5 Stock-Picking Tips (the billionaire way)

Jun 28, 2025Read time - 3 minutes / Disclosure

Picking individual stocks can:

- Boost your returns.

- Expand your net worth.

- Grow your account faster.

Unfortunately, stock picking isn't easy.

Not Losing Money

Investing in the wrong stock can be:

- Painful.

- Stressful.

- Expensive.

How the heck do you avoid it?

By learning from great investors (like warren buffett).

Warren's company Berkshire Hathaway:

- Is the 5th largest company in the U.S.

- Has grown 20% per year on average.

He's widely known as an expert stock picker.

During the first 10 years of my stock investing journey.

An S&P500 fund (like VOO) was my only investment.

After watching that portfolio go from $0 to $500k (which shocked the hell out of me).

I started to tinker with individual stocks.

But my biggest fear was—

Losing money.

So I studied investing in individual stocks.

Reading books, going to seminars, taking online investing classes all helped.

The more knowledge my brain absorbed, the less fearful I felt.

Warren Buffett was one of my favorite investors to study.

Here's 5 stock-picking tips the Warren Buffett way (hope it's helpful).

Let's dive in:

1. The Understanding

“Risk comes from not knowing what you're doing.”

When investing in an individual company.

Buffett says it's important to understand:

- The product.

- The industry.

- The competitors.

Buffett has owned Coca-Cola stock since 1988.

Photo: gettyimages

The company and its industry must have long term growth potential.

2. The Advantage

"If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes."

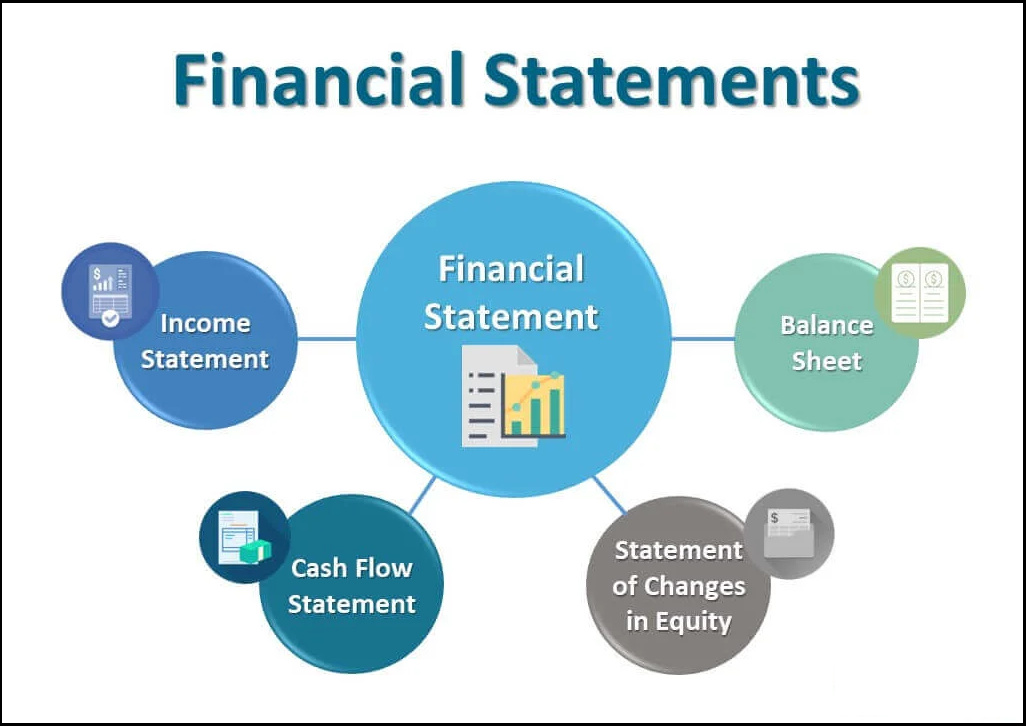

Buffett also says before investing it's important to understand a company's:

- Finances.

- Business model.

- Competitive advantage.

This info can be found inside the company's financial statements.

A company's financial statements outline its opportunities and advantages.

3. The Management

“I learned to go into business only with people whom I like, trust, and admire.”

Buffett says you want the CEO of the company you invest in to be:

- Honest.

- Dedicated.

- Successful.

Buffett is a good example.

A strong CEO is an important part of a business's financial success.

4. The Price

“Price is what you pay. Value is what you get.”

Buffett says price and value are different things.

It's important to understand:

- When a stock price is "high"

- When a stock price is "low"

There are many different ways to figure this out.

Analyzing a company's financials helps you figure out a "fair" stock price.

5. The Patience

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful.”

Buffett says after finding a company to buy, it's important to buy the stock at a fair price.

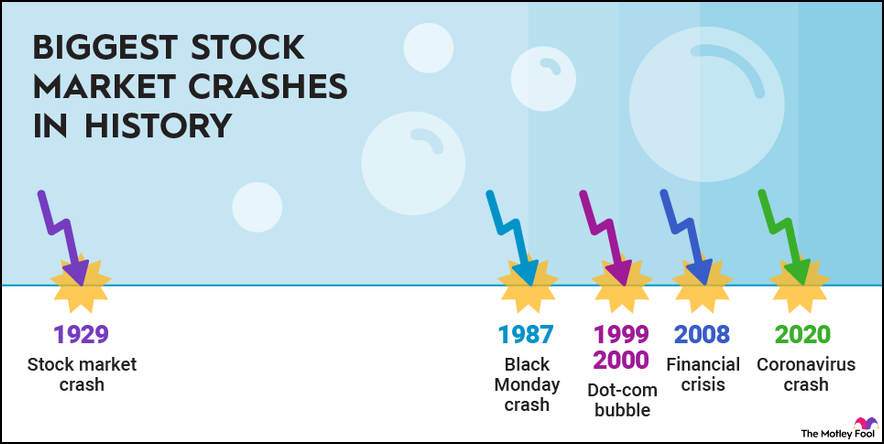

On average, stocks drop:

- 10% every other year.

- 20% every 4 years.

Sometimes they drop 30%, 40%, or 50%.

Over time, the stock market has always recovered from a crash.

Patience and market crashes can be great stock-buying opportunities.

The Bottom Line

Investing in individual stocks:

- Takes time.

And

- Takes patience.

(especially if you're doing it the warren buffett way)

The truth is—

Not everyone has time and patience to invest in individual stocks.

For those people, Buffett says:

"The goal of non-professionals shouldn't be to pick winners, rather to own businesses bound to do well, a low-cost S&P 500 index fund will achieve this goal."

It's often called "VOO and chill".

Investing in an S&P500 fund like VOO (the top 500 companies in America) has been my easiest investment.

Plus, having a smaller side portfolio of individual stocks to research and follow.

I hope Warren Buffett's tips are helpful for the individual stock investors out there.

Keep building 💰

See you next week.