7 Money-Boosting Tips (a cheat sheet)

Jun 21, 2025Read time - 3 minutes / Disclosure

More money can:

- Help you invest.

- Help you buy a home.

- Help you quit 9-5 life sooner.

Unfortunately, daily living has become wildly expensive.

Inflation Stings

Since 2020, according to the government:

- Homes cost 31% more.

- Used cars cost 37% more.

- Even coffee costs 86% more.

Finding ways to make more money or save more money has become necessary.

Especially if leaving 9-5 life early is a goal.

5 signs you're on track to quit

— JOHN HENRY (@thejohnhenry_) October 17, 2025

the rat race early:

1. No car payment.

2. No credit card debt.

3. An emergency fund.

4. Growing your income.

5. Investing every month.

At first, I did many of these things backward.

- Big car payments.

- Maxed out credit cards.

- Not much money saved.

But my habits eventually changed.

And I focused hard on investing.

Over time those investments grew from:

$0 to $10k

$10k to $50k

$50k to $100k

$100k to $250k

$250k to $500k

$500k to $1M

The truth is—

It's never too late to pivot.

To adopt a few new habits.

To plan a freer future.

The 10 years I spent at Chase as a banker was a big part of the journey.

Watching all of the different ways people make more money and save more money was fascinating.

So I started keeping track of the different ways.

The Cash Flow Cheat Sheet

Here are 7 things people do (to make more money and save more money).

Hope it's helpful.

Let's dive in:

1. The Raise

Asking for a raise has high upside (more money).

And low downside (no change in pay).

Life continues either way.

If you're a great employee, why not ask?

Getting a raise can mean thousands of dollars in extra income.

2. The Company

Job hopping may turn into:

- Higher pay.

- Better benefits.

- A more flexible schedule.

Recently, I came across this silly cartoon:

It's a good reminder to weigh the pros and cons first.

Switching jobs can grow your income by thousands or tens of thousands.

3. The Refinance

Refinancing a loan may mean lower monthly costs.

For example, refinancing:

- A car loan.

- A home loan.

- A student loan.

A lower interest rate can be a huge money-saver.

Refinancing a loan may save you hundreds or thousands in interest payments.

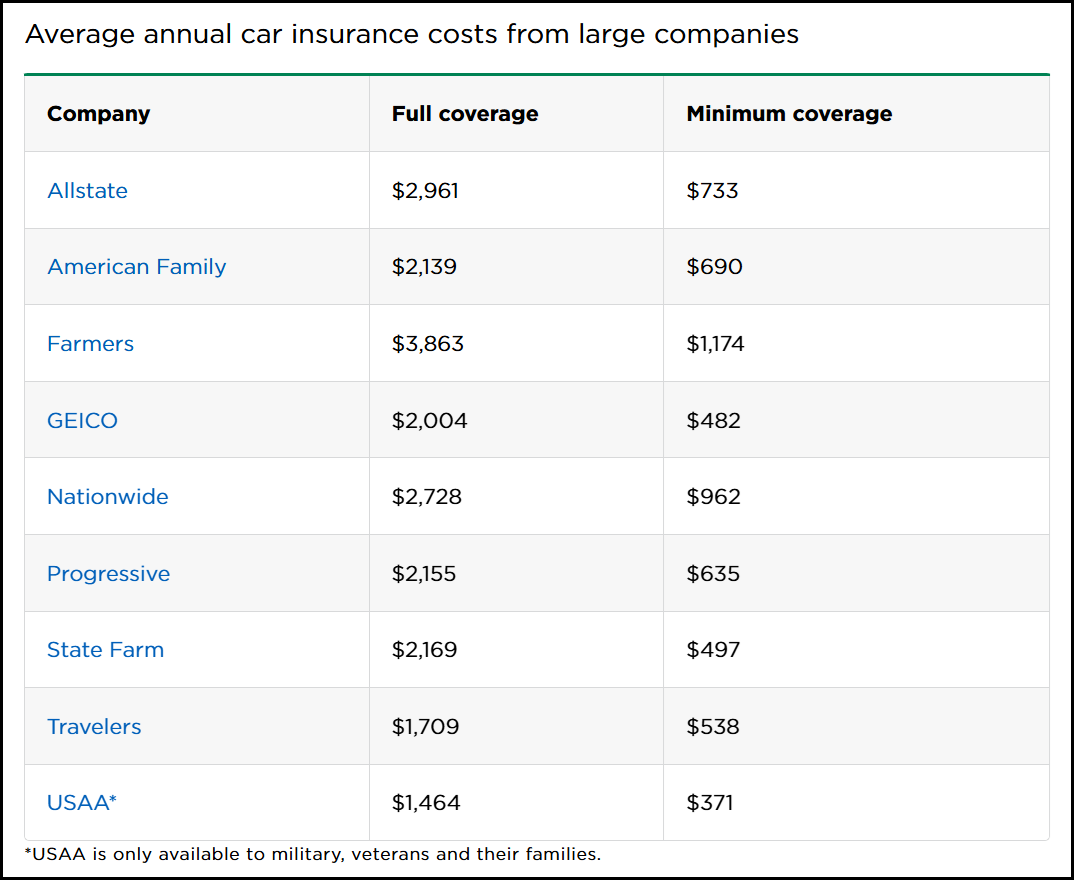

4. The Insurance

Changing insurance companies may = big savings

For example, changing:

- Car insurance.

- Health insurance.

- Homeowners insurance.

Here's a car insurance cheat sheet from Nerdwallet:

Photo Credit: nerdwallet

I've had Travelers for 10+ years (a fan).

Keeping car and home insurance with the same company often comes with a discount (worth checking if you have both).

Switching insurance may save you hundreds or thousands of dollars every year.

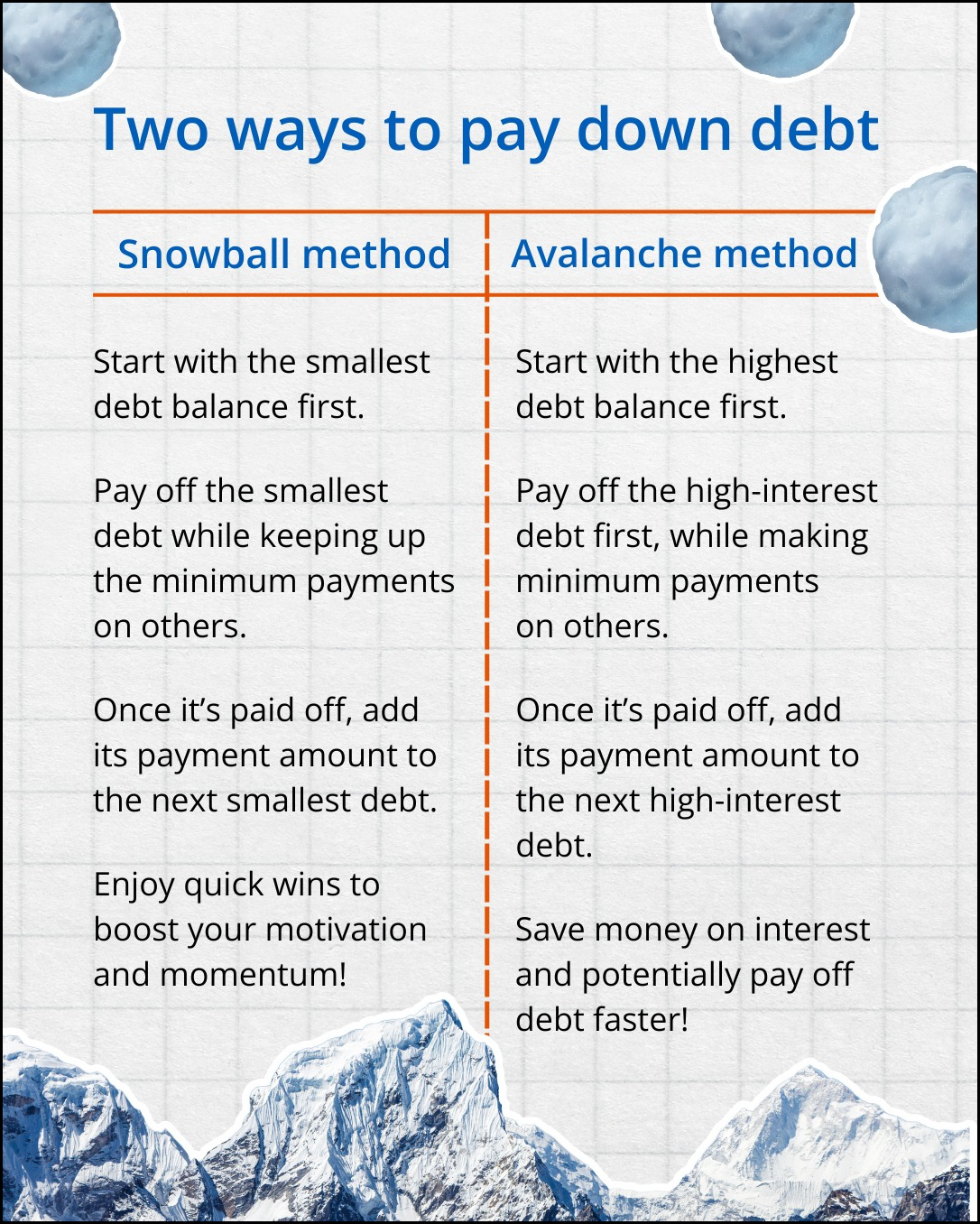

5. The Debt

Paying debt off early (if possible) can free up more monthly cash.

For example, paying off:

- A car loan.

- A student loan.

- A personal loan.

The Snowball Method and Avalanche Method are popular ways to pay off debt early:

Paying off debt early (if possible) can save hundreds or thousands in interest costs.

6. The Rental

Renting out your unused space can be profitable.

For example, renting out:

- An unused bedroom.

- An unused parking space.

- Extra space in the backyard to an RV owner (if an option).

Neighborhood is a neat app I've been tinkering with. It helps people rent out extra space.

Renting out unused space can earn you hundreds or thousands per month.

7. The Side Biz

Everyone knows a lot about something.

For example:

- Photography.

- Graphic design.

- Personal training.

Profitable knowledge or skills often come from a job or a hobby.

Sharing your knowledge or skills can be a profitable side income.

The bottom line

Money can be emotional.

Especially if you feel stuck and you're trying to move forward (I've been there too) — keep going my friend.

In banking, many people would ask me what to do to have more money left over each month.

Sharing this little cheat sheet (of what works for other people) became a helpful tool.

Of course everyone's money situation is unique.

So take what you find useful, and ignore the rest.

That's all for today.

See you next Saturday.