7 Home Buying "Hacks" (that nobody talks about)

May 17, 2025Read time - 4 minutes / Disclosure

Buying a home can:

- Grow your net worth.

- Give you more stability.

- Help you build wealth faster.

Unfortunately, most people think you need piles of money.

Buying A Home

For years the media has been saying:

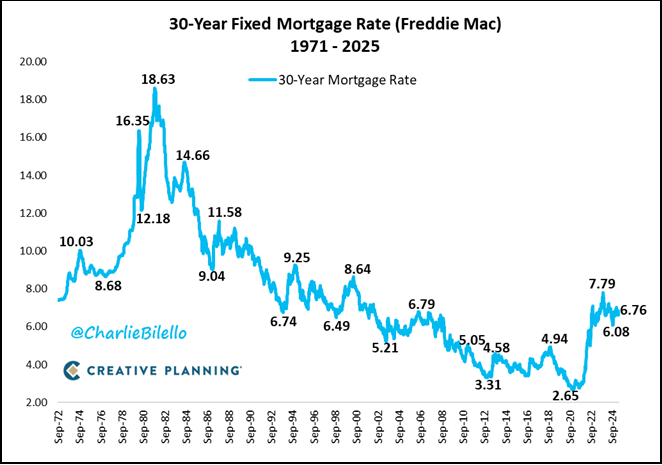

- Interest rates are high.

- Homes are expensive.

- Buying is too hard.

But higher interest rates today don't mean higher interest rates forever.

I think the trend in lower rates will eventually continue.

So, what's the solution if you want to buy a home now?

Creativity.

Figuring out how to buy a home without coming up with a bunch of money has always been a weird obsession of mine.

I bought my 1st home with 0% down (no money down).

Two years later I sold it and made $100k.

This motivated me like crazy.

I repeated that playbook over and over.

Until I bought 7 properties.

I put 0% down twice (no money down).

Another time I put 3% down.

I didn't have to come up with a bunch of money most of the time.

Which was great because I didn't have much money starting off.

Along the way I learned these 7 home buying hacks.

Hope they're helpful if you want to buy a home (and you're starting at $0 like I did).

Let's dive in:

1. The 0% Down Hack

Most people need a loan to buy a home.

Many loan programs allow you to buy with little or no money down.

You still need to qualify for the loan and be comfortable with the monthly payment.

Ask your loan officer about these options.

Many home loan programs are flexible and don't require much up-front money.

2. The Down Payment Hack

There's over 2,000+ down payment help programs.

Many give you $5k, $10k, or $20k+ to buy a home.

You just need to know where to look.

The Fannie Mae website is a good place to find them.

Many programs charge 0% interest and expect to be paid back when you sell your home.

Downpayment help programs are a great resource to use before home shopping.

3. The Cash Flow Hack

Find a home that pays you.

Many homes can be used as a rental while you live there.

The key is—

Finding the right home.

In my opinion, the right home has a separate rentable area (so you don't have to share your living space if you don't want to).

Here's two examples that worked for me.

Example #1:

Separate Bedroom & Bath Downstairs

Example #2:

Separate Entrance To Bedroom & Bath

Renting out a separate area in your home is one of my favorite strategies.

You can also find a home with a rentable until in the backyard.

They're often called "tiny homes" or "ADUs" (accessory dwelling units).

Home Depot sells lots of them.

Liveable Unit In The Backyard

Buying a home that has a separate rentable area can save you a ton of money.

4. The Loan Takeover Hack

Taking over someone's loan can be a big money-saver.

Here's an example:

Your neighbor wants to sell their home.

And you want to buy it.

They got their home when interest rates were 3% (lower than today).

Taking over their 3% loan is cheaper than getting a brand new loan.

It's called "loan assumption".

Here's 3 things to know:

1. You have to apply through their lender and qualify to take over their loan.

2. Not all home loans can be taken over (VA loans, FHA loans, and USDA loans can be).

3. You also need to get a 2nd loan. Why? For example: They want to sell their property to you for $500,000 and the loan you take over is $400,000 (you also need a 2nd loan for the $100,000 difference unless you have cash).

Roam is a helpful resource if you want to get more info on this topic.

Taking over an existing home loan can save you thousands in monthly payments.

5. The Family Hack

Buying property from family is often a great deal (if you're going to live in the property).

Usually:

- You don't need a down payment.

PLUS

- You don't need to come up with money for closing costs.

Amazing right?

Each situation is different (here's an example I've posted a few times):

Parents selling homes to children.

— JOHN HENRY (@Millennial_Wlth) May 6, 2024

No down payment needed.

A popular option: pic.twitter.com/0V7wValBpr

Buying property from family can usually be done with no money down.

6. The Rental Hack

If you want to own a few properties.

You can repeat the above home buying strategies over and over.

That's what I did.

Each time I bought a new property with a loan, I moved into it, and rented out the property I moved out of (make sure rent covers your monthly payment first).

Banks only offer no down payment loans or small down payment loans if the property you buy is your primary residence (you must move into the new property for at least 1 year).

This is the least expensive way I know to get yourself 2 or 3+ properties without having a boatload of money (if you don't mind moving a few times).

Buying a home and renting out your last one repeatedly is also called "househacking".

7. The Cashout Hack

Real estate has amazing tax perks.

My favorite—

Refinancing a property every 5-10 years.

Pulling out $50,000 - $100,000 cash and using that money to buy other assets (while legally paying no taxes on the money).

Some people do this to buy more property (for good reason).

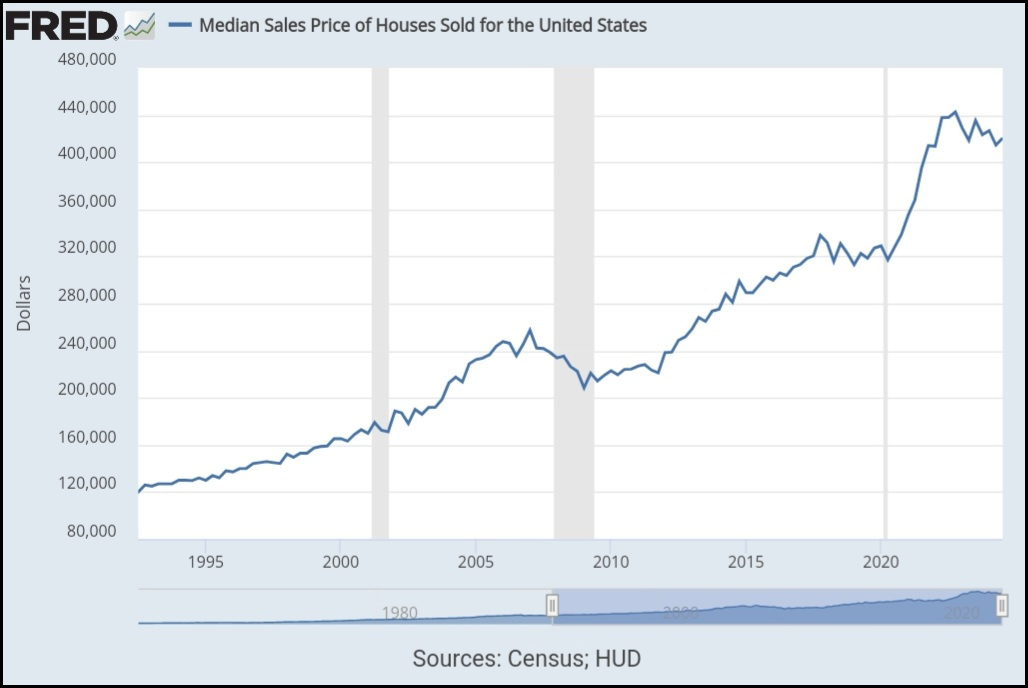

The price of property has been doubling every 14yrs on average.

Refinancing a home loan and taking cash out to buy other assets is a common strategy.

(chat with a CPA first)

The bottom line

I stumbled upon many of these tips or "hacks" myself over the years.

And learned some from other real estate investors (people with lots more experience than me).

If you're looking to buy your 1st home..

I hope these 7 hacks are useful.

That's all for today.

See you next Saturday.