7 Investing Traps (hard lessons)

Oct 18, 2025Read time - 4 minutes / Disclosure

Avoiding investing traps can save you:

- Time.

- Money.

- Your sanity.

Unfortunately, these traps can be hard to avoid.

The Investing Paradox

Part of investing is knowing:

- What to avoid.

- Why to avoid it.

- How to avoid it.

Most people are unaware of these traps.

Especially new investors.

And lord knows I stepped in many of them.

But my desire to build a freer life kept driving me forward.

Old way:

— JOHN HENRY (@thejohnhenry_) August 4, 2025

- 40 years at a job

- 50 hour work weeks

- 15 years of freedom

New way:

- Investing early & often

- Escaping 9-5 life early

- Having more freedom

Building $1M of investments from scratch while working my 9-5 became an obsession.

Not to buy:

- Fancy cars.

- Luxurious vacations.

- A humongous house.

These things are nice.

But the main motivation was:

- Not having to work a 9-5 for 40 years.

- Quitting fulltime work decades early.

- Working part-time for myself.

- Having more free time.

Learning to invest became the solution.

And there were many investing traps along the way before leaving my fulltime finance job in 2020.

The "Investing Traps" Checklist

Here's 7 investing traps I've learned the hard way (hope they're helpful).

Let's dive in:

1. The Media

News outlets drive emotion.

Emotion can lead to action.

(like selling investments)

An example:

But the interesting thing.

Stocks went up 20% from May through the summer.

Trying to time the market based on the news can be a trap.

"Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves." — Peter Lynch

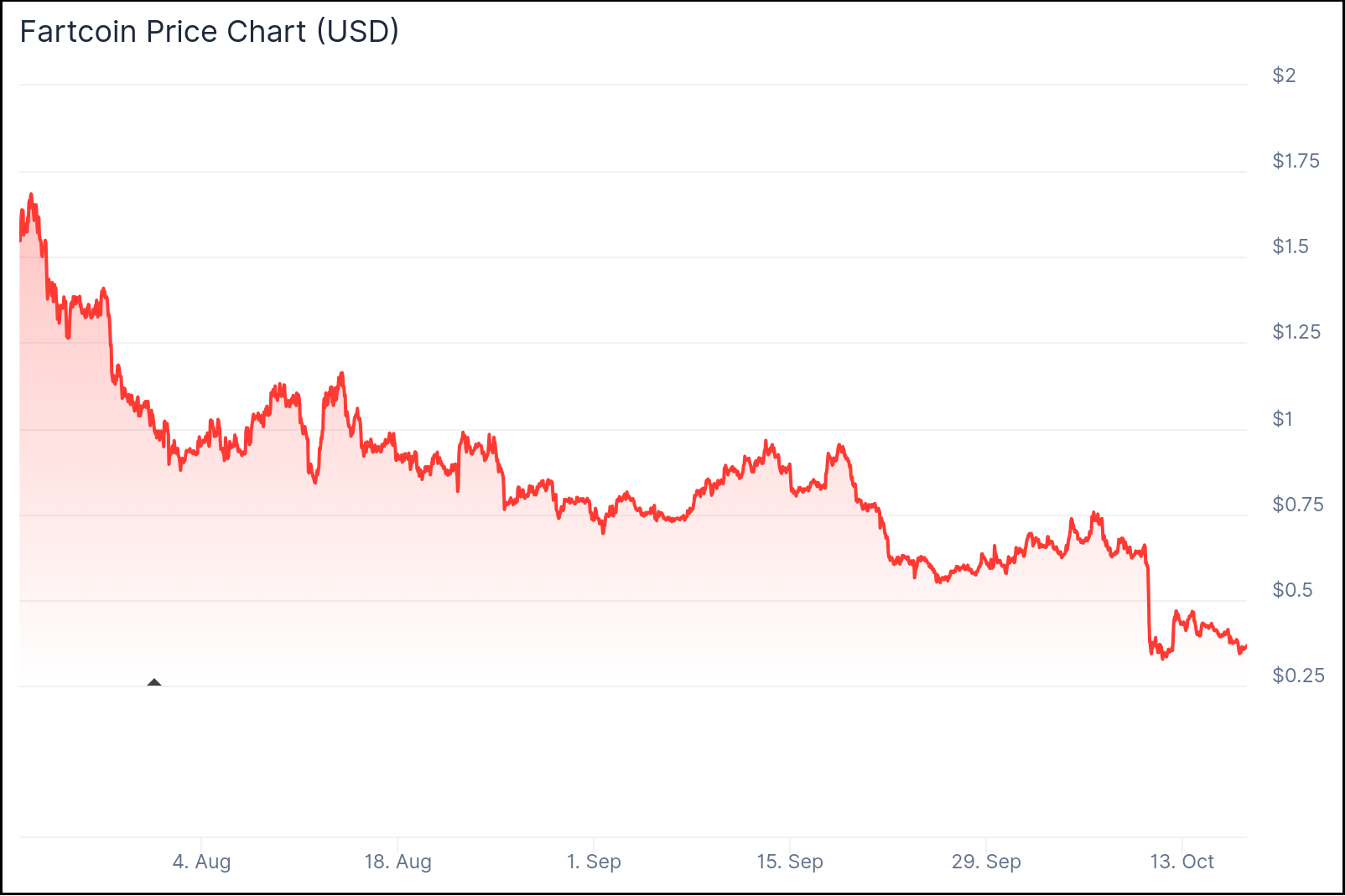

2. The Herd

Not following the crowd can be hard.

Especially when you hear stories like:

"NFTs are at an all time high."

"Dogecoin is at an all time high."

"Fart coin is at an all time high."

80% crash as of 10/2025

Following the crowd can be a trap.

"Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years." — Warren Buffett

3. The Confidence

Over-confidence can be costly.

During my investing journey, there's been some great gains and some lousy losses.

5-figure and 6-figure losses to be exact — some big blunders.

Big blunders often come from having too much confidence in 1 thing.

"I knew that no matter how confident I was in making any single bet, that I could still be wrong." — Ray Dalio

4. The Game

Investing has been gamified.

Many investing apps send you a notification when:

- Stocks are up.

- Stocks are down.

Many companies make money when people trade stocks.

And notifications can lead to more trading.

Notifications can be a trap (turning them off helps).

"The big money is not in the buying and the selling...it's in the waiting." — Charlie Munger

5. The Doomers

Pessimism is contagious.

For decades there's been people talking about a big stock market "crash".

Some say it's an 80% or 90% crash.

People following this idea sometimes sell their investments to wait for "the crash".

Some have been waiting for decades.

But the stock market keeps growing..

Stock market since 1989

"Despite some severe interruptions, our country's economic progress has been breathtaking. Our unwavering conclusion: Never bet against America." — Warren Buffett in 2021

6. The Gurus

Optimism is contagious.

Someone's always claiming to know which stock will double, or triple or go up 1,000%.

People excitedly open their wallets to pay for this "advice".

But the harsh reality —

Most tips lead to lost money.

"One should only invest in what they know. Do not listen to hot stock tips." — Jim Rogers

7. The Luck

It's easy to confuse luck for skill with investing.

(especially in the beginning)

My first experience with this..

Getting a loan to buy a tiny condo that went up in value $100k in 2 years.

Seattle, Washington

When selling that condo, I felt like a genius.

And got another loan to buy a house.

But over the next 3 years the value of that house dropped $160k.

It was then I realized the $100k condo profit was total luck.

(buying it and selling it right before the financial crisis)

Eventually the house sold for a profit, but it was many years later.

"People think making money is about luck. It's not. It's about becoming the kind of person that makes money." — Naval Ravikant

The bottom line

Most people want investing to be quick and exciting.

But the truth is —

It's pretty dang boring.

$100 invested in an S&P500 stock fund like VOO in 2010 (the largest 500 companies in America).

Is worth around $600 in 2025.

It grew 600% in 15 years.

Everyone's searching for the secret to a $100k or $1M investment portfolio this year.

Hell, I searched for it too in the beginning.

But eventually realized building 6 or 7-figures worth of investments over the longer term is a better bet.

And those years fly by..

That's all for today.

See you next Saturday.