4 Ways to Get a Lower Interest Rate (for homebuyers)

Dec 20, 2025Read time - 4 minutes / Disclosure

Getting a lower interest rate on your home loan means:

- Lower interest costs.

- Lower monthly payments.

- More money saved.

Unfortunately, how to get a lower interest rate isn't common knowledge.

Home Loans

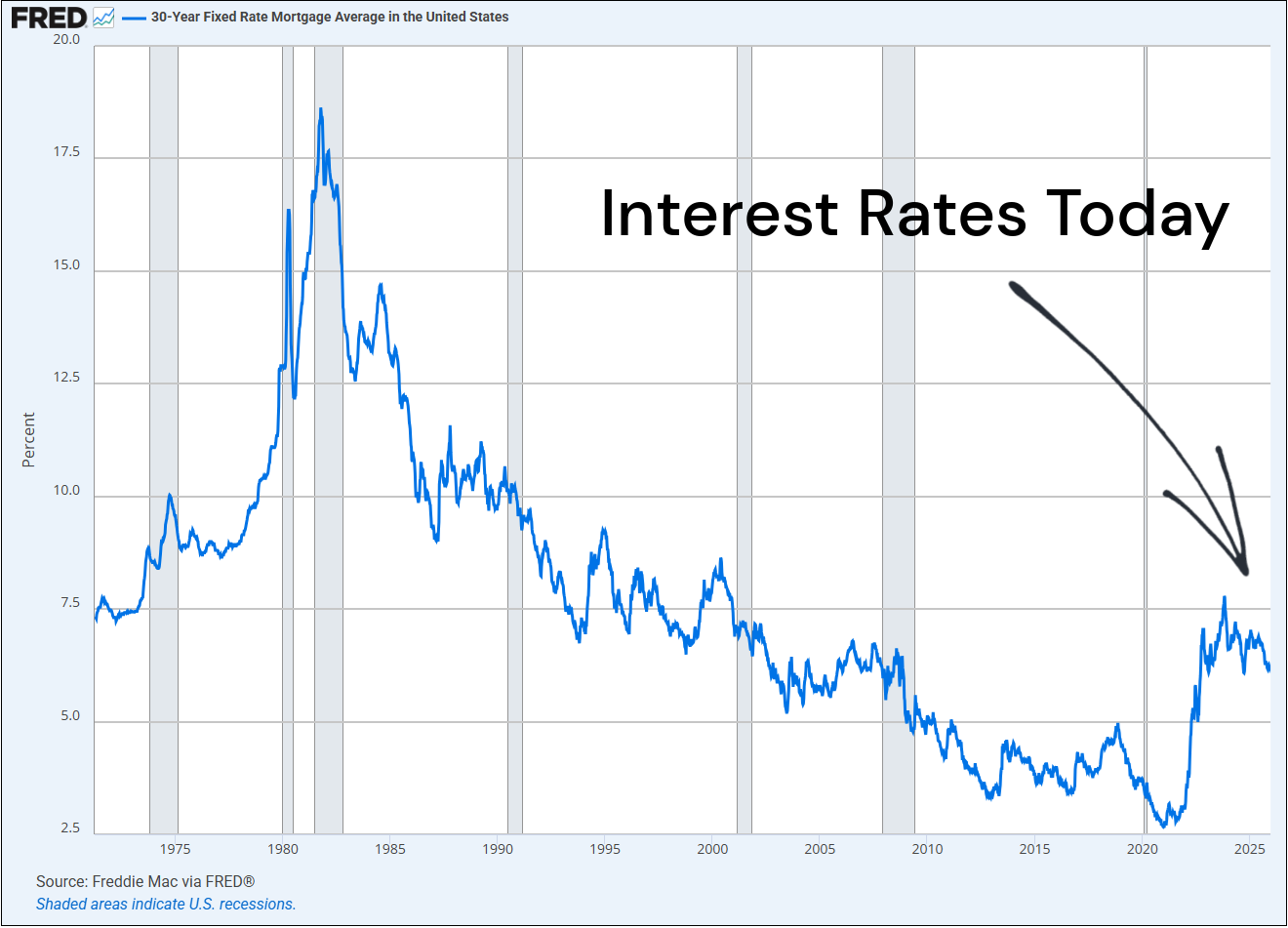

In 2021 interest rates went up and many people:

- Continued renting.

- Delayed buying.

- Wondered if interest rates would come back down.

Some people decided to become long term renters.

While others decided to buy a home at some point in the future.

Fortunately, interest rates are still lower than they were a few decades ago.

Interest rate history

Like it was last week, I remember getting a loan to buy my first home.

It was a tiny condo outside of Seattle, Washington.

I didn't know anything about interest rates or loans back then.

And I was thrilled a lender was willing to give me a loan to buy a home.

So I didn't ask many questions.

But after working in finance for 10 years.

And watching hundreds of people buy homes.

I realized there's many ways to get a lower interest rate.

Ways I didn't even know existed.

Until trying to get my 5th home loan after starting from scratch with that tiny condo.

"Let us never negotiate out of fear. But let us never fear to negotiate."

— John F Kennedy

The Interest Rate Cheat Sheet

Here's 4 ways I've learned to get a lower interest rate on a home loan.

Hope it's useful.

Let's dive in:

1. The Buy Down

Most people don't know they can pick their interest rate when getting a home loan.

Heck, I didn't know this was an option until much later in my homebuying journey.

Here's an example:

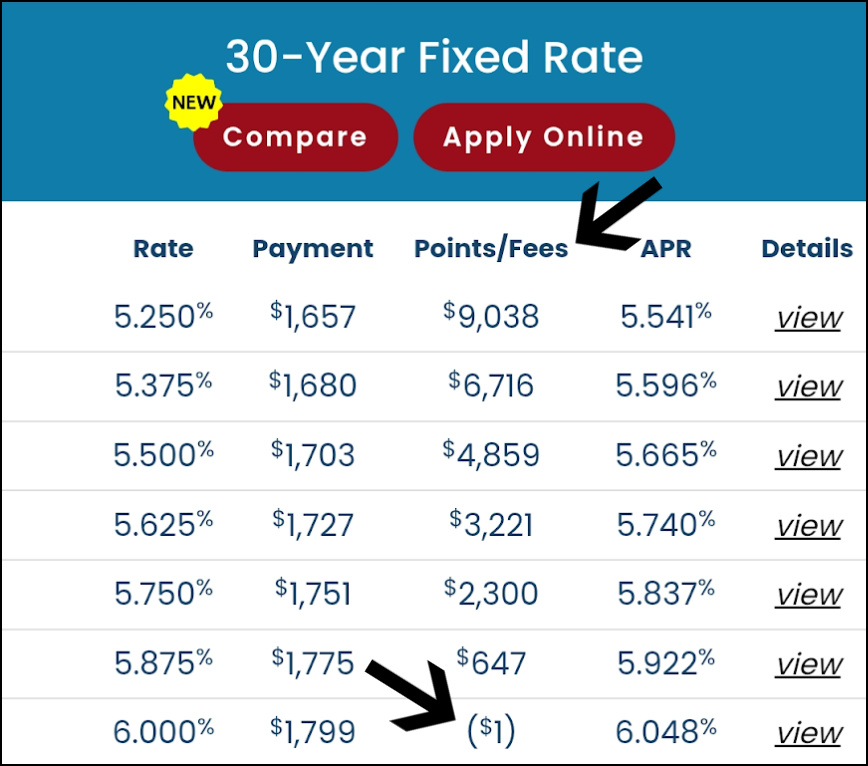

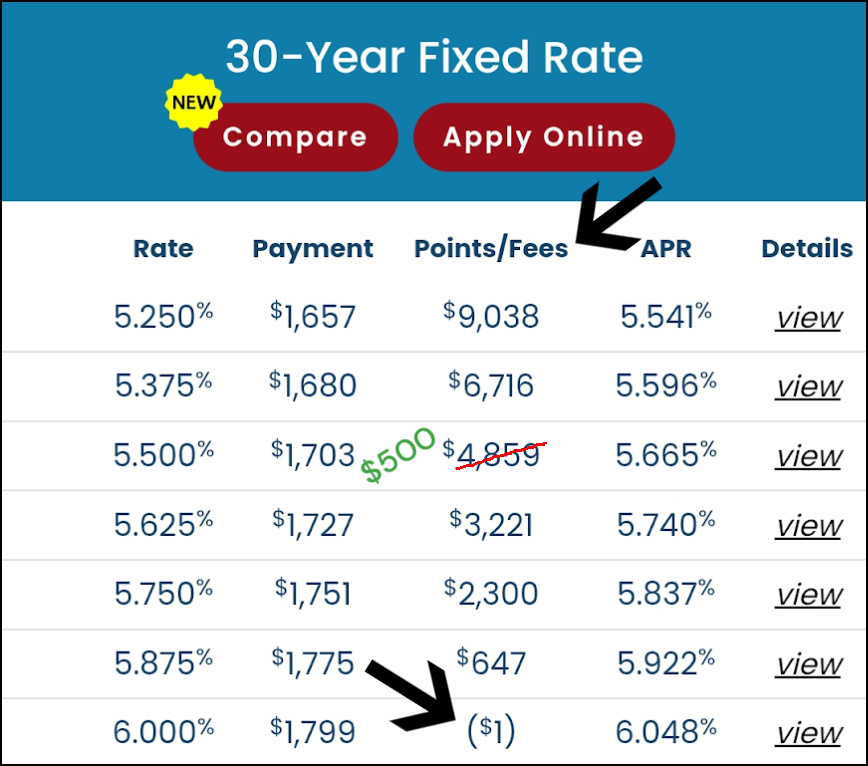

See the "points/fees" column below from this online lender?

It represents the one time fee they charge to setup your home loan.

Interest rate example

See the different interest rates on the left hand side?

The lower the interest rate you pick, the higher the one time fee they charge listed in the "points/fees" column.

Choosing to pay a one time fee up front is one way to get a lower interest rate on a home loan.

It's called "buying down the rate" or "paying points".

Many lenders give you the option to pay extra money up front to get a lower interest rate. But if you don't ask to see the options, many lenders will offer you the higher rate.

2. The Price Match

Shopping around can save you thousands of dollars.

For example.

Let's say Dave is getting a home loan and decides to pay extra money up front to get a lower interest rate.

And he decides on the 5.50% interest rate.

But it costs an extra $4,859 (yikes).

Interest rate example

But Dave doesn't want to pay an extra $4,859.

One way he can get around this is to..

Shop around.

To check with another home loan lender.

To compare what they charge for the same 5.50% interest rate.

Now-a-days this can be done online.

American Internet Mortgage is one of my favorite places to compare home loan interest rates.

Let's say Dave finds another lender charging just $500 for the exact same 5.50% interest rate instead of $4,859.

He could change his home loan to this other lender charging less money.

Or he can tell his current lender to see if they can do a price match.

Getting a price match is usually the easiest option instead of starting all over again with a different lender.

Dave's new interest rate after his lender approves the price match:

Interest rate example

Spending an hour comparing interest rates can save you thousands of dollars in loan fees and get you a lower interest rate.

3. The Closing Credit

When buying a home there's many ways to get money to help keep your homebuying costs down.

But as a first time buyer.

Most people don't know all of the different ways.

Let's say Dave asked for and got the following homebuyer credits:

$1,000 Lender credit.

$2,000 Home seller credit.

$2,000 Special program credit.

$1,000 Real estate agent credit.

$6,000 Total credits.

Dave could use that $6,000 credit to get a lower interest rate.

For example.

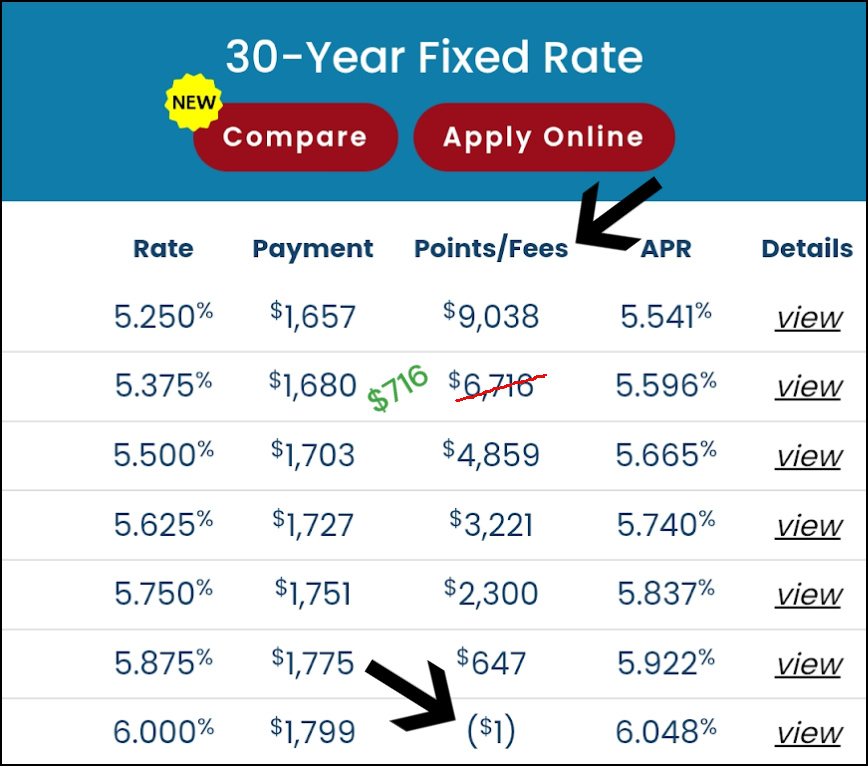

The 5.375% interest rate normal price:

= $6,716

Dave's price:

$6,716 - $6,000 credit

= $716

Interest rate example

Homebuyer credits can be used to get a lower interest rate for less money.

4. The Assumable Loan

Assuming someone else's home loan can be a big money saver.

Assuming a loan means taking the loan out of someone else's name.

And putting it in your name.

Then taking over the monthly payments.

Here's an example:

Dave's neighbor wants to sell their home.

And Dave wants to buy it.

Dave's neighbor got their home loan when interest rates were 3% (lower than today).

Taking over his neighbor's 3% interest rate home loan means Dave would have a lower monthly payment than if he got a new home loan today (interest rates are higher than 3%).

Here's 3 things to know:

1. Dave must apply to take over the neighbor's loan through the neighbor's lender (the company that sends the monthly bill). And Dave must qualify for the neighbor's monthly home loan payment.

2. Not all home loans can be taken over. Dave's neighbor can call their lender and ask if their home loan can be taken over.

3. Dave needs to get a 2nd loan as well. Why? For example: If Dave's neighbors want to sell him their home for $400,000 and the loan he's taking over is just $300,000. He needs a 2nd loan for the difference.

$400,000 - $300,000

= a 2nd loan for $100,000

(unless Dave has $100,000 cash to give his neighbors)

I know that sounds a bit complex.

But Dave and his neighbor could use a real estate agent and a loan officer to help them figure things out.

Many companies are popping up that help people find homes to buy with a low interest rate home loan that can be taken over.

Roam

Buying a home with an assumable loan can save you thousands of dollars in interest payments.

The bottom line

Buying a home can be confusing.

It sure was for me the first time.

And I've learned many things the hard way since that 1st tiny condo.

One thing I wish I figured out sooner was how to get a lower interest rate.

And how to get as much homebuyer money as possible.

I hope this little cheat sheet is useful to help you save money if you see homebuying in your future.

That's all for today.

See you next Saturday.