Making Money Off Inflation (4 ways people profit)

Jul 05, 2025Read time - 3 minutes / Disclosure

Inflation can:

- Build wealth.

- Provide income.

- Offer more freedom.

Unfortunately, inflation can also make life difficult.

Friend Or Foe

Inflation has pros and cons. The cons of rising prices can lead to:

- Stress.

- Anxiety.

- Financial troubles.

Most people try to deal with inflation by making more money, cutting back spending, or both.

But the hash reality—

Inflation is never-ending.

Trying to make more money and cut back spending can feel endless.

Especially when the government expects inflation each year.

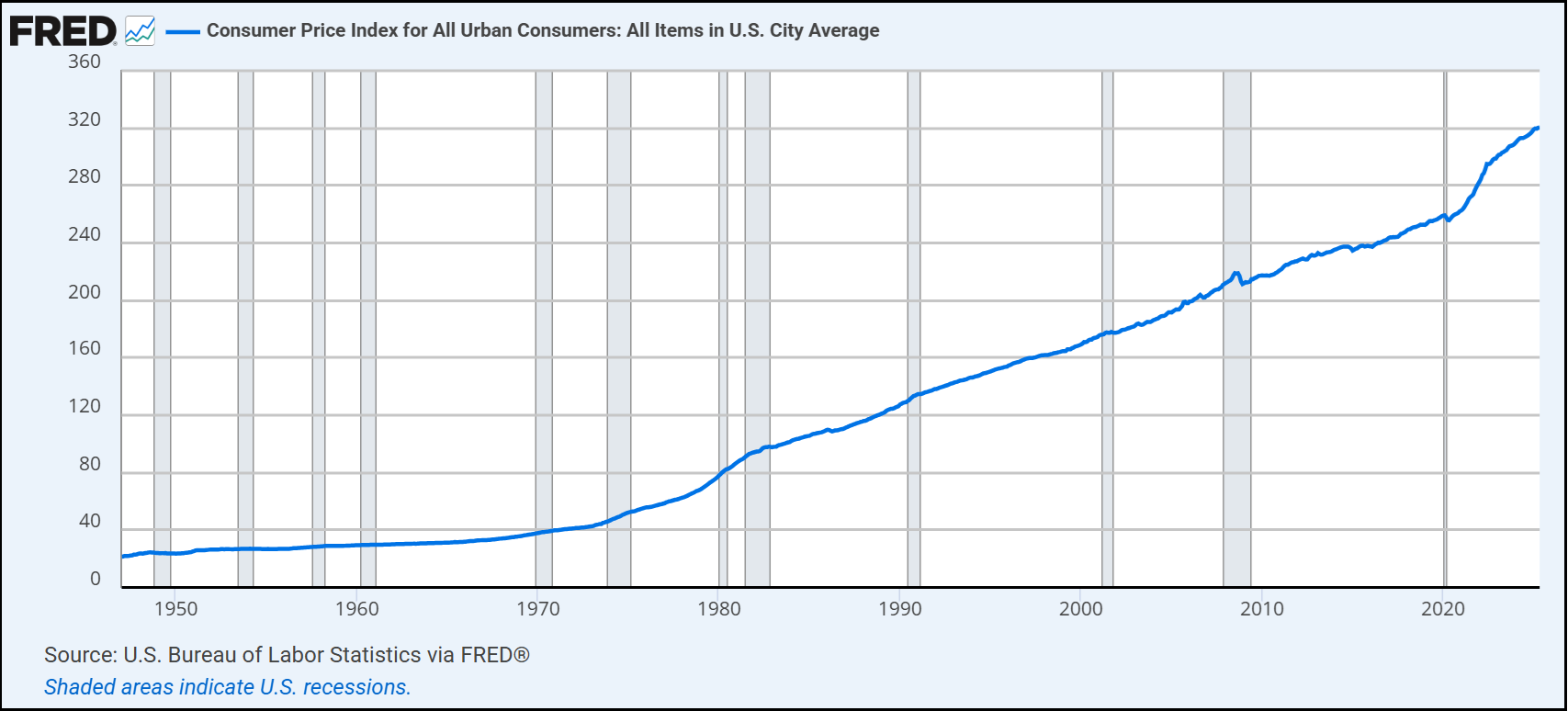

Inflation Since the 1950s

So how do you take advantage of inflation (instead of feeling taken advantage of)?

I thought a lot about this as a new investor starting at $0.

Eventually I came to the conclusion—

You copy wealthy people.

After I got a job in banking, I studied the bank's best customers closely to see how they made their money.

And I shamelessly copied them.

Here's 4 things I saw them do to profit from inflation instead of feeling stressed out over it (you can too).

Hope it's helpful.

Let's dive in:

1: The Stock Play

$100 invested in the S&P500 30 years ago is worth around $2,000 today.

Investing in an S&P500 fund like VOO (top 500 companies in the U.S.) has been my easiest investment.

From my early 20s to my mid 30s my investing account grew from $0 to $500k.

Stocks allow you to benefit from the growth of a business (without having to do any work).

S&P500 History

The stock market has gone up 10% a year on average the past 30 years.

2: The Real Estate Play

A $130,000 home bought 30 years ago is worth around $420,000 today.

After getting a loan to buy my first property (I didn't have much money).

I became obsessed with figuring out how to do it over and over — loans helped me buy 7 properties (one every 2-3 years).

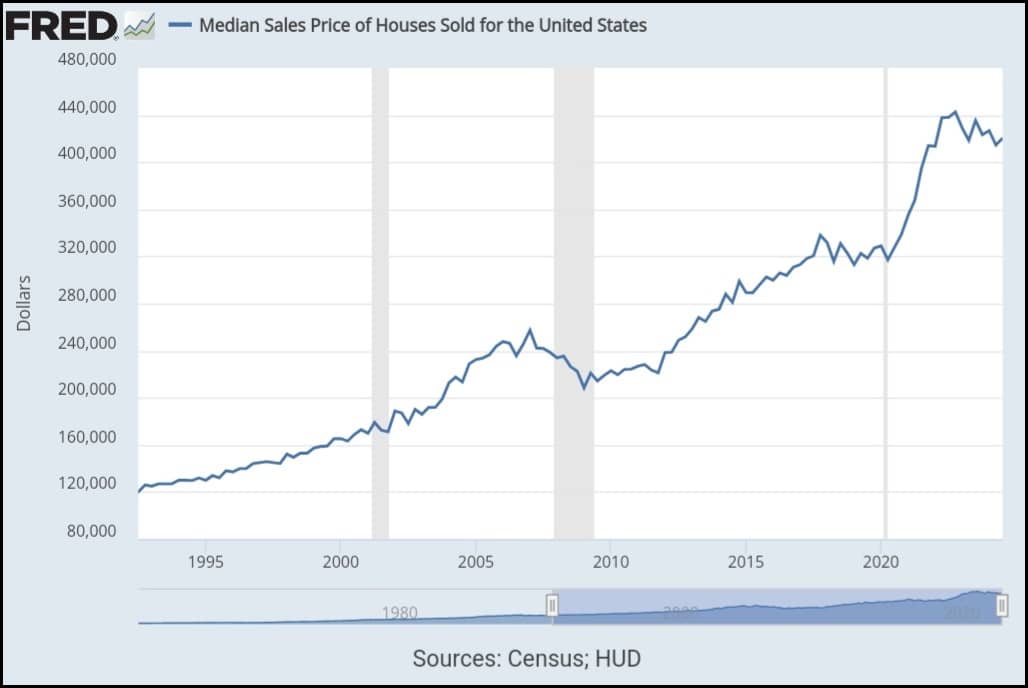

Average Home Price History

The cost of real estate has doubled every decade or so the past 30 years.

3: The Commodities Play

A $300 ounce of gold 30 years ago is now worth over $3,000 today.

It's easy to buy gold online and they'll store it for you in a vault if you're interested (pretty cool).

Goldsilver dot com has been my go to.

Gold Price History

With the government recognizing Bitcoin as a commodity, I own some of that too (bought using coinbase and store it on a ledger nano).

Bitcoin Price History

Commodities like gold or bitcoin have been going up in value faster than inflation.

4: The Business Play

Over the past 2 years I've spent around $10,000 on online courses.

Figuring out how to build a cheap little online biz has been the goal.

And there's many options:

Creating millennial wealth education has been a fun little experiment.

Releasing a free beginner investing course and a free beginner homebuyer course are the next few steps in this journey (been slowly working through this).

If you're interested in starting your own little online biz (and don't want to spend $10k figuring it out), Justin Welsh is my favorite guy to learn from.

Starting a cheap online business to build your own thing has never been easier.

The Bottom Line

I know that's quite a bit to ponder.

But the main point is—

Assets go up with inflation.

Assets like: stocks, homes, gold, or your own little business (that eventually sells things).

Most of the bank clients I shamelessly copied had some or all of these things.

People that don't have any of these things often struggle with inflation.

I know this because I was one of them starting off.

Investing helped give me the freedom to leave my job and focus more on the things I enjoy (like writing this newsletter).

If you're figuring out investing and starting out at $0 like I did.

I'd suggest learning a little bit more about investing each day.

Here's a few things I found helpful:

- Listening to a podcast while driving.

- Getting up 1 hour early to do an online course.

- Following people you admire on social media (that built the life you want).

Small daily steps can lead to a life that looks incredibly different a handful of years later.

Keep building 💰

See you next week.