4 Modern Money Tips (not taught in school)

Dec 06, 2025Read time - 4 minutes / Disclosure

Learning about money can:

- Help you save.

- Help you invest.

- Help you build wealth faster.

Unfortunately, most schools teach nothing about money.

The Game

Not learning about the game of money can lead to:

- Stress.

- Anxiety.

- Having to work in retirement.

Most people want to break free from 9-5 life early.

But they don't know where to start.

If you didn't learn about money in school (like me) or from your parents.

Knowing what to do and what not to do as a young person is tough.

7 money tips I wish I knew at 21:

— JOHN HENRY (@thejohnhenry_) December 4, 2025

1. Avoid car loans.

2. Work different jobs.

3. Learn high-value skills.

4. Save money each payday.

5. Learn how to invest & start.

6. Begin working on a side hustle.

7. Plan to escape the 9-5 life early.

I've done many things wrong with my money and a few things right.

But 4 money tips had the biggest impact.

And motivated me to invest consistently while working my 9-5.

Which took my investments from $0 to $1M in just over a decade.

Working in finance felt like a cheat code.

To learn the things most schools don't teach.

To see and copy what successful bank clients did.

To opt out of working a 9-5 job a few decades early to do my own thing.

But I've also made my fair share of mistakes along the way..

Like having $50k on my credit cards in my late 20s.

The Money Levers

Learning these 4 tips "money levers" from people much smarter than me had the biggest impact on my money and investing journey.

Hope they're useful.

Let's dive in:

1. The Compounding Game

Compound interest made famous investor Warren Buffett rich.

Buffett's net worth is $160 billion according to Forbes.

And he started with $20k in his early 20s.

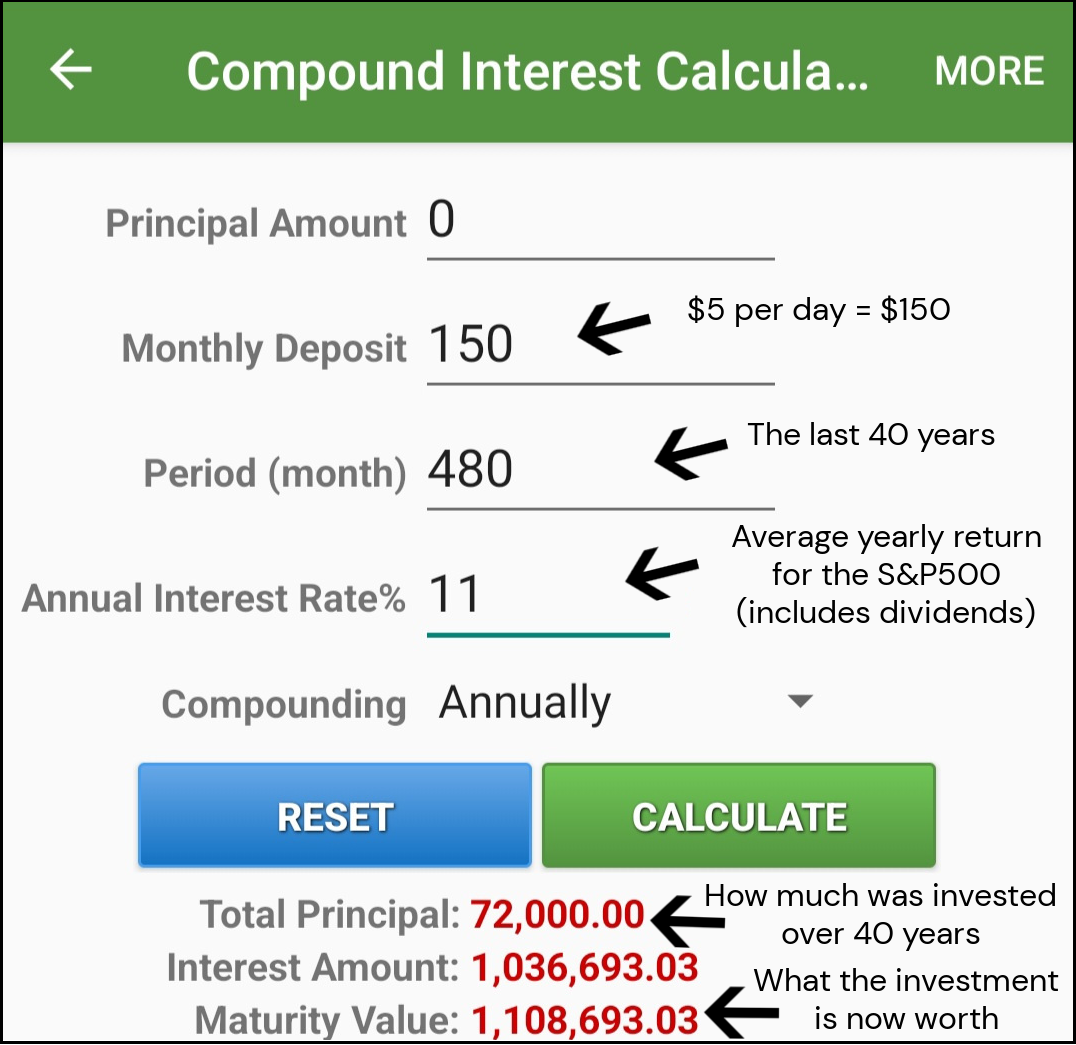

Running a few "what if" scenarios is a helpful way to make sense of compound interest.

FN Calculator is my favorite free compound interest app to download and tinker with while planning my investments.

For example:

Over the last 40 years.

If someone saved $5 per day.

Invested $150 per month.

Into the S&P500 (stock market).

Here's how it turned out:

FN calculator

The S&P500 (stock market) has grown 11% per year on average the past 40 years.

It's also important to remember if starting from scratch.

$1M in 40 years won't buy as much stuff as $1M today.

Because the price of everything goes up every year.

To get around this I started my investing journey with a smaller amount.

And added more money as I made more money each year.

Knowing how compound interest works is helpful when planning your investments.

2. The Income Game

There's many ways to make money.

But school only talks about one way..

Getting a job.

Learning these 3 facts changed how I thought about making money.

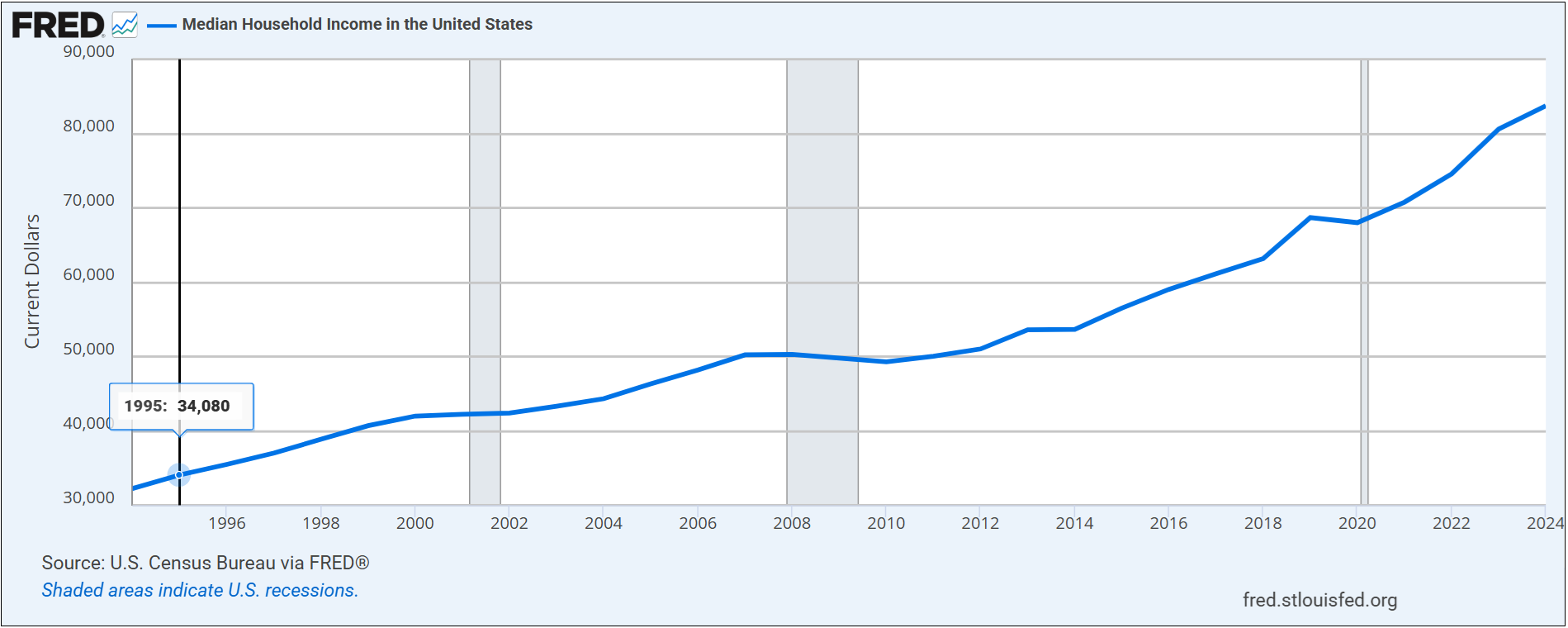

Fact #1

30 years ago.

The average income of a family in the U.S. was:

$34,080

Today the average income of a family is:

$83,730

That means family income went up:

145% in the last 30 years.

Family income

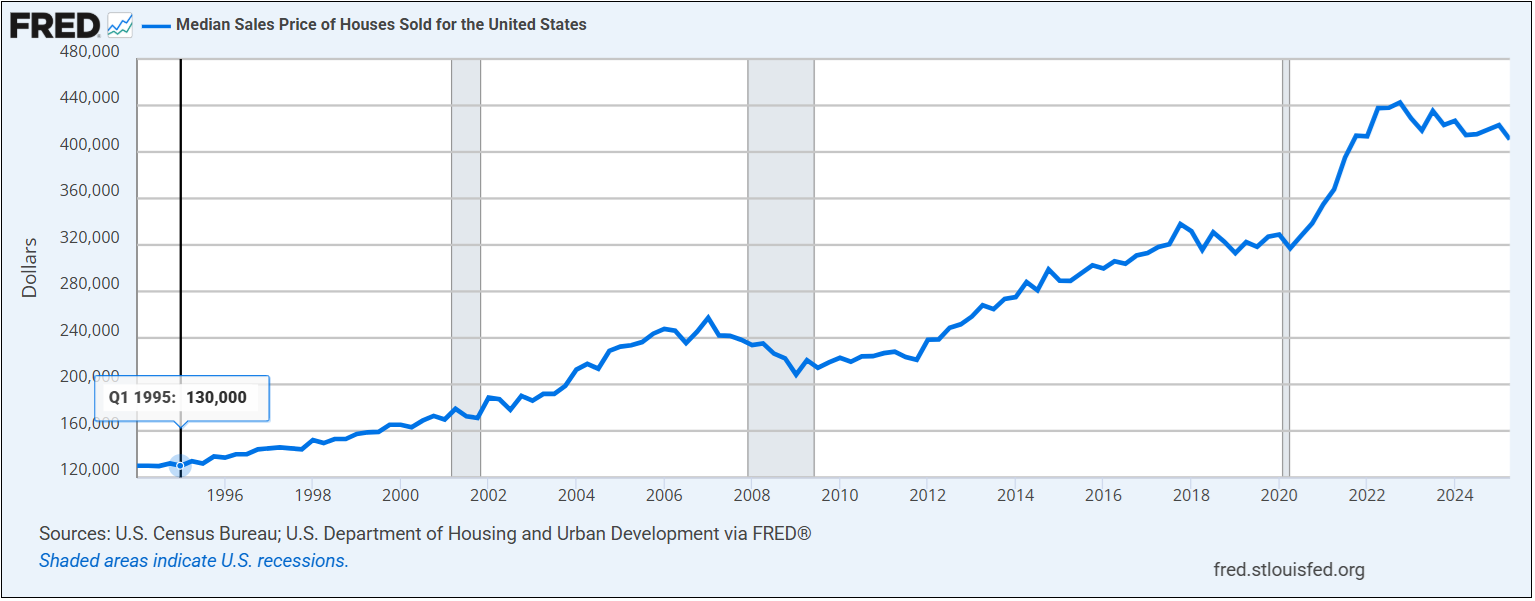

Fact #2

30 years ago the average home cost:

$130,000

Today the average home costs:

$410,000

That means homes went up:

315% in the last 30 years (more than peoples income).

House prices

Fact #3

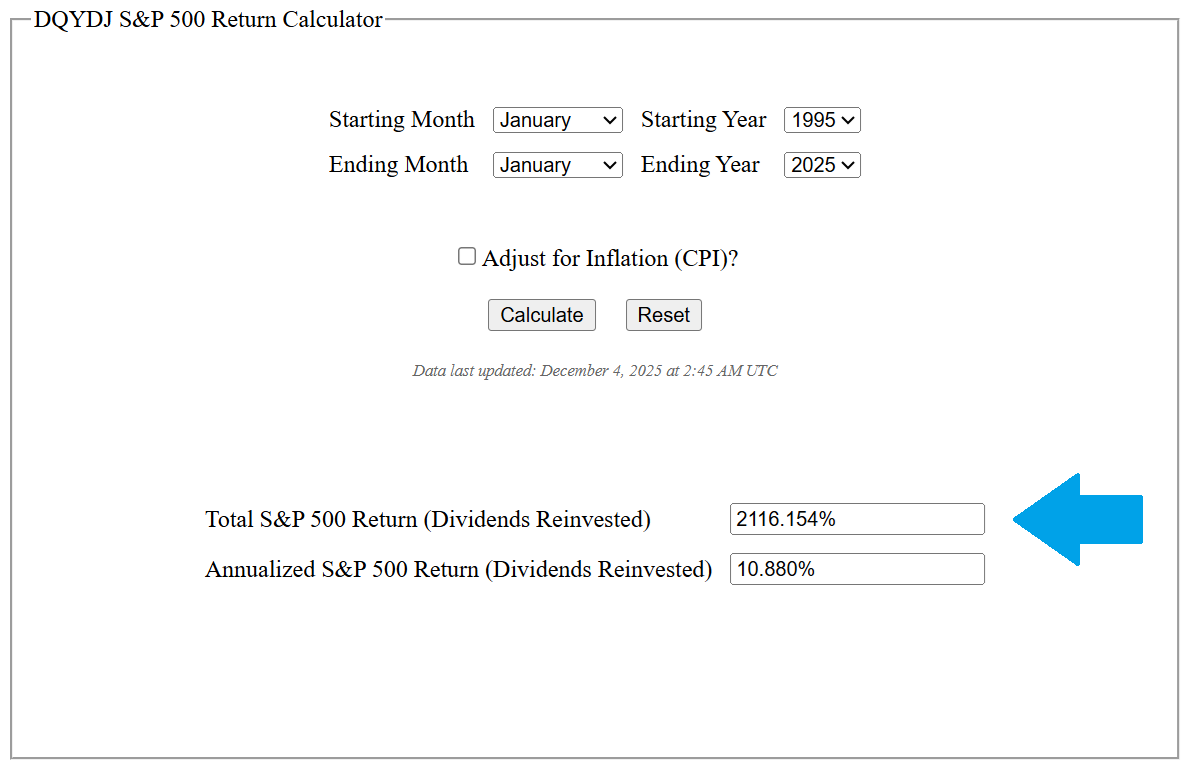

30 years ago.

$100 invested in the stock market.

Is worth a total of $2,216 today.

That means the stock market went up over 2,000% the last 30 years.

Stock market growth

To recap.

In the last 30 years:

Homes went up 315%.

Stocks went up 2,000%.

People's income only went up 145%.

Learning these facts motivated the heck out of me to invest.

The stock market and real estate commonly grow faster than peoples income.

3. The Investing Game

Famed investor Naval Ravikant's quote is harsh but worth knowing:

"You're not going to get rich by renting out your time. You must own equity (aka investing in assets)."

— Naval Ravikant

Here's an example to consider:

Dave is a computer programmer.

He works 50 hours per week at his job.

But if Dave is laid off.

Money from his job stops coming in.

If years earlier Dave got a loan and bought a home.

And was investing part of his money every month.

His home and his investments would likely continue to grow in value as he searched for a new job.

"Wealth is assets that earn while you sleep."

— Naval Ravikant

Income from a job takes continuous effort every week while income from investments often take no effort or minimal time.

4. The Taxes Game

Taxes are based on the type of income that you make.

For example.

If comparing:

- Income from a job.

- Income from investments.

- Income from a self employed person.

People making income from investments often pay the least amount of tax.

The money cruncher is a good follow for taxes. Met him last year, sharp guy.

Strategic withdrawals from your portfolio is the key to paying $0 in taxes.

— The Money Cruncher, CPA (@money_cruncher) October 2, 2025

If you are married, you can pull:

• $31,500 from your pre-tax 401k

• $58,500 of long-term capital gains from brokerage

• $10,000 from your Roth IRA

= $0 in federal taxes, $100,000 of cash. (Assuming…

People who make most of their income from investments, often pay the least amount of tax.

The bottom line

I remember reading about these things inside a Barnes and Noble.

Back when I lived in Los Angeles in my early 20s.

And didn't have money to buy books on investing.

It didn't make much sense back then.

But working in finance helped me learn more about this stuff.

And motivated me to focus more on investing after learning:

- How Warren Buffett one of the richest guys made his money with compound interest.

- How income from a job grows slower than real estate and the stock market.

- How investments often require no work to make money unlike a job.

- How taxes are based on the type of income you make and people with investment income often pay the least amount in tax.

These realizations where big "ah-hah" moments in my life and have given me freedom of my time much sooner than expected.

I hope they're useful things to know on your investing journey.

That's all for today.

See you next Saturday.