The 6 Things in a House Payment (and how to save money)

Feb 20, 2026Read time - 4 minutes / Disclosure

Knowing how a house payment works can help you:

- Pay less interest costs.

- Pay less insurance costs.

- Help you save a lot of money.

Unfortunately, it can be a confusing thing.

The Monthly Bill

Most people looking at their home loan statement see words they've never saw before like:

- Impound account.

- Principal payment.

- Primary mortgage insurance.

It can sound like a lot of gibberish.

Most people assume the bill is right.

Send in the money.

And life goes on.

But making sense of a home loan statement can lead to unexpected savings.

"If you want to get rich, think of saving as earning."

— Andrew Carnegie

A month after getting a loan to buy my first tiny home.

I got my home loan statement in the mail.

Looking through the bill confused the hell out of me.

But I assumed it was right.

And made the payments.

10 years later I found myself doing loans at a bank for other people.

After looking through thousands of home loan bills.

I finally learned how to make sense of them.

And how to save more money.

The House Payment

Here's the 6 parts of a house payment (and how knowing this can help you save money).

Hope it's useful.

Let's dive in.

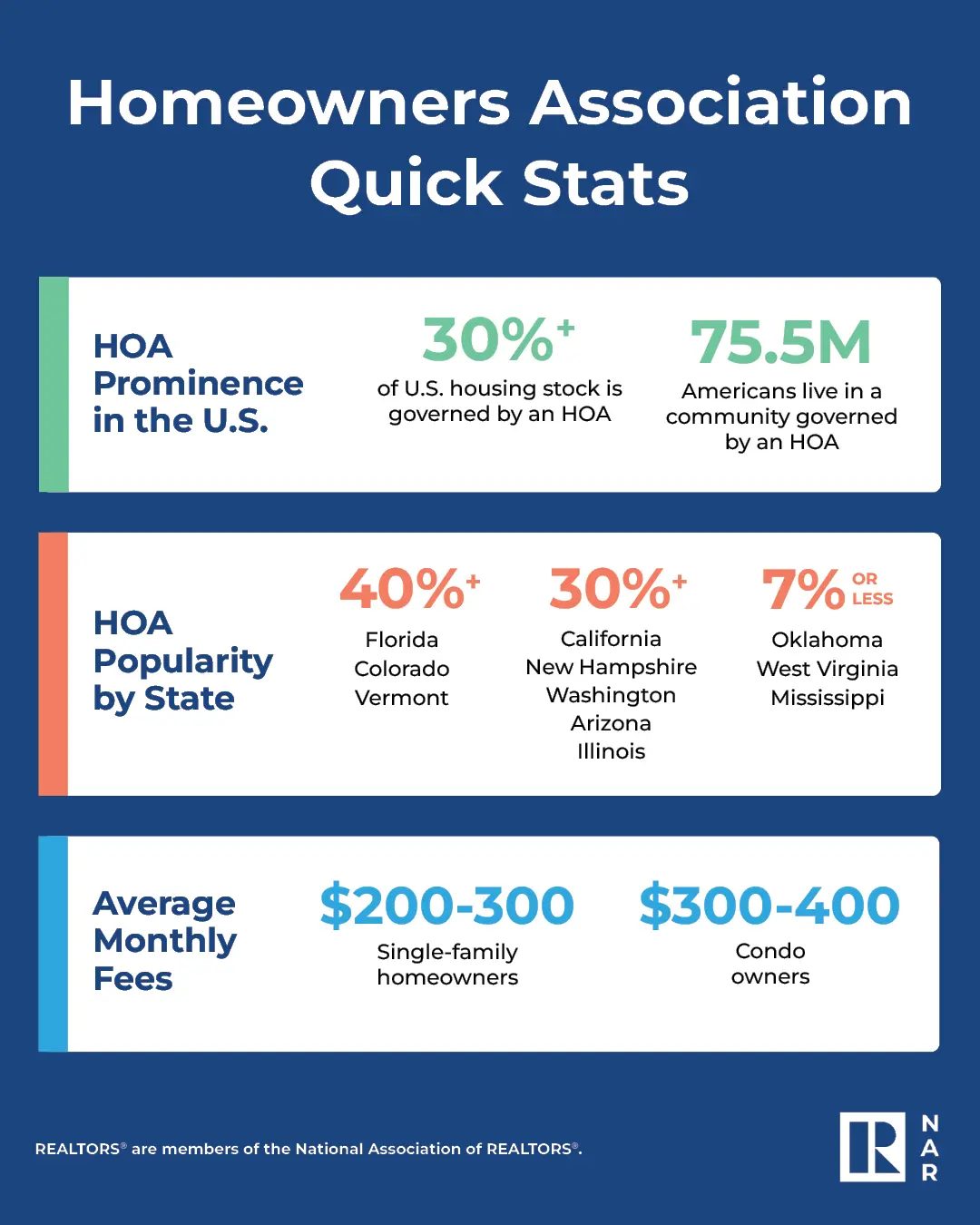

1. The Association

Many homes are part of an association.

They're called HOAs.

Which stands for Home Owners Association.

Think of it like a mandatory membership.

Something you must become part of if you buy a home in a certain area.

For example.

My first home was a tiny condo.

It was part of an association.

So I had to pay a few hundred bucks every month to the condo association.

That payment included my monthly:

- Water costs.

- Sewer costs.

- Garbage costs.

So I didn't get a separate bill for those things.

And the condo complex I lived in had a pool and a little gym.

The monthly association dues helped maintain them.

Houses and townhouses are sometimes part of an association too.

Association dues are a monthly payment you must make if you choose to buy a home that's part of an association.

2. The Insurance

According to Progressive, most people pay around $200 per month on average for their homeowners insurance.

Sometimes lots more, sometimes less depending on where you live.

And getting a loan on a home means needing insurance.

Homeowners insurance covers things like:

- Stolen property.

- Damage from a fire.

- Injuries on your property.

I've found most people with cheaper homeowners insurance often have 2 things in common:

1. They get their home and car insurance from the same company.

It's called "bundling" your policies. Many insurance companies offer a discount if you have home insurance and car insurance with the same company.

2. They have a high credit score.

Many states allow insurance companies to use your credit score when deciding how much to charge you for insurance.

Bundling your insurance policies with the same company and having a high credit score can help lower your homeowners insurance costs.

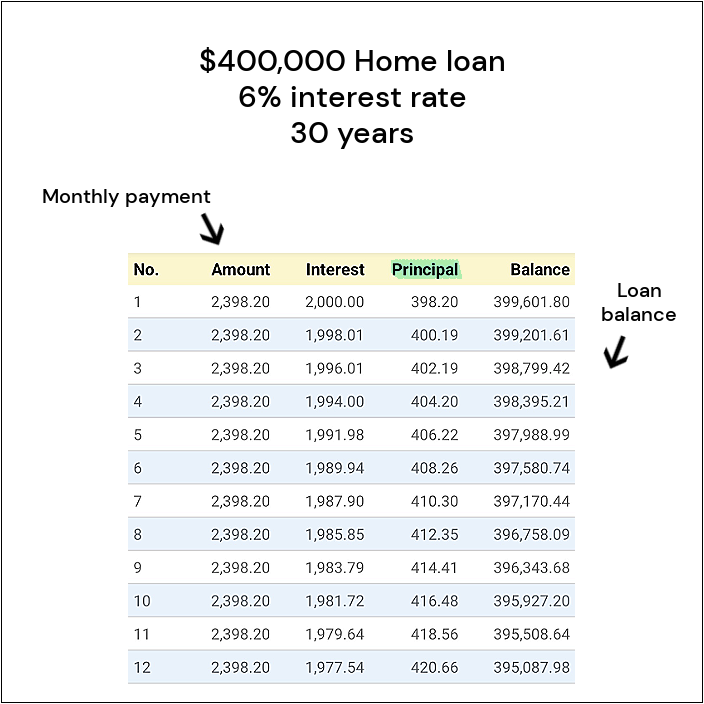

3. The Principal

With most home loans, every monthly payment you make helps lower the balance owed on your loan.

For example:

See how part of each monthly payment below goes towards the "principal"?

Example

Money going towards the principal of your loan every month shows on your monthly home loan statement and helps you pay off your loan.

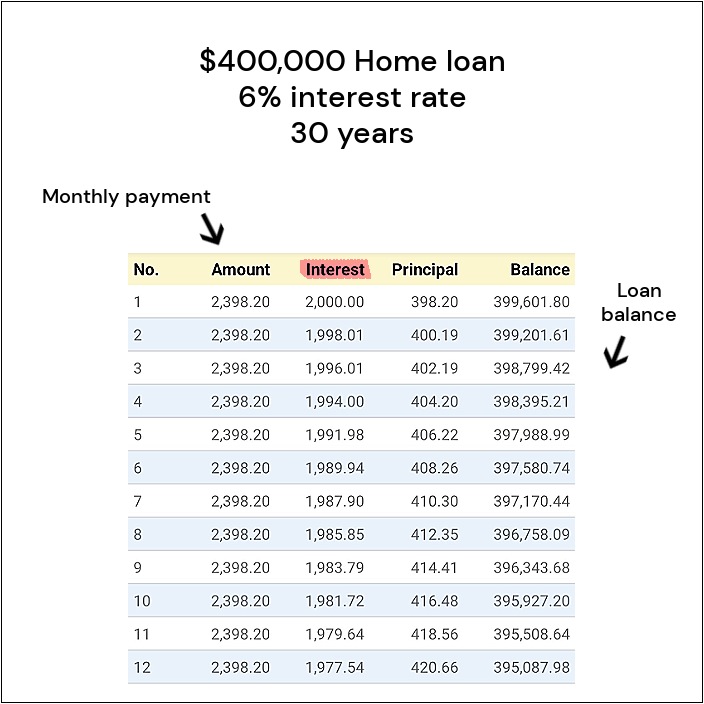

4. The Interest

Monthly interest paid on your loan also shows up on your home loan statement.

For example:

See how part of each monthly payment below also goes towards the "interest"?

Example

And in this example see how the interest is lots more than the principle right when you start paying on a new loan?

One way to pay less interest over the long run.

Is to make an extra principal payment each month.

Here's what happens if making an extra $100 payment each month:

Example

An extra $100 each month in this example saves an extra $55,758.08 in loan interest.

And pays off the home loan 36 months early (3 years early).

Here's the free calculator app I like to use to run these little examples:

Making an extra principal payment each month can help you save money on interest and help you pay off your home loan faster.

5. The Taxes

Owning a home means paying property taxes.

According to the National Association of Homebuilders, property taxes average $350 per month.

Sometimes lots more, sometimes less depending on where you live.

Fortunately, most people's property taxes are included in their monthly home loan payment.

And most people's homeowners insurance is also included in their monthly home loan payment.

(unless your home loan lender lets you pay them separately on your own)

Once per year home loan companies adjust your monthly home loan payment as your property taxes and homeowners insurance costs change each year.

6. The PMI

Many first time homebuyers also have a monthly charge listed on their home loan statement called PMI.

Which stands for Private Mortgage Insurance.

When you get a loan to buy a home.

And you don't have a lot of money to put down (like me when buying my first tiny condo).

PMI is an extra charge that's often added to your monthly payment.

It can cost you anywhere from $100 to $300 per month on average.

PMI is "extra insurance" that protects the lender making your home loan.

But the good news..

You can get rid of it as the value of your home goes up.

And the balance on your home loan goes down.

I've seen people get rid of it in as little as 2 years after getting their home loan.

Unfortunately, many people forget they can get rid of PMI and keep paying for it year after year.

Proactively calling your lender to remove PMI can help lower your monthly home loan payment.

The bottom line

There's many different things that can make up your house payment.

- Association dues.

- Insurance.

- Principal.

- Interest.

- Taxes.

- PMI.

Making sense of these different things is the first step to saving money.

If I was buying my first home again.

I'd be thinking through these 4 things to save money:

1. Do I really want to have association dues? Or can I find a home with low or no association dues?

After getting a home loan, to save more money I'd be thinking:

2. Am I getting a good deal on my homeowners insurance or should I check other options?

3. Can I pay a little bit extra on my loan every month to save a lot of money in interest charges in the long run (which will also pay my loan off early)?

4. If I have PMI showing up on my home loan statement, I need to get rid of it asap by talking to my home loan lender which will likely save me thousands of dollars per year.

Four things I wish I thought about much sooner! Hope they're useful.

That's all for today.

See you next Saturday.