

• 40% in the Vanguard Long Term Bond Fund (VGLT)

• 15% in the Vanguard Intermediate Bond Fund (IEF)

• 7.5% in the Invesco DB Commodity Index Fund (DBC)

• 7.5% in the iShares Gold Trust Fund (IAU)

Using The All Weather Portfolio means you pick 5 funds to invest in.

The Bottom Line

So which investment strategy do you pick?

I've spent an ungodly amount of time trying to answer this question.

I fiddled with my investments like crazy in the early years.

The truth is—

There's no "perfect" strategy.

If you ask 10 people in finance how you should invest.

You'll get 10 different answers.

I've realized it comes down to 2 things (for me):

1. Is it easy?

2. Is it low stress?

An S&P500 fund (option 1) plus owning a few long term rental properties checks those boxes for me.

I like having a smaller investment account on the side to tinker with as well (higher risk investments).

If you're trying to figure out your investment strategy.

I'd tell my younger self—

Keep it simple.

Having different investment funds, commodities, digital assets, individual stocks, etc all take time to keep track of.

Time away from the most important things.

Enjoying family and living life.

Keep building 💰

See you next week.