Finding Money to Buy a Home (how I got $30,000)

Aug 30, 2025Read time - 5 minutes / Disclosure

Finding homebuying money can:

- Help you get a deal.

- Help you buy sooner.

- Help you buy more easily.

Unfortunately, nobody tells you where to look.

The Costs

Most people think buying a home means:

- Saving piles of money.

- Spending every dollar.

- Having little savings left.

I thought the same at first.

But one thing changed it all.

A loan guy telling me I only needed $1,500 to buy my first little condo.

It shocked the hell out of me.

Getting a loan and giving up $1,500 to own my first property seemed absurd.

I figured it would take a lot more money than that.

After getting that little condo I became obsessed with homebuying.

My big idea was..

To shamelessly copy smart investors.

Don’t waste life in your 20s.

— JOHN HENRY (@thejohn_henry_) July 18, 2025

25 to 35 is only 10 years.

Study successful people.

Learn what they did.

Shamelessly copy.

(this seems to work later in life too)

Without a lot of upfront money, I ended up owning 6 more properties.

This shocks the heck out of me to say because I'm a guy that started at $0.

I just copied the habits of people who had the things I wanted.

Working in banking was a big help.

It allowed me to watch the smartest investors.

One of my favorite habits to copy when buying a home is:

The Max Cash Playbook

It works if buying your first home or even a rental property.

The goal is to get as much homebuyer credit as possible.

And it works if the real estate market is good or bad.

I used it to get $30,000 when buying this California home years ago.

Here's the 4 places I've learned to look for money when homebuying (hope it's useful).

Let's dive in:

1. The Program

Homebuyer programs can help cover your costs.

There's 2,000+ of them in the U.S.

Many of them give you money for things like:

- Being a veteran.

- Working in healthcare.

- Buying in a certain area.

The home I bought was in a certain neighborhood that qualified for a $5,000 credit towards my homebuying costs.

Fannie Mae Search Tool

Fannie Mae Search Tool

The Fannie Mae search tool is a great place to find special homebuyer programs.

2. The Seller

A seller can help cover your homebuying costs.

After finding my home, I learned there are 2 opportunities to ask the seller to help pay your costs.

1. When making an offer.

AND

2. After the home inspection.

My real estate agent asked the seller for homebuyer credit when making my offer and the seller agreed to put $7,500 towards my homebuying costs.

There weren't any surprises during my home inspection. So, I didn't ask for any further credits when that was done.

Making an offer and doing a home inspection are common times to ask a seller for homebuyer credits.

3. The Agent

A real estate agent can help cover your costs.

The agent I used only showed me one property.

So I asked if he'd be willing to split his commission if my offer was accepted.

He agreed to a $7,500 credit towards my homebuying costs.

A real estate agent can help cover part of your homebuying costs (if they agree).

4. The Lender

Lenders don't just charge fees.

They can help cover your costs too.

Most people tell their lender "gimme the best rate".

And that's the end of the interest rate conversation.

But I've learned there's much more to it.

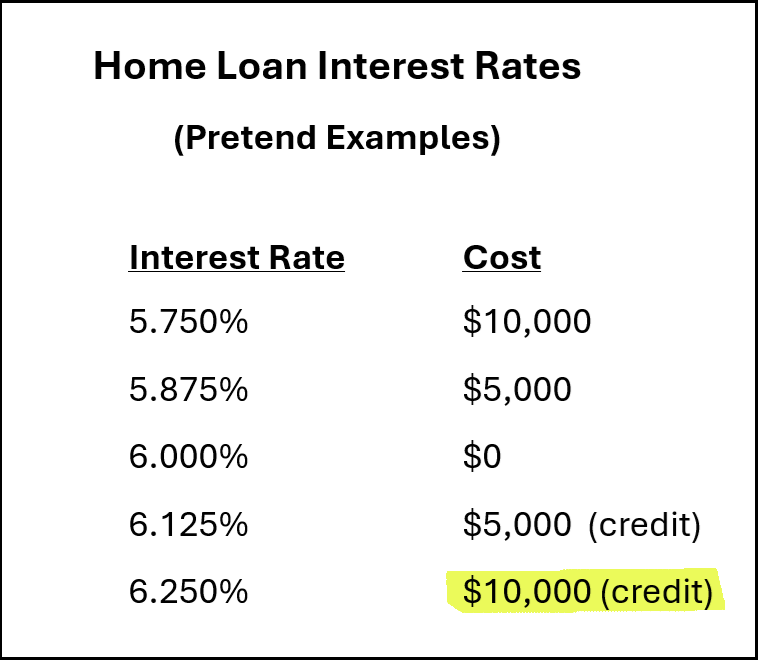

When talking about your interest rate, many lenders are looking at a sheet like this:

Telling a lender "gimme your best rate" means they'll likely offer you the 6.000% rate (in this example).

The 6.000% rate doesn't cost you any extra money.

But if you take the 5.875% rate or the 5.750% rate, you pay $5,000 or $10,000 more in homebuyer costs (it's called "buying down the rate" or "paying points").

If you take the higher 6.125% or the 6.250% rate, you get a $5,000 or $10,000 credit towards your homebuyer costs (it's called "getting lender credit").

Most people don't have these conversations with their lender.

Mainly because they don't know these other options exist.

Hell, I sure didn't in the beginning.

Weighing the pros and cons of doing something like this is important.

I was planning to refinance my home loan after fixing up the California home 1 year later.

So, taking a slightly higher rate to get the credit was worth it in my opinion.

My home loan lender offered a $10,000 credit towards my homebuying costs if I took the slightly higher rate.

Many lenders offer credit towards your homebuying costs (but not all of them explain these options unless you ask).

The Bottom Line

I know that's a lot to consider.

The truth is..

There's many ways to get money when buying a home.

But it's not common knowledge.

Heck, it took me years to figure this out.

Here's how things ended up:

- $5,000 special program credit.

- $7,500 real estate agent credit.

- $7,500 home seller credit.

- $10,000 lender credit.

$30,000 total homebuyer credits.

Here's 3 things I've learned the hard way:

1. When asking a real estate agent for credit.

I make sure to ask them up front.

And I make sure they're not doing much work.

After getting my home loan pre-approval.

I use online tools like redfin or zillow to find homes for sale.

Next I drive the neighborhood to make sure I want to see the inside of the home before contacting my agent.

I've found asking an agent to help cover your homebuying costs after they've spent dozens of hours showing you 10, 20, or 30 homes doesn't work as well as asking an agent that just showed you 1, 2 or 3 homes.

In the above example, the agent only showed me 1 home so he was willing to give me homebuyer credit.

2. When asking a home seller for credit.

I make sure my real estate agent knows I want to ask a home seller for credit up front.

Home sellers are more open to giving larger homebuyer credits when they're asked up front vs last minute in my experience.

3. When asking a lender for credit.

I've learned when doing my home loan pre-approval.

I need to make sure my lender knows about any credits I'm planning to ask for up front.

Of course it's not possible to know all of these details in the beginning.

But telling your lender getting homebuyer credits is part of your homebuying plan makes a huge difference when they're figuring out how much of a loan and a home that you qualify for (especially if you're planning to ask for $10,000+ in homebuyer credits).

I hope these 4 ways to get money while buying a home is useful.

To recap (ways to get money):

1. The Program.

2. The Agent.

3. The Seller.

4. The Lender.

That's all for today.

See you next Saturday.