10 Money Saving Tips (that actually work)

Feb 06, 2026Read time - 4 minutes / Disclosure

Saving more money can:

- Lower your stress.

- Boost your bank account.

- Grow your investments faster.

Unfortunately, the cost of things keeps going up.

Everyday Living

Today most people are stressed over:

- The cost of food.

- The cost of housing.

- The cost of insurance.

Hell, I've been worried about it too.

Prices have been growing faster than usual.

Which can be stressful.

Most people do their best to deal with it.

But there's only 2 ways to do that:

1. Make more money.

2. Save more money.

Not worrying about what other people think can be helpful too.

5 signs you're on track to escape

— JOHN HENRY (@thejohnhenry_) February 2, 2026

the 9-5 life early:

1. No car payment.

2. No credit card debt.

3. An emergency fund.

4. Investing every month.

5. Not caring what other people think.

When I was younger, I remember learning most of this stuff the hard way.

I had:

- A big car payment.

- Maxed out credit cards.

- Not much money saved.

And it was super stressful.

The truth is..

It all happened slowly.

One day at a time.

One small money decision at a time.

And one day I woke up thinking...

"how the heck did I get here?"

Stressing about money was a terrible feeling.

But working in finance helped me fix many of my bad habits.

Learning from people smarter than me.

Shamelessly stealing what works.

And building those better money habits into my life.

"Saving is the gap between your ego and your income."

— Morgan Housel

The Less Stressful Path

Here's 10 money saving tips I learned before leave my bank job of 10 years.

Tips that completely changed my financial life.

Hope they're helpful.

Let's begin.

1. The Account Split

Most people have their checking and savings accounts at the same bank.

I did too for a long time.

But I eventually learned keeping them at different banks works better.

Transferring money between a checking and a savings account is easy..

When they're at the same bank.

When they're at different banks.

It's harder.

Which helps remove the temptation of quickly transferring money.

From a savings account to a checking account.

And spending the money.

Keeping a savings account at a different bank than your main checking account can help you spend less money.

2. The High-Yield Savings

Most people keep their savings account at a big bank.

But according to nerdwallet.

Most big banks pay 21 times less interest on their savings accounts.

Compared to an opening a high-yield savings account.

For example:

$5,000 in a savings account at a big bank paying .02% interest

= $1.00 in 1 year

$5,000 in a high yield savings account paying 3% interest

= $150 in 1 year

A massive difference.

Using a high yield savings account can help you save more money than using a big bank savings account.

3. The Auto-Pilot Hack

Most people plan to save and invest when they have "extra money".

That's what I thought too initially.

But life gets busy.

Things come up.

And before you know it..

5 or 10 years have passed and there's still no savings or investment accounts.

I've found investing on auto-pilot is a better way to go.

Which means having part of each paycheck:

- Go into a savings account automatically.

- Go into a retirement account automatically.

- Go into an investment account automatically.

Instead of dumping each paycheck into a checking account and then spending the money.

Having each paycheck go into a checking account plus a savings account and an investment account.

Most employers let their employees send their paycheck to 2 or 3 different accounts.

"Do not save what is left after spending, but spend what is left after saving."

— Warren Buffett

Saving and investing automatically (even if it's a smaller amount) helps you build wealth for the future every time you're paid.

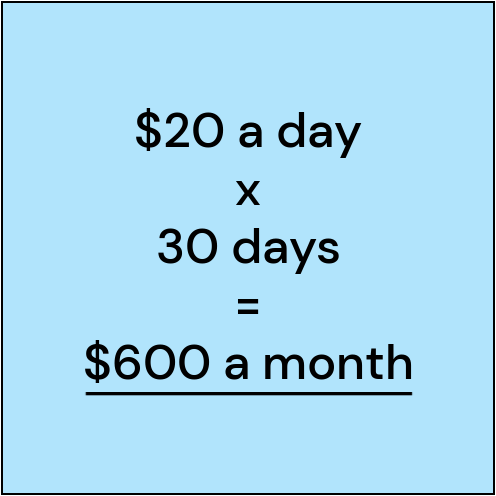

4. The 30-Day Rule

Most people spend money on smaller things everyday without giving it much thought.

Things like:

- Coffee.

- A snack.

- A nice lunch.

- Dinner from a food delivery app.

But I've found the small daily things can be very sneaky.

The 30-day rule helps.

It says to "multiply each small daily thing by 30".

So if spending $20 a day on a coffee and lunch...it looks like this:

The 30 day rule helps you better understand how smaller daily spending affects your total monthly spending.

5. The Credit Card Hack

Most people make a payment on their credit card after receiving the bill.

But there's 2 big perks I've discovered if paying my credit card before the bill comes.

Perk #1:

Setting a reminder on my phone to check my credit card every 2 weeks (every other Sunday).

And paying the bill off early.

I've found doing this makes it harder to spend too much money.

Perk #2:

Paying the card off before the bill comes means the credit card always shows up on my credit report as a $0 balance.

This helps my credit score and helps make getting loans easier (like a home loan)..

Since my credit card balance always shows as $0 on my credit report.

Setting a phone reminder to pay your credit card every 2 weeks instead of every month can help you spend less money.

6. The Authorized User Hack

Most people with low credit scores pay more money for everyday living.

Credit scores have a big impact on how much money we spend on:

- Renting an apartment.

- Getting insurance.

- Buying a home.

But the authorized user hack can help boost a credit score.

For example:

Emma and Dan want to buy a home.

Emma has an amazing credit score.

Dan's credit score needs a lot of work.

Both Emma and Dan know his low score can affect the interest rate they get on a home loan.

So Emma decides to add Dan as an authorized user to a credit card she's had for a long time that has a big credit limit and a zero balance.

Emma figures if adding Dan doesn't help his credit score.

She can always go back and delete him as an authorized user.

So Emma logs into her credit card account online and adds Dan as an authorized user.

Within 30 days, Dan's credit score goes up 80 points.

In finance, I've watched people do this over and over again.

The authorized user hack can be a quick way to boost a low credit score (but there's no guarantees it will work).

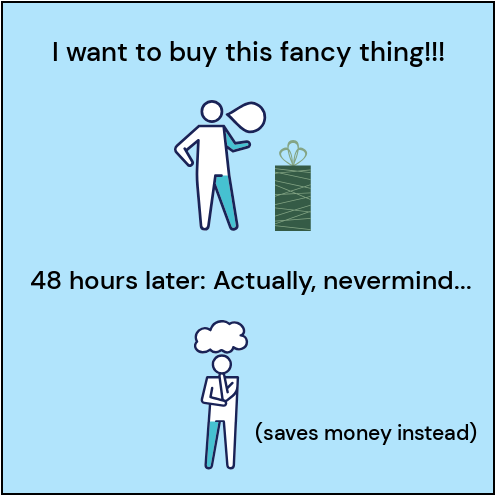

7. The 48-Hour Rule

Many people make big purchase decisions quickly.

- Buying a car.

- Buying a timeshare.

- Buying an expensive online course they didn't use.

I've made many of these mistakes.

But after discovering the 48-hour rule.

It's helped me avoid big impulse purchases and often looks like this:

The 48-hour rule says: "wait a full 48-hours before buying an expensive thing you want".

I've found most of the time, the urge to buy the expensive thing completely passes.

The 48-hour rule can help you avoid impulse purchases and only buy the things you truly want or need.

8. The Big Ticket Hack

Many people take the first offer when buying an expensive thing.

Things like:

- A car.

- A home loan.

- A new roof on their house.

But negotiating can be a massive money saver.

The Big Ticket Hack says: "get 2 estimates at the exact same time whenever possible".

For example:

I needed a new hot water heater a few months ago.

I scheduled 2 companies to come and give me an estimate at the exact same time.

Both of the guys sat in their trucks waiting for me to make a decision after providing their estimate.

In the end, one company was $500 cheaper than the other.

The big ticket hack forces companies to compete for your business which can save you a lot of money.

9. The Insurance Rule

Most people quickly setup an insurance policy when needed and don't think about it again.

Many years pass before they start to wonder..

"am I paying too much money"

So they spend hours shopping around comparing quotes.

Before switching their insurance policy to a different company.

It can be a pain.

I've been there too.

But one day my friend that owns an insurance agency told me about "the insurance rule".

The rule says: "instead of getting quotes from individual insurance companies, just use an insurance broker".

So I switched my insurance policies to an insurance broker 10+ years ago.

Most insurance brokers have access to 30+ different insurance companies.

That means with one quick call every couple years.

They can easily shop insurance rate for me, cancel my current policies, and switch me to a different insurance company with better pricing.

I've found it to be so much easier.

Using an insurance broker can save you time and money (google "insurance broker" + "your city" to find several of them).

10. The Retirement Short Cut

Most people save and invest most of their money in a retirement account.

That's exactly what I did too for a long time.

But then one day I realized most of the people I worked with in my finance job that retired early.

They didn't just have retirement investments.

They also had "before retirement investments".

Because they didn't want to wait until their 60s to leave 9-5 life.

So I started focusing more on also having "before retirement investments".

Which meant investing in a retirement account plus investing in a non retirement account (they're often called a "self directed investing account".)

Having before retirement investments can help make leaving 9-5 life earlier much easier (if you want).

The bottom line

Most of the people I've met that retired early or left 9-5 life early.

Had a playbook of tips, hacks, rules, or habits they followed every month.

Not just one or two of them.

But a handful of different short cuts.

Short cuts to help them:

- Save more money.

- Invest more money.

- Have more money so they had more options in life.

Not to buy a fancy car.

Or some fancy clothes.

Or a fancy watch.

But to buy back their time.

To leave 9-5 life early to do their own thing.

To see their family more.

To take more trips.

To work part time on something they truly enjoy doing it instead of working full time.

I hope this little list of 10 money tips is as helpful for you as it's been for me on my investing journey.

Thanks for reading it.

That's all for today.

See you next Saturday.