Invest Now? Or Invest Later? (6 things to know)

Jun 07, 2025Read time - 3 minutes / Disclosure

Knowing when to invest can:

- Give you clarity.

- Give you confidence.

- Motivate you to invest.

Unfortunately, worrying about your timing is common.

Getting It Wrong

The media talks a lot about:

- Market crashes.

- Worried politicians.

- A troubled economy.

It's natural to wonder if now is the right time to invest, especially with articles like this:

The interesting thing is—

Stocks went up 6% in May.

Not down.

So...

How do you know what to listen to (and what to ignore)?

And when exactly is the right time to invest?

I spent years trying to figure this out.

With a goal of building a $1M portfolio from scratch as quickly as possible.

I wanted to avoid big mistakes.

Mistakes that could set my investments back years (or decades).

Eventually, I hit my goal at age 36.

But I still made many mistakes.

If you're starting out at $0 like I did.

Here's 6 things I learned along the way (if you're wondering if now is a good time to invest).

Hope it's helpful.

Let's dive in:

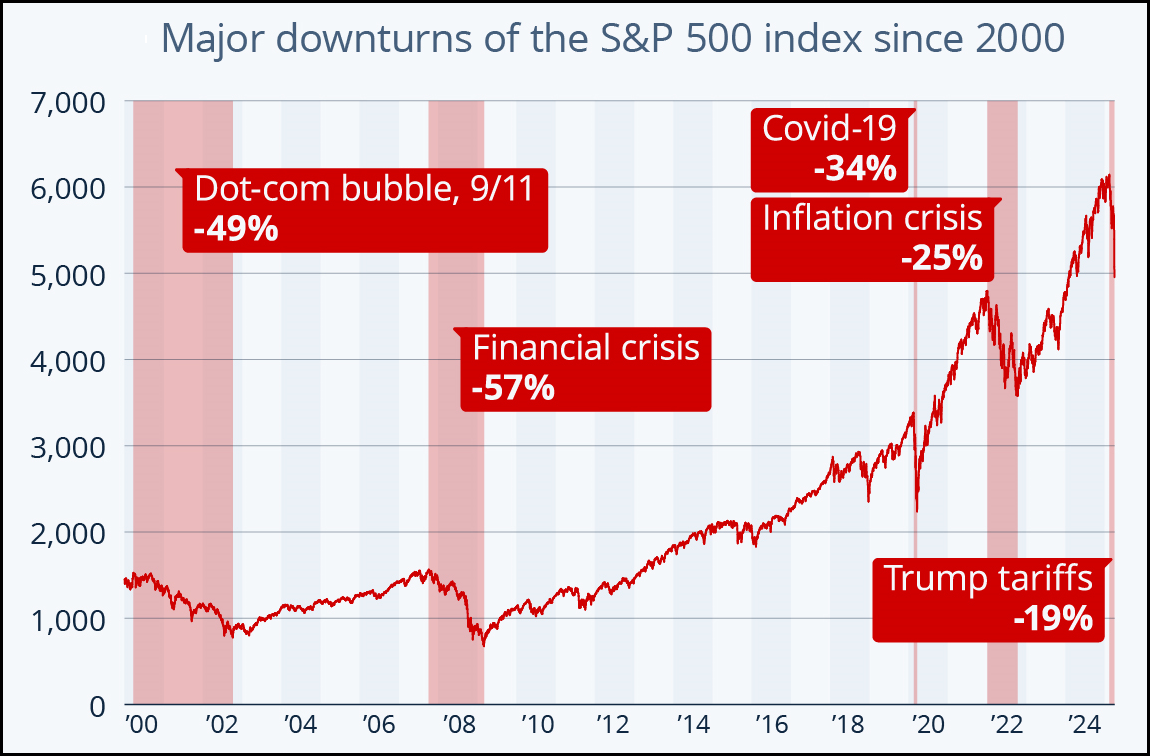

1. The Wild Ride

Stocks are squirly.

On average they drop:

- 10% every other year.

- 20% every 4 years.

There's usually a good reason.

Source: Stock Market History / statista

The stock market drops regularly but over time it has always recovered.

2. The Bad News

There's always bad news.

And bad news can drive you to do things with your stocks you otherwise wouldn't do.

News like—

"Worst week since the Great Recession"

OR

"Many fear the worst has yet to come"

A recent example:

Since this article, the stock market is up 17%.

Go figure!

There's always bad news about stocks somewhere (it's often wrong).

3. The Smart Investors

Learn from the best.

At the 2022 Berkshire Hathaway Meeting.

Billionaire investor Warren Buffett shared:

"We haven't the faintest idea what the stock market is gonna do when it opens on Monday — we never have."

"We haven't ever timed anything."

Source: Warren Buffett / cnbc

Even the smartest investors say they are unable to "time" the stock market.

4. The Best Days

The best days add up.

Staying invested long term instead of trying to "time" the market often works best.

According to a study by Hartford:

Source: Hartford Funds

Missing the best days in the stock market can lower investing returns big time.

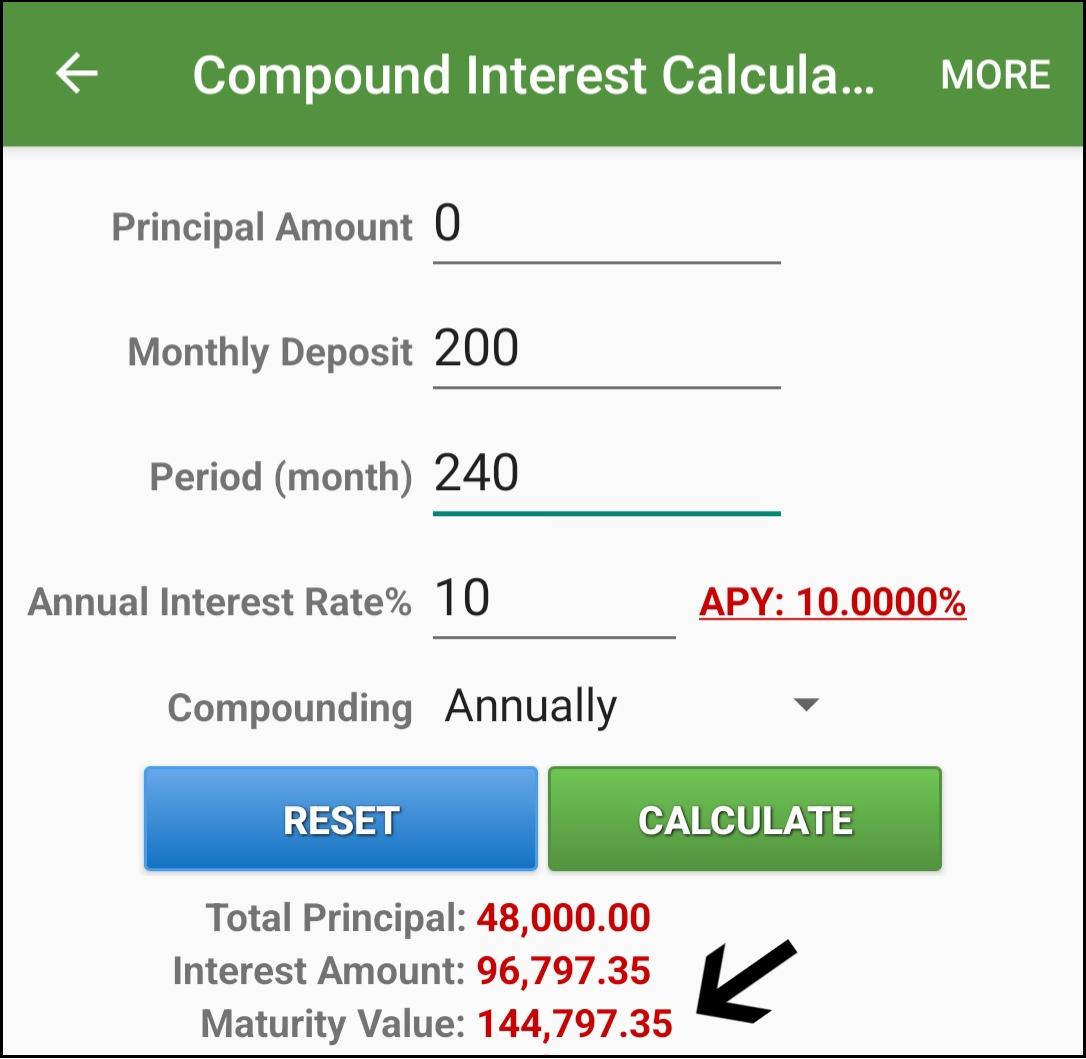

5. The Timeline Matters

Longer timelines = massive outcomes

Here's 2 examples.

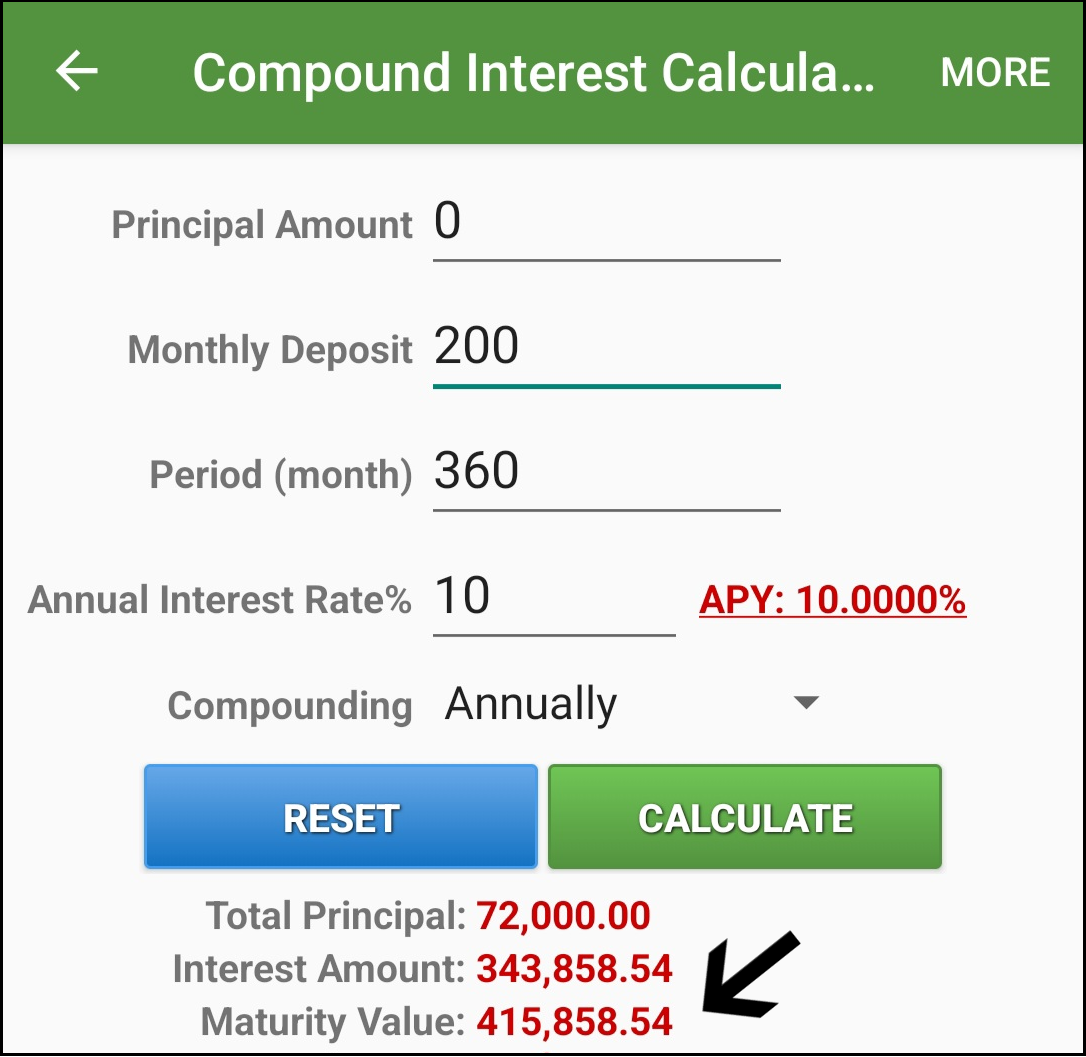

Example #1 based on:

- Saving $7 per day

- Investing $200 per month

- Into the S&P500 (stocks)

- Over the last 20 years:

The S&P500 (500 largest companies) went up 10% per year on average the past 20 years.

Example #2 based on:

- Saving $7 per day

- Investing $200 per month

- Into the S&P500 (stocks)

- Over the last 30 years:

The S&P500 (500 largest companies) went up 10% per year on average the past 30 years.

The Example Outcomes:

Investing 20 years

= $144,797

Investing 30 years

= $415,858

Investing longer term can have massive outcomes due to compound interest.

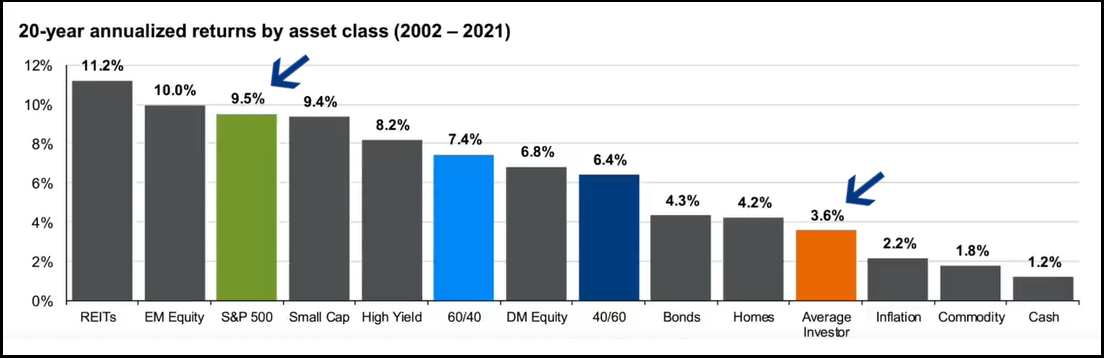

6. The Average Investor

Average investors struggle.

According to JPM Asset Management.

The average investor trying to "time" the market would be better off buying an S&P500 fund.

Source: JPM Asset Management

Owning an S&P 500 fund means...

Owning 500 of the largest companies in America.

Two of the largest S&P500 funds are:

- SPDR S&P 500 (SPY)

OR

- Vanguard S&P500 (VOO)

Studies show long term investing is better than trying to time the stock market.

The Bottom Line

It's easy to put off investing for several reasons.

Not wanting to make a mistake.

Not wanting to start at the wrong time.

I've been there too.

But I eventually realized starting small was better than not starting at all.

And sticking with it long term.

So I put 5% of my pay into my retirement account.

As time passed I bumped it to 10%.

As more time passed I bumped it to 15%.

Next I opened a brokerage account and starting putting money in there too (and studied how to buy real estate without much money).

Going from $0 to $1M feels impossible in the beginning.

It's a slow grind at first.

But watching your investments compound faster and faster.

And one day realizing your job needs you more than you need your full time job makes it all worth it.

Until then..

Keep building 💰

See you next week.

(hope this was useful)