How the Rich Get Rich (using other people's money)

Nov 08, 2025Read time - 4 minutes / Disclosure

Using other people's money can:

- Boost your assets.

- Grow your income.

- Make 9-5 life optional sooner.

Unfortunately, using other people's money to build wealth isn't talked about in school.

The Traditional Path

When finding work, most people focus on:

- Getting a secure job.

- Keeping it long term.

- Hoping it covers the bills.

- Praying retirement is in the cards 40 years later.

Trying to get promotions and trying to make more money per hour is the game most people play.

Heck, it's the game I played too.

But over time I eventually learned.

Trading time for money is the longer path to a freer life.

"Seek wealth, not money or status. Wealth is having assets that earn while you sleep."

— Naval Ravikant

Working in banking for 10 years taught me wealthy people play a different game.

It's not about:

- Getting raises.

- Getting promotions.

- Counting down the days to retirement in 40 years.

It's about using other people's money (OPM) to build wealth faster.

Over 5 years.

Over 10 years.

Or over 15 years (instead of over 40 years).

I'll never forget helping a banking customer worth $50 million dollars.

He refinanced his $700,000 home loan twice.

He could of easily paid off the darn thing.

But he didn't.

Watching wealthy people make and manage their money fascinated the hell out of me.

After growing up watching my family struggle with money.

And eating a lot of tv dinners and top ramen in my early 20s.

Watching wealthy people felt like a cheat code.

It gave me the confidence to invest in the stock market.

Figure out how to own 7 properties without having to come up with a bunch of money.

Turn in my notice and leave my 9-5 job in my later 30s.

And start this little online business (Millennial Wealth).

The "Other People's Money" Advantage

Here's 4 things I'd see wealthy bank clients do to build wealth faster (hope it's useful).

Let's dive in:

1. The Real Estate Loans

Most people think you need a 20% down payment to get a loan to buy real estate.

But many home loan lenders offer no money down loans.

Especially if you plan to live on the property for at least one year (and you qualify for the loan).

Home loan lenders also allow people to buy a 3-unit or 4-unit property with just a 3.5% down payment.

Many wealthy bank clients play the real estate game.

Getting loans to buy property over and over again.

Sometimes putting down a lot of money.

Sometimes putting down hardly any.

It's not for everyone.

But it's an option.

Using loans to buy property is a common way to build wealth in real estate without using a lot of your own money.

2. The Rental Properties

Most people think you need a lot of money to own rental properties.

But most home loan lenders are paid on commission.

And will happily explain how to qualify for a home loan.

Learning how home loans work is a cheat code.

Playing that game over and over can mean owning 1, 2, 3, 4, 5+ properties.

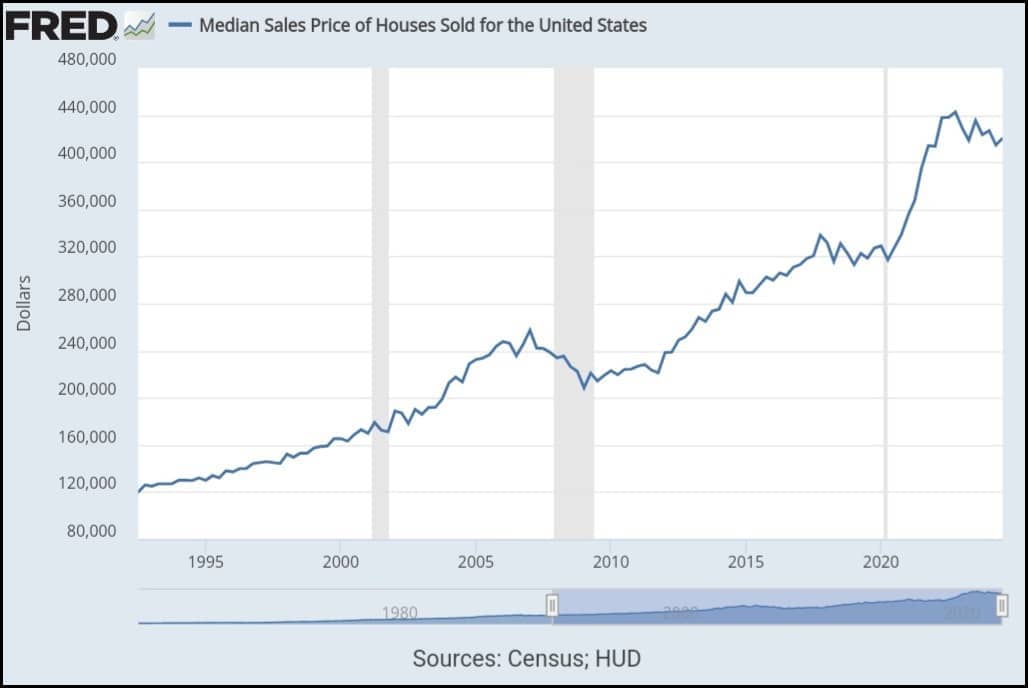

And with the value of real estate doubling every 14 years on average since the 1990s.

It's been a profitable game.

Home prices history

Getting home loans and having rental property is a common way to build wealth as renters pay off the home loans.

3. The Business Loans

Most people think it's impossible to get a business loan.

But there's many business loan programs available.

And most business loan lenders are paid on commission (just like home loan lenders).

Many will happily explain how to qualify for a loan.

Business loans are also a cheat code and can be used to:

- Buy a business.

- Grow the business.

- Buy things for the business.

A popular way to get a business loan is through a government program called the SBA (small business administration).

sba dot gov website

Using business loans to buy or grow a business is a common way to build wealth without using a lot of your own money.

4. The Small Business

Most people think starting a small business is risky and expensive.

But for a few hundred bucks, you can use an online company like Legalzoom to setup your business LLC in an hour or less.

It's never been easier or cheaper to start a little online business.

- Setting up a website.

- Offering a product or a service.

- Finding customers on social media.

Anyone with an internet connection and motivation can do these things without a lot of money.

Everyone’s looking to find the secret

— JOHN HENRY (@thejohnhenry_) October 14, 2025

to get rich and the secret still is:

- Stocks.

- Real estate.

- Starting a small business.

I'll never forget helping a banking customer in her 20s.

She setup a small video gaming business.

People would pay to watch her play video games all day.

Her online business was making $20,000+ per month.

Wild.

Setting up a cheap little business to sell products or services can generate thousands of dollars per day or per month.

The bottom line

Most people are taught debt is bad.

Heck, I was taught that too.

- Car loan debt.

- Credit card debt.

- Student loan debt.

It can be painful.

After getting rid of it, many people avoid debt completely.

But I watched wealthy bank clients use debt to build wealth over and over again.

- Getting loans to buy real estate (and their renters paid off the loans).

- Getting loans to buy or build a small business (and money received from customers paid off the loans).

Debt can be really painful.

Or debt can be really helpful.

Like most stories in life.

There's always two sides.

That's all for today.

See you next Saturday.