Invest in Stocks or Real Estate? (4 things to know)

Dec 13, 2025Read time - 4 minutes / Disclosure

Knowing the difference between stock investing and real estate can:

- Give you clarity.

- Give you confidence.

- Help you invest with certainty.

Unfortunately, it can be a tough choice.

The Options

Not knowing which option to pick can mean:

- Not investing.

- Putting it off.

- A delayed retirement.

Most people stress over what to invest in.

I did too near the beginning of my journey.

But working in finance and watching other people was a big help.

Most of the millionaires I've met

— JOHN HENRY (@thejohnhenry_) November 28, 2025

do boring things.

They didn't:

- Invent something.

- Build something.

- Change the world.

Instead they:

- Bought stock.

- Bought property.

- Invested long term.

Most people want the hack but

the hack is consistency.

At 21, I remember wanting to become a millionaire in my 30s.

It feels silly to say.

Who doesn't want to feel financially secure?

But I didn't want to do it by—

Inventing something.

Building something.

Changing the world.

I just wanted to have enough money to quit my job.

And do my own thing.

To work for myself part time.

To not have a 9-5 schedule.

But I didn't know anything about investing.

And I didn't have much money to invest.

So I spent hundreds of hours reading about the stock market and real estate.

To figure out how to build wealth as quickly as possible.

As an average person.

While working a 9-5 job.

Stocks vs Real Estate

Here's 4 things I learned while building my investments from $0 to $1M.

Hope it's useful.

Let's dive in:

1. The Loan Leverage

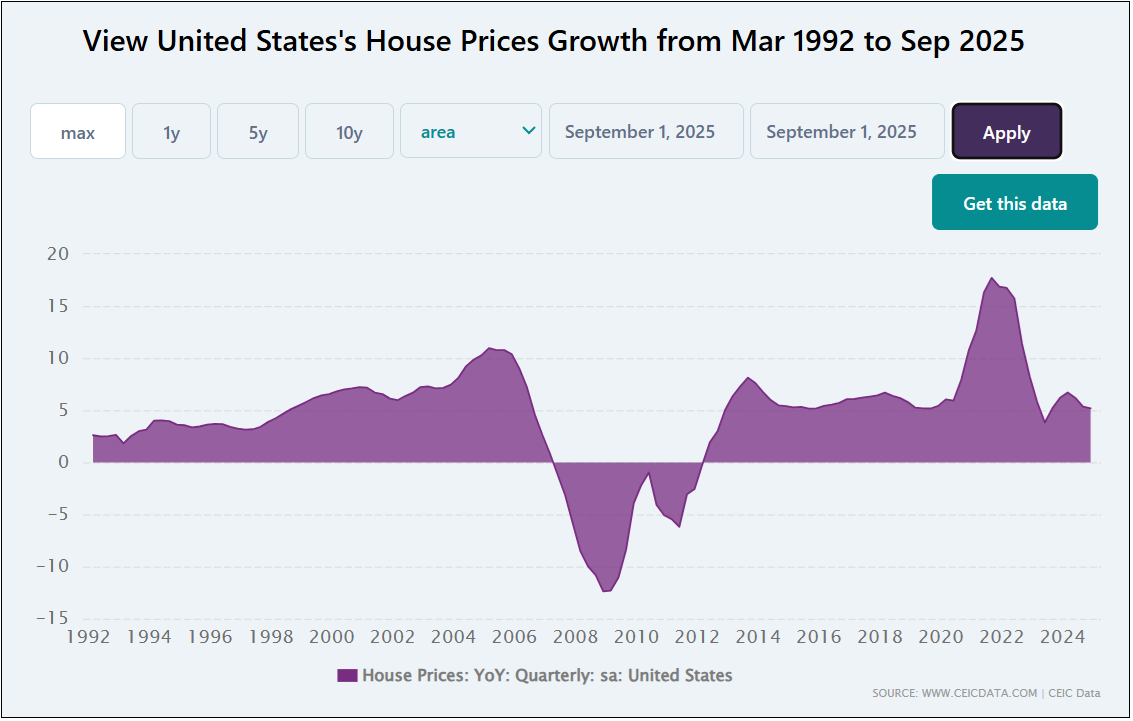

Most people see the stock market going up 10% per year on average.

Stock market growth

And see real estate going up half as fast, around 4% per year.

Real estate growth

Real estate growth

And think stocks are the better investment.

I thought that too at first.

But then I discovered one big advantage with real estate.

Loans.

It's often called O.P.M.

Which stands for other people's money.

Using other peoples money like loans from a bank as a wealth-building tool.

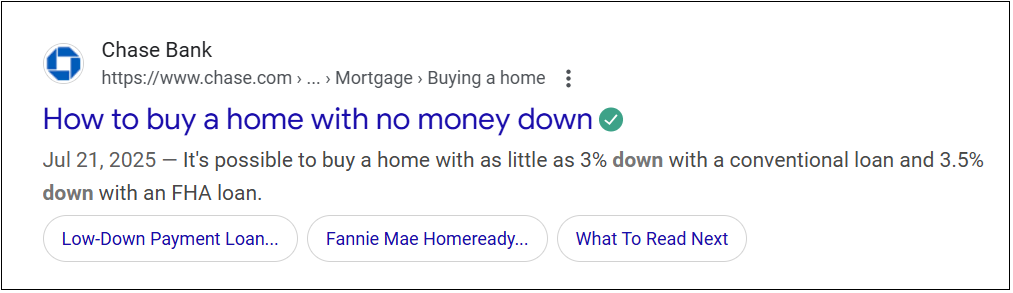

Getting a loan to buy real estate is a common thing.

According to the National Association of Realtors.

Over 91% of first time homebuyers get a loan.

And it's even possible to buy real estate with no money down.

I watched many people do this the 10 years I worked as a banker at Chase.

It's not an option everyone's comfortable with doing.

But it's been an option for decades.

And there's a big difference between a stock portfolio worth $50,000 going up 10% per year on average.

10% x $50,000

= $5,000 profit

And a home worth $400,000 going up 4% per year on average.

4% x $400,000

= $16,000 profit

Investing in real estate often means getting a home loan while investing in stocks often means using 100% your money.

2. The Closing Credit

Getting huge credits to buy real estate can lower your costs.

- Credits from the seller.

- Credits from the agent.

- Credits from the lender.

- Credits from a program.

Using loans and huge credits was the reason I was able to own 7 properties without using a lot of my own money.

Credits can be used to lower your interest rate too.

(the playbook I've used to get $30,000 when buying a home)

Investing in real estate means having the option to get a lot of up front money to lower your costs.

3. The Stock Bump

According to Fidelity, the average employer will match around 5% of an employees pay if the employee puts money into a retirement account.

So if an employee makes $70,000 per year.

5% of $70,000

= The job giving the employee $3,500 per year

And the employee can invest that money in the stock market.

Investing in the stock market often means getting money to invest from an employer as an added benefit if offered.

4. The Passive Plan

People love passive income.

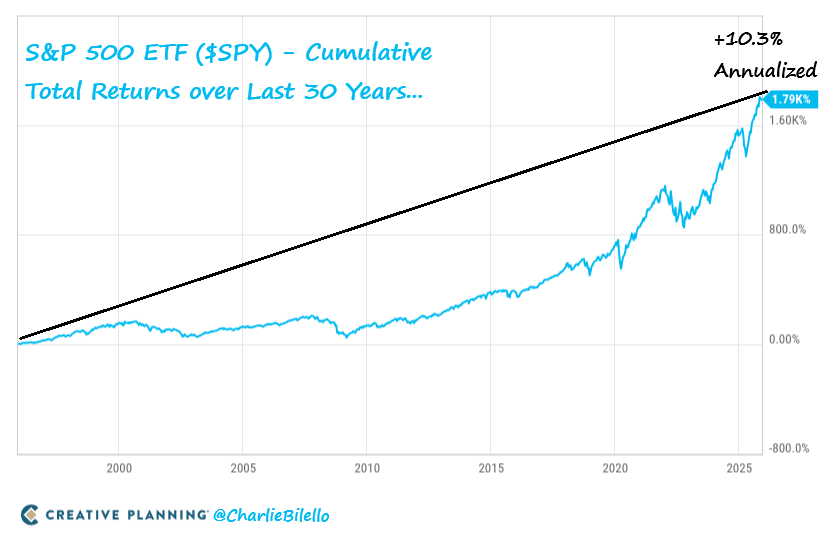

And for the past 30 years.

The S&P500, the largest 500 companies listed on the stock market.

Have went up an average of 10% per year.

Stock market history

Investing in the stock market means not having to:

- Buy a new carpet.

- Pay for a new roof.

- Fix a broken toilet.

- Replace a refrigerator.

All of these things are part of owning real estate.

But none of these things are part of owning stocks.

"The stock market is a device for transferring money from the impatient to the patient. Our favorite holding period is forever."

— Investor Warren Buffett

Investing in the stock market often means less work while investing in real estate often means more work.

The bottom line

Deciding what to invest in can be hard.

There's pros and cons to both stocks and real estate.

The answer has much to do with the type of investor you want to become.

I chose to focus on both.

Using the stock market to—

- Get my full retirement match at work.

- Invest more money each year in my retirement account.

- Invest that money into an S&P500 fund (most retirement accounts have this option).

- Open a non-retirement account, invest money there too into an S&P500 fund.

Plus investing in real estate by—

- Working with a loan officer to get a home loan.

- Getting large credits using the max cash playbook so I don't have to come up with a lot of my own money.

- Moving into the home and getting a renter or buying a home that has a separate area that can be rented out to help keep my costs down.

- Living there for a few years, then working with a loan officer again to get another loan to buy another home.

- Renting out the property I live in and moving into the new property and doing this over and over again to own rental properties without having to come up with a lot of my own money.

That was my boring playbook for a decade to build wealth.

And I sure made lots of mistakes along the way trying to figure it all out.

Your journey will surely look different.

So take what you find useful, and discard the rest.

Thank you for being part of this weekly newsletter with me.

I hope it's useful and appreciate you reading it.

That's all for today.

See you next Saturday.