The 7 Homebuying Myths (and the actual truth)

Sep 13, 2025Read time - 4 minutes / Disclosure

Buying a home can be:

- Fun.

- Exciting.

- An amazing asset.

Unfortunately, there's many homebuying myths.

False Beliefs

Getting the wrong information about buying a home:

- From a relative.

- From a friend.

- On the news.

...can cost you.

Many people use that information to make one of the biggest financial decisions of their life.

Getting the right information is crucial.

Although buying a home is still part of the American Dream.

That dream seems to be changing.

The outdated American dream:

— JOHN HENRY (@thejohn_henry_) September 9, 2025

- Big car payments.

- Big house payments.

- Working until age 65.

The modern American dream:

- Keeping costs low.

- Investing every month.

- Escaping the 9-5 life early.

So how the heck do you buy a home without spending an arm and a leg?

After working in banking and helping 1,000+ homebuyers.

I realized homebuying boils down to 2 things:

1. A person's willingness to play the homebuying game.

2. A person's willingness to separate myths from truths.

Homebuying is a game of making your finances look a certain way.

A way that allows a loan officer to approve your loan so you can buy a home.

And most loan officers will tell you exactly what they need to get your loan approved after looking at your finances.

Why?

Because most of them work on commission.

And getting your loan approved means more money in their pocket.

It might take a few weeks.

It might take a few months.

It might take a year.

But if you're willing to do what needs to be done.

Most loan officers will gladly meet you half way.

Another big part of homebuying is separating myths from truths.

The "Homebuying Myths" Checklist

Here's 7 common homebuying myths — and how knowing them can help you buy sooner than later (hope it's helpful).

Let's dive in:

1. The Less Debt Myth

Many people think they need low debt or no debt to buy a home.

But cash-flow matters most.

For example, most home loan lenders view:

- A $300 car payment with a $20,000 loan balance.

The same as..

- A $300 car payment with a $40,000 loan balance.

Why?

Because your ability to make a monthly home loan payment matters more than your total debt.

Monthly cash flow is more important than your total debt when trying to get a home loan.

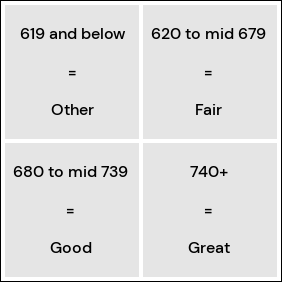

2. The Perfect Credit Myth

Many people think they need really good credit to buy a home.

But many home loan programs allow a credit score below 619.

Home Loan Credit Score Ranking

The "other" category has homebuying programs too.

Not having a high credit score doesn't mean you can't get a home loan.

3. The 20% Down Myth

Many people think they need a 20% down payment to qualify for a home loan.

But many home loan programs allow:

- A 5% down payment.

- A 3% down payment.

- A 0% (no down payment).

Not having a big down payment doesn't mean buying a home isn't possible.

4. The Long-Term Job Myth

Many people think they need a long-term job to buy a home.

But most home loan lenders only look at your last 2 years of work history.

If that includes:

- 4 different jobs.

- Several months off.

- An unexpected lay off.

That doesn't mean owning a home is out of the question.

A perfect work history isn't necessary to get a home loan.

5. The Pay Now Myth

Many people think they need to pay their loan officer and their real estate agent up front.

But it's common practice to pay your loan officer after finding your new home.

And its common for the seller of your new home to pay for your real estate agent.

Loan officers and real estate agents normally get paid after you close on your new home.

6. The Never Move Myth

Many people think getting a home loan means they must live in the home a long time.

But if buying a home as your primary residence, most home loan lenders only require you live in the home for 1 year.

After that you may decide:

- To move out.

- To sell the home.

- To rent the home.

Most home loan lenders understand your needs may change after buying your home.

7. The Forever Loan Myth

Many people think they must keep their home loan long term.

But most home loans can be refinanced whenever you want.

For example:

Maybe you got a home loan and your interest rate is 6%.

And a short time after buying your home maybe the interest rates drop to 5%.

Refinancing your home loan may save you thousands of dollars in loan payments.

Refinancing a home loan can be a great way to save money when interest rates drop.

The bottom line

One thing to remember with homebuying (and homebuying myths).

Everyone's journey looks different.

Susan the schoolteacher may have received a $10,000 educator credit to buy a home.

So she didn't need to come up with a lot of money for her homebuying costs.

Scott the plumber may have received a lower than normal interest rate.

Because he bought a home in a neighborhood with a special program.

Jenna the flight attendant may have qualified for a larger home loan then her flight attendant friend.

Because her car payment ends in 10 months and her loan officer was able to leave it off her loan application.

Homebuying myths are often half-truths from someone else's unique homebuying journey.

Don't allow them to discourage you if you see homebuying in your future.

That's all for today.

See you next Saturday.