My Complete $1M Journey (the 7 steps)

Jun 14, 2025Read time - 6 minutes / Disclosure

At age 36, my investments passed $1M.

Of course, it was impossible to imagine in the beginning.

Like it was last week, I remember getting my first 9-5 job in Redding, CA selling cell phones in the mall with $0 money saved.

But the thought of needing to work fulltime for 40 years scared the hell out of me. I was determined to figure out a short cut.

So, I spent years studying people I admire, reading books, taking courses, and trying different things. I got many things wrong and a few things right.

My journey unfolded like this:

• Age 24 - $30k

• Age 26 - $150k

• Age 28 - $200k

• Age 30 - $100k**

• Age 32 - $400k

• Age 34 - $700k

• Age 36 - $1M

(**during the great financial crisis)

This was achieved by investing in an S&P500 fund (stocks) and real estate.

In my 20s I worked for AT&T and Verizon in sales. In my 30s I worked as a banker at a local Chase Bank. I didn't receive any trust funds or lottery winnings (nuts).

I left my 9-5 at Chase three years after investments hit $1M and started working on this little online business part time.

I get many questions about my journey, from people at different stages in their financial life.

So today I'm sharing how this all happened and the most important things I learned along the way to $1M in investments.

I want to point out guides like this aren't meant to be followed exactly. Every journey is different, and if you tried to recreate mine, you may not have the same luck or timing.

That said, this is what I did, in the order I did it.

Step 1: Took the Retirement Match

When I started, I looked at my retirement account match as free money.

So, I had 5% of my pay go into my retirement account at work and my job matched the 5% (10% of my annual pay went into retirement).

I tinkered a lot with my account in the beginning trying to decide how to invest the money.

Eventually, I settled on an S&P500 fund.

Most retirement accounts offer an S&P500 fund.

If your employer doesn't offer a retirement account, opening your own Individual Retirement Account (IRA) online works too at places like Fidelity, Schwab, etc.

Step 2: Got a Home Loan

Along with stocks I wanted to invest in real estate.

But I didn't know anything about buying or selling property.

I took the plunge and got a loan to buy my first starter condo in Bellevue, Washington.

The loan covered the entire cost of the little condo.

I just had to come up with $1,000 or so to cover the fees.

This amazed me (that I didn't have to come up with much money).

My friend moved in as my "renter" so I didn't have to make the entire monthly payment.

Step 3: Bought More Stocks

At this point, I received a promotion at work so I increased the money going into my retirement account and put more money in the S&P500 (stocks).

I changed it from 5% to 10% of my pay.

Plus my job matched 5% (15% of my annual pay went into retirement).

According to Fidelity, most employers that offer a retirement account will match 5% of your annual pay on average.

It's a perk worth taking if offered (in my opinion).

Step 4: Got Another Home Loan

Over the next 2 years, my little starter condo went up $100k.

So I sold it, put the money towards a house in Seattle, WA and got another home loan for the difference.

My roommate friend and I both moved into the house.

The home had an upstairs and a downstairs living area which worked well.

These types of homes are great for rental income (especially if you don't like sharing your space).

Getting the 1st starter condo plus the house a few years later without having to come up with hardly any of my own money amazed the hell out of me.

So, I decided to do it again and again.

Stocks and real estate became my main focus.

Step 5: Applied for More Home Loans

Over the next few years I got 2 more home loans that allowed me to buy 2 more little condos in Seattle, WA.

I eventually realized, you get the best deal if you move into the home that you buy.

Most home loan lenders require that you live in the property for at least 1 year.

The interest rate is better and you don't have to put a lot of money down.

But you need to qualify for the loan (and make sure you're ok with the monthly payment).

Working with a good loan officer was a big part.

My real estate agent referred me to one named Joe (he's retired now).

Loan officers help you understand how to get approved for 1, 2, or 3+ home loans.

I lived in each of the little Seattle condos for a period of time and shared space with a roommate which helped lower my monthly costs.

Step 6: Boosted Stock Buying

At this point, I started working at a local Chase Bank and was making more money.

So I increased the money going into my retirement account from 10% to 15% of my pay.

Plus my job matched 5% (20% of my annual pay went into retirement which bought more S&P500 stocks).

I also opened a brokerage investment account that was separate from my retirement account.

The IRS says retirement age is 59 1/2.

Accessing retirement money early means paying a 10% penalty in most cases.

I wanted to avoid this.

So I opened, and started investing in a separate brokerage account as well (you can take money out whenever you want).

The Vanguard S&P500 ETF (VOO) was the fund I invested in.

Stocks went up and down but I continued to invest.

Photo Credit: personalfinanceclub

Step 7: Got a Few More Home Loans

I hadn't planned on buying any more property.

But I moved to San Diego, CA from Seattle, WA.

(all 3 Seattle properties were rented out)

After being a renter in San Diego for 2 years, I decided to become a homeowner.

I found a property that had a separate living area I could rent out to help keep my monthly costs down.

I knew I wouldn't want to share my living space as I got older (unless it was with family).

The home loan covered 97% of the cost of the home.

So I had to come up with 3% of the cost of the home (not too painful).

I've always found it fascinating you can buy property without much money in the U.S.

Unfortunately, the news has most people thinking a ton of money is the only way to own a home.

The next property I bought was from a family member in Northern California.

I didn't have to put any money down, just had to get a loan to buy the home.

That's often the case when you buy from family (but not always).

The last property I bought was a house in bad shape that I tried to flip.

It was a painful lesson.

Buying a property that needs a lot of work, fixing it up, and selling it to someone else looks a lot cooler on TV than in real life (in my opinion).

The bottom line

Here's what my investments looked like when they hit $1M:

• $510k S&P500 (stocks)

• $490k Real Estate (property value minus the loans)

A few important notes:

• Several years have passed

• I sold 3 properties (4 remain)

• I left my 9-5 job 5 years ago

This newsletter issue might make the journey seem easy, but it wasn't. I got fired, maxed out my credit cards, and almost filed bankruptcy near the beginning of my journey.

It also came with mistakes and hard lessons. Figuring out money while balancing life is not easy.

If I was starting over:

1. I'd invest in the S&P500 (again).

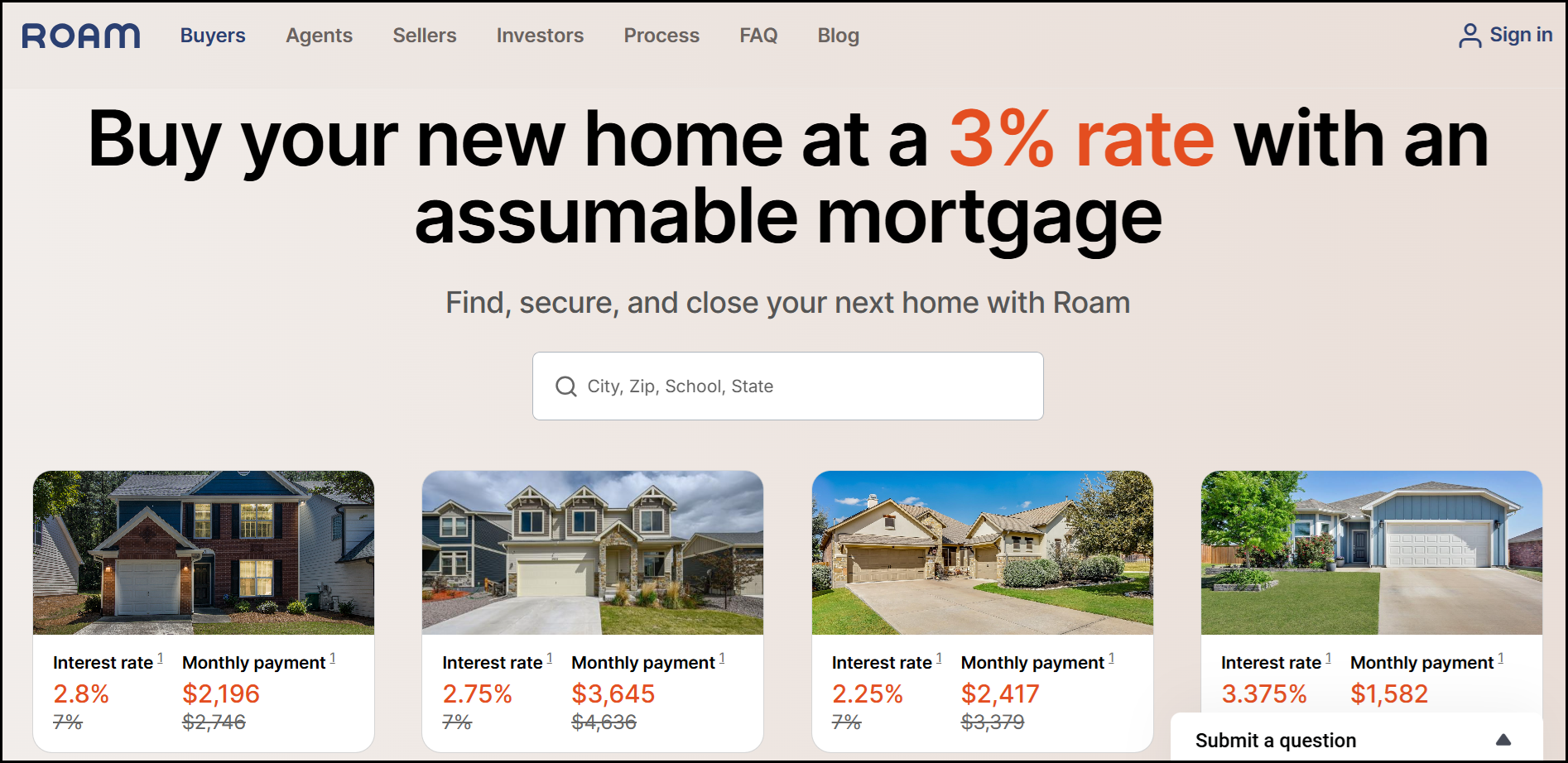

2. Since real estate is more challenging these days, I'd use the 2,000+ down payment help programs and check out companies like Roam. They help you get a low interest rate by taking over someone's existing home loan (people who want to sell their home and have a low interest rate).

Roam is expected to be in all 50 states in 2026. Assumable.io is another company that helps you do the same thing.

These 7 steps aren't a guarantee, and your journey will surely look different. But many of these principles can change most beginner investors' money situations quickly. So take what you find useful, and discard the rest.

Thank you for being part of this weekly newsletter with me. I hope it's useful and appreciate you reading it.

That's all for today.

See you next Saturday.