7 Homeowner Hacks to Save Money (that actually work)

Oct 11, 2025Read time - 4.5 minutes / Disclosure

Saving money as a home owner means:

- More vacations.

- More eating out.

- Less money stress.

Unfortunately, nobody hands you a money-saving guide when buying a home.

Life's Surprises

Owning a home means spending money on:

- Insurance.

- Property taxes.

- Home loan payments.

Most of these things are expected.

But the unexpected things can be painful.

When getting my first loan to buy a little condo in Seattle, Washington.

There weren't many surprises.

Needing to replace:

- The carpet.

- The microwave.

- The refrigerator.

...were all expected.

But after selling that little condo 2 years later.

And getting a new loan to buy a house is when things got interesting...

Needing to:

- Repair the roof.

- Take down a tree.

- Fix a leak in the basement.

...were dang expensive.

After deciding to use house hacking as a wealth building tool.

And figuring out how to own 5 more properties without a truckload of money (because I didn't have much in the beginning)...

Keeping costs low was super important.

The Homesaver Checklist

Here's 7 homeowner hacks I've learned the hard way to save money as a homeowner (hope they're helpful).

Let's dive in:

1. The Insurance

Keeping your auto insurance and home insurance with the same company = big savings.

Most insurance companies give you a 15% to 30% discount if you do that.

Having two different companies = paying more money (in most cases).

Combining your insurance policies can save you hundreds or thousands of dollars every year.

2. The Payment

Making bi-weekly payments on your home loan = big savings.

Most people make their home loan payment once per month.

But most home loan lenders also offer bi-weekly payments.

A bi-weekly payment means making half your home loan payment every 2 weeks.

Doing this helps you pay off your loan faster.

Choosing bi-weekly payments can save you thousands of dollars in interest costs every year.

3. The Interest

Attacking the loan directly every month = big savings.

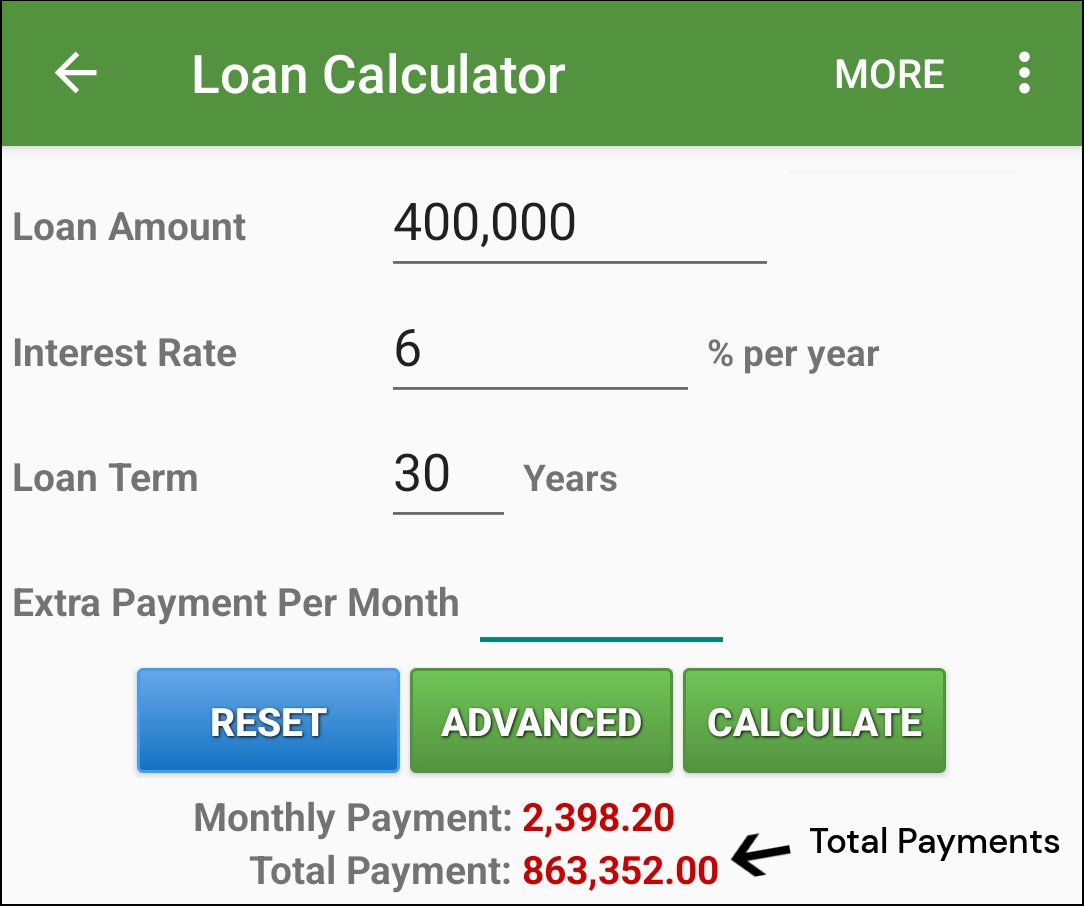

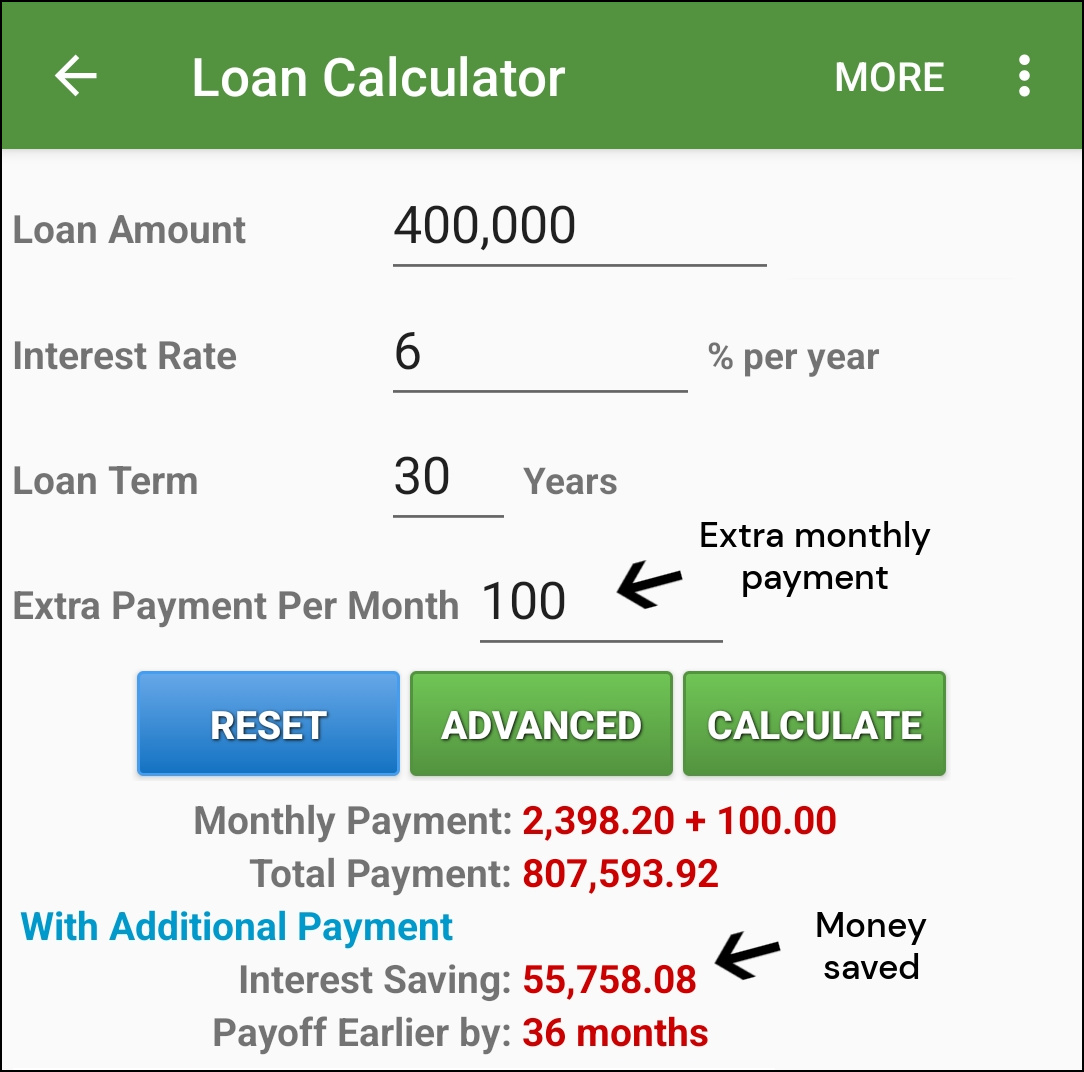

Here's what a $400,000 home loan with a 6% interest rate over 30 years looks like:

It's wild to see a $2,398.20 monthly payment.

Times 360 months (30 years)

= $863,352 in total payments

Double the loan amount.

When many people see this, they often wonder...

Is owning a home worth it?

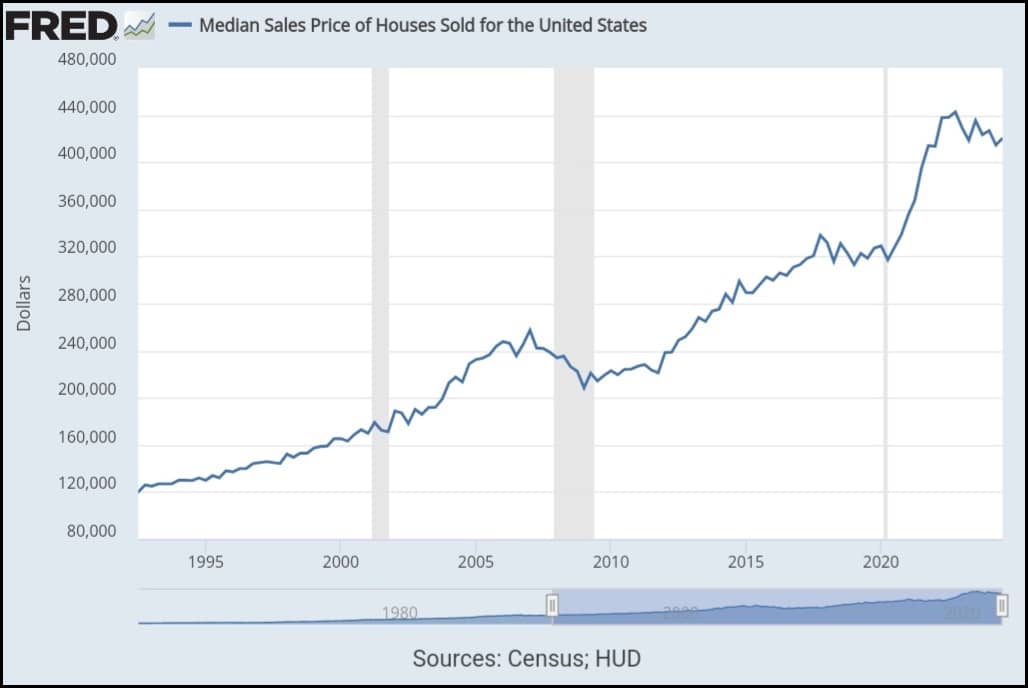

But after seeing a chart of home prices going back 30 years.

They often change their mind.

Home prices have been doubling every 14 years or so.

Attacking the $400,000 loan with an extra payment of $100 every month looks like this:

$100 extra every month in this example means $55,758 in savings.

And paying off the loan 36 months early (3 years).

Attacking your home loan with an extra payment every month can save you thousands of dollars in interest costs.

4. The Warranty

Most homes come with a limited warranty.

The warranty is an insurance policy often paid for by the person selling you the home.

And it covers problems with things like:

- The electrical.

- The plumbing.

- The dishwasher.

- The refrigerator.

- The water heater.

But most people don't know receiving a warranty is a common thing when buying a home.

Using your home warranty during the 1st year of homeownership can save you thousands of dollars (ask your real estate agent about it).

5. The Taxes

Every year the local government changes the property taxes.

And they send each homeowner a letter.

The letter tells you how much money they're going to charge you in property taxes the following year.

Most people hastily throw away the letter.

But the thing to know...

You can dispute your property taxes if you think you're being overcharged.

Google "appeal property taxes (and the county you live in)".

You'll find instructions on how to do it.

Disputing your property taxes can save you hundreds or thousands of dollars every year (if you have the time and good reasons to do it).

6. The Upgrades

Turn home upgrades into savings.

When unexpected things happen like:

- Needing a new ac.

- Needing a new roof.

- Needing a new furnace.

Here's a little hack I've come across that works well:

1. Schedule 2 different companies to give you a quote on the job you need done the same day.

2. Schedule them to come to your home at the exact same time (if possible).

For the homeowners.

— JOHN HENRY (@thejohnhenry_) January 13, 2024

My old heater went out.

Needed a new one.

1st quote:

$9,100

Said I was "shopping around."

His new offer (5 mins later):

$7,400

Always negotiate.

Getting a quote from 2 companies at the same time when upgrading your home can save you hundreds or thousands of dollars as each company fights to win your business.

7. The Planning

Beat unexpected costs to the punch.

Needing to come up with hundreds or thousands of dollars unexpectedly... really stinks.

It can lead to unexpected costs being added to a credit card, and paying 20%+ interest.

A way to help avoid that is to setup a "House Account".

Here's how it works:

1. Open a savings account at a different bank than your checking account.

2. Link your checking account to your new savings account.

3. Setup an automatic transfer from your checking to your savings every month.

Here's an example:

The first time I set this up.

$100 transferred from my checking to my savings (my "house account") automatically every month on the 1st.

Having my savings account at a different bank then my checking account meant—

I was less likely to transfer money from my checking to my savings (in a moment of weakness).

When unexpected house costs come up.

Having a few thousand dollars automatically built up in a savings account (your "house account") is a big relief.

Creating a "House Account" helps you prepare for unexpected costs and helps you avoid paying high interest on credit cards.

The bottom line

Homeownership is a big adjustment.

Especially in the beginning.

It can feel overwhelming.

But using a few money-saving best practices.

Can bring more peace of mind and make the homeownership experience more enjoyable.

That's all for today.

See you next Saturday.