4 Popular Home Loans (and how to get one)

Nov 29, 2025Read time - 4 minutes / Disclosure

Getting a home loan can:

- Grow your assets.

- Build your net worth.

- Create generational wealth.

Unfortunately, home loans can be a confusing thing.

The Options

Making sense of home loan topics like:

- Down payment.

- Escrow account.

- Earnest money deposit.

...can sound like a foreign language to a first-time homebuyer.

It did to me in the beginning.

But learning about loans is a big part of homebuying.

"91% of first time buyers finance their purchase."

— National Association of Realtors

Most people don't have cash to buy their first home.

I sure didn't.

Getting a home loan was a necessary thing for me to buy a home.

And getting that first home loan completely changed the way I saw real estate.

Before buying a home.

I thought the stock market would be the best way for me to build wealth while working my 9-5 job.

The math behind becoming a millionaire:

— JOHN HENRY (@thejohnhenry_) November 25, 2025

Investments growing at 10% while:

- Investing $125 a week for 30 years.

- Investing $350 a week for 20 years.

- Investing $630 a week for 15 years.

It sure isn't easy.

But it's easier than winning the lottery.

But after getting my first home loan.

And only needing to come up with $1,500 of my own money to become a homeowner.

And watching the value of my tiny condo go up $100,000 in two years.

I realized real estate was another way I could build wealth (without using a lot of my own money).

"Buy land, they're not making it anymore."

— Mark Twain

The Home Loan Cheat Sheet

After working in finance for 10 years.

And getting loans to buy more properties.

I realized how important it is to know the 4 most popular home loans.

Here they are (hope it's useful).

Let's dive in:

1. The USDA Loan

USDA stands for:

United States Department of Agriculture

USDA home loans are available in the suburbs and rural areas.

If you don't live in a big city.

The odds are high the USDA home loan is an option.

Here's 3 things to know:

1. USDA loans have an annual income limit.

You must make less than the annual limit.

The limit is based on where you buy your home.

$119,850 is the annual income limit in many areas as of 2025 for a household of up to 4 people.

How much money you make no longer matters after getting a USDA loan.

2. USDA loans need the home you buy to be your primary residence.

You must live in the home for at least the first 12 months.

3. USDA loans don't need a down payment.

So if you qualify for the monthly loan payment.

You don't need to come up with a down payment unless you want to have a smaller monthly payment.

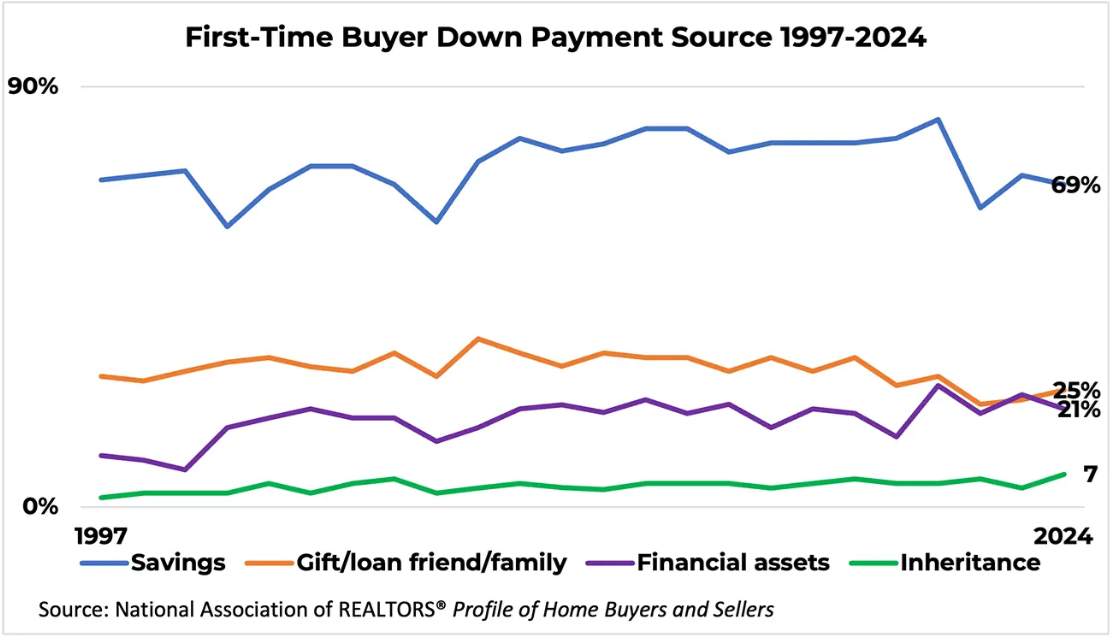

Here's where most people get additional money when buying a home (but it's missing a 5th option worth knowing we'll talk about below).

USDA loans are a common way to buy a home without a lot of up front money if you live in the suburbs or a rural area.

2. The VA Loan

VA stands for:

Veterans Administration

VA home loans are available for people affiliated with the military.

For example:

- Veterans.

- Active duty members.

- Reservists and National Guard members.

Here's 2 things to know:

1. VA loans need the home to be your primary residence.

You must live in the home for at least the first 12 months.

2. VA loans don't need a down payment.

So if you qualify for the monthly loan payment.

You don't need to come up with a down payment unless you want to have a smaller monthly loan payment.

VA loans are a common way to buy a home without a lot of up front money if you're affiliated with the military.

3. The Conventional Loan

Conventional home loans are available to everyone.

This type of loan often allows a down payment as low as 3%.

So if buying a $400,000 home.

3% of $400,000 =

A $12,000 down payment.

It's also important to remember.

When buying a home there's also "closing costs".

Which covers things like:

- The escrow company.

- Your home insurance.

- Your property taxes.

These costs can be several thousand dollars as well.

But there's a 5th way to get money when buying a home that nobody talks about (the exact playbook I used to get $30,000 in homebuyer money)

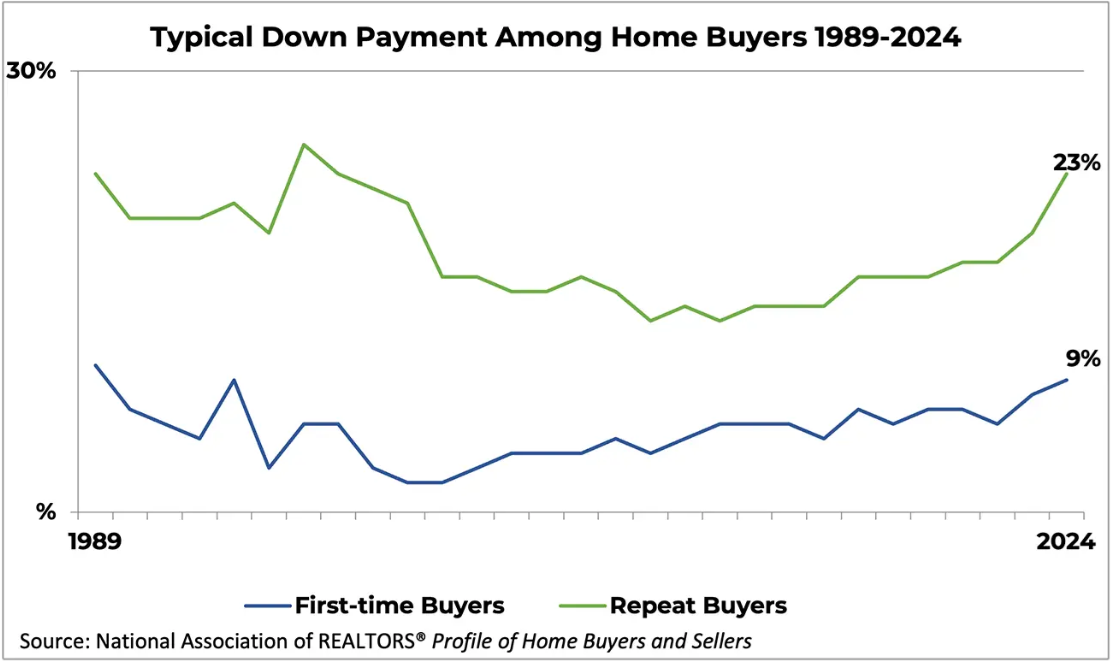

On average most first time homebuyers put down around 9% of the cost of their home.

Conventional loans are available to everyone and are a common way to buy a home.

4. The FHA Loan

FHA stands for:

Federal Housing Administration

FHA home loans are available to everyone.

Here's 2 things to know:

1. FHA loans need the home to be your primary residence.

You must live in the home for at least the first 12 months.

2. FHA loans need at least a 3.5% down payment.

So if buying a $400,000 home.

3.5% of $400,000 =

A $14,000 down payment.

FHA loans are available to everyone and are a common way to buy a home.

At this point you may be wondering..

Which option do most people pick?

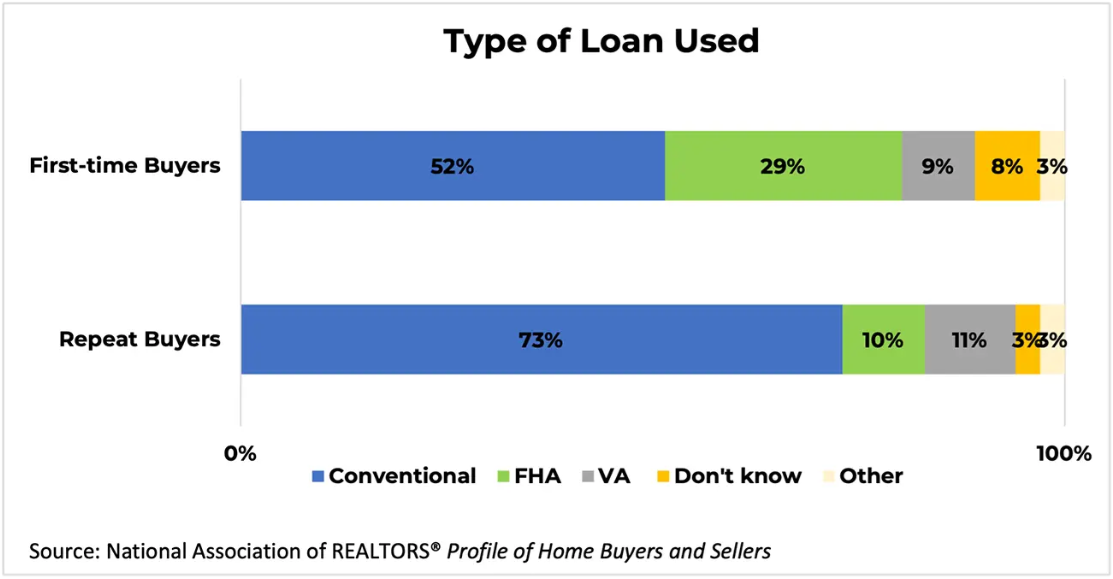

Here's the breakdown:

According to the National Association of Realtors.

52% of first time homebuyers use a conventional loan.

The 2nd most popular home loan at 29% is an FHA loan.

The bottom line

I know that's a lot to ponder.

Now that we'd reviewed the basics.

The next step when you're ready is to connect with a loan officer.

They're free to talk to.

And they'll look through your:

- Paystubs.

- Credit report.

- Bank statements.

And help you figure out which home loan works best for you.

If you don't qualify for the loan you want just yet.

Most loan officers are happy to help you figure it out since many of them work on commission and only get paid when you get your home loan.

This might help too: The exact playbook I used to get $30,000 in homebuyer money.

That's all for today.

See you next Saturday.