The 7 Steps to Buy Stock (for beginners)

May 10, 2025Read time - 3 minutes / Disclosure

Buying stock can:

- Grow your savings.

- Boost your net worth.

- Free you from 9-5 life early.

Unfortunately, it can be a confusing thing.

Options Galore

You're given many options when buying stock like:

- Stop limit.

- Limit order.

- Market order.

But what the heck do you choose?

Here's a quick stock market refresher if needed before buying your first stock:

Stocks can make you a millionaire.

— JOHN HENRY (@thejohnhenry_) November 23, 2024

But 99% don’t know the basics.

Here’s 10 tips to get you started:

After working in banking for 10 years.

I noticed 3 big things:

- Most people want to invest.

- Many don't because they're fearful.

- Many put it off because it can be confusing.

I felt fearful (and confused) too when I started to invest.

I didn't want to:

- Click the wrong button.

- Do the wrong thing.

- Lose my money.

But the more I learned.

The more confident I felt.

The truth is—

Buying stock has never been easier.

You can start with $1.

If you're new to investing, here's 7 steps to buy your first stock (hope it's helpful).

Let's dive in:

Step 1: The Account

Create an investing account.

There's hundreds of brokerage companies to choose from.

Most companies allow you to buy stock using their mobile app or you can login using a regular computer.

Example photo

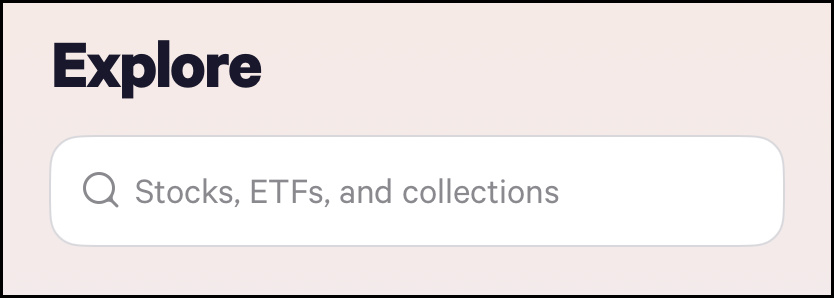

Step 2: The Search

Look for the stock search tool.

There's usually a magnifying glass 🔍 you can click to search for a stock or a fund.

Buying a stock means owning 1 company.

Buying an ETF (aka Exchange Traded Fund) means owning multiple companies.

For this example, let's look up the ETF "VOO".

Example photo

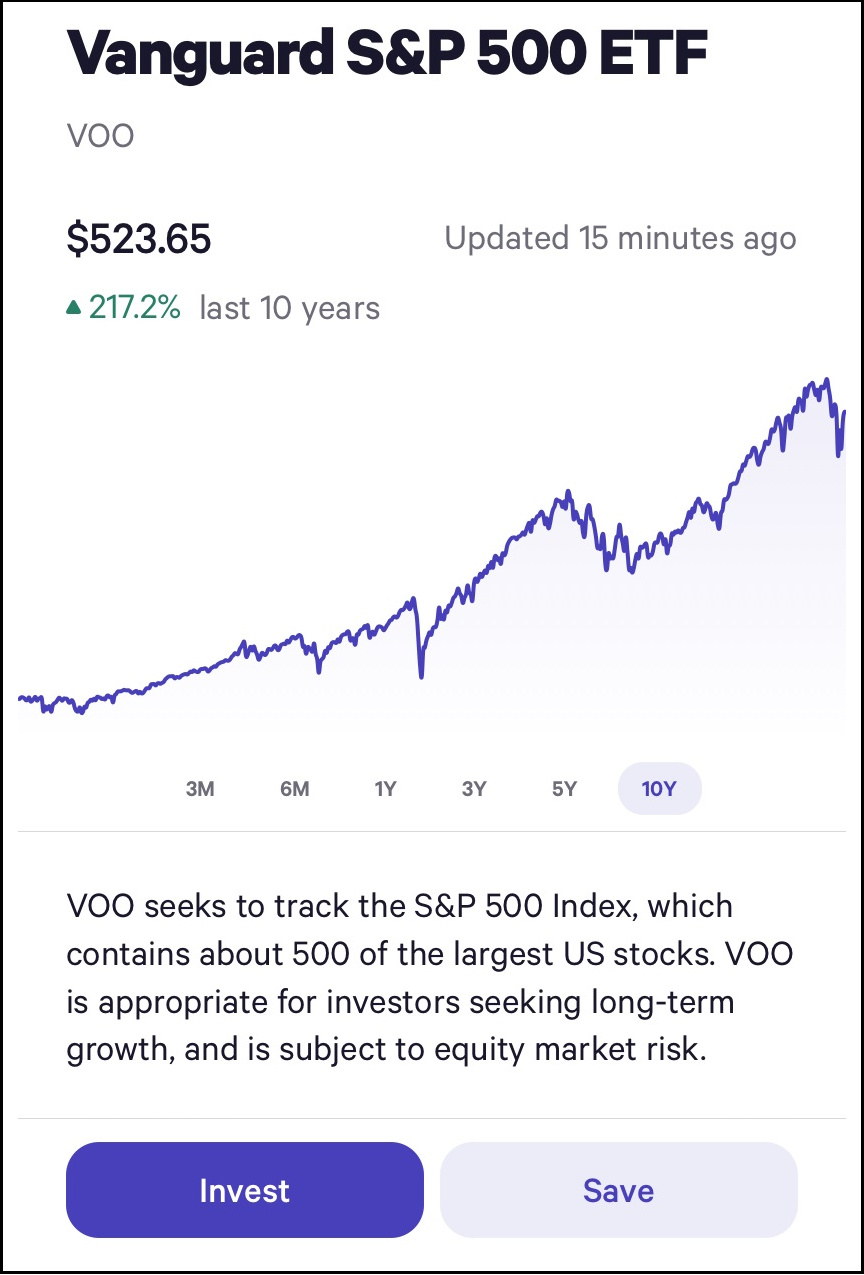

Step 3: The Action

Pick what you're buying.

The ETF example we're using is:

The Vanguard S&P 500 ETF (it's nickname is VOO).

You'll see a button to click that says "buy" or "invest".

Example photo

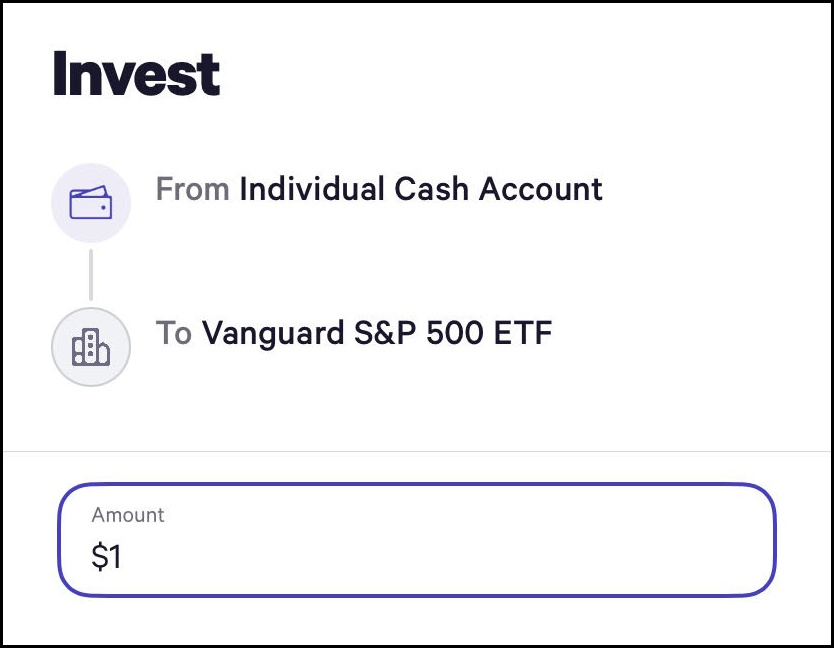

Step 4: The Amount

Type in your investment.

You'll see a summary of where your money is moving from and where it is moving to.

When you deposit money into an investment account, it hangs out inside a savings account (aka cash account) until you invest your money.

Many stocks or ETFs allow you to invest as little as $1.

Example photo

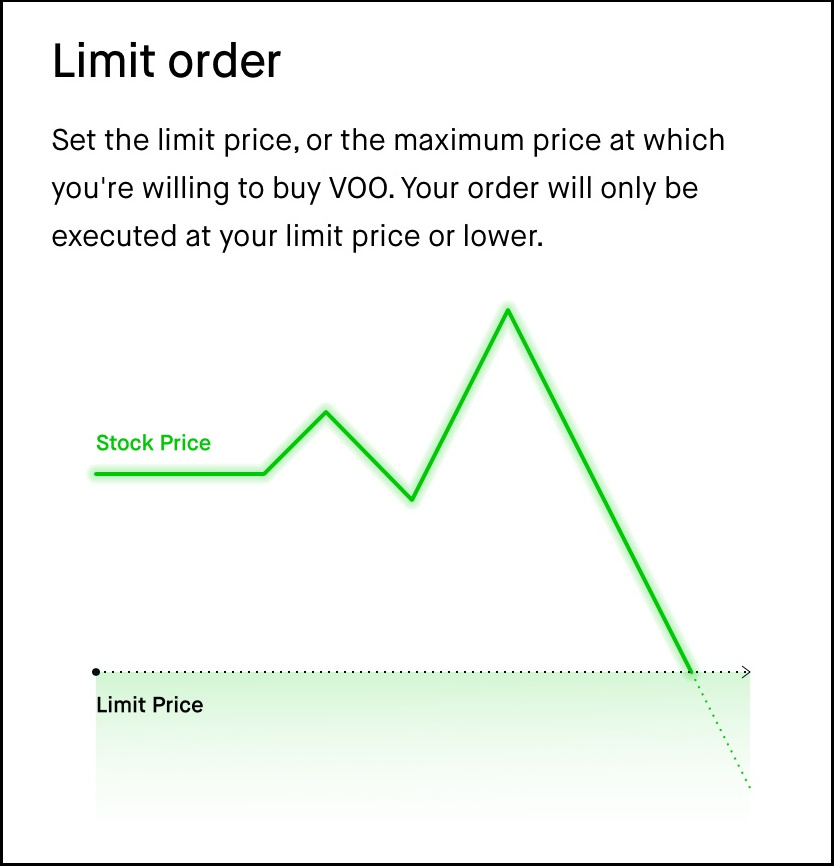

Step 5: The Order Type

Select your order type.

Common options you're given (but not always) are:

- Market order

- Limit order

If you pick Market order—

This means you want to buy the stock or ETF at its current price.

If you pick Limit order—

This means you want to buy the stock or ETF at a certain price.

Example photo

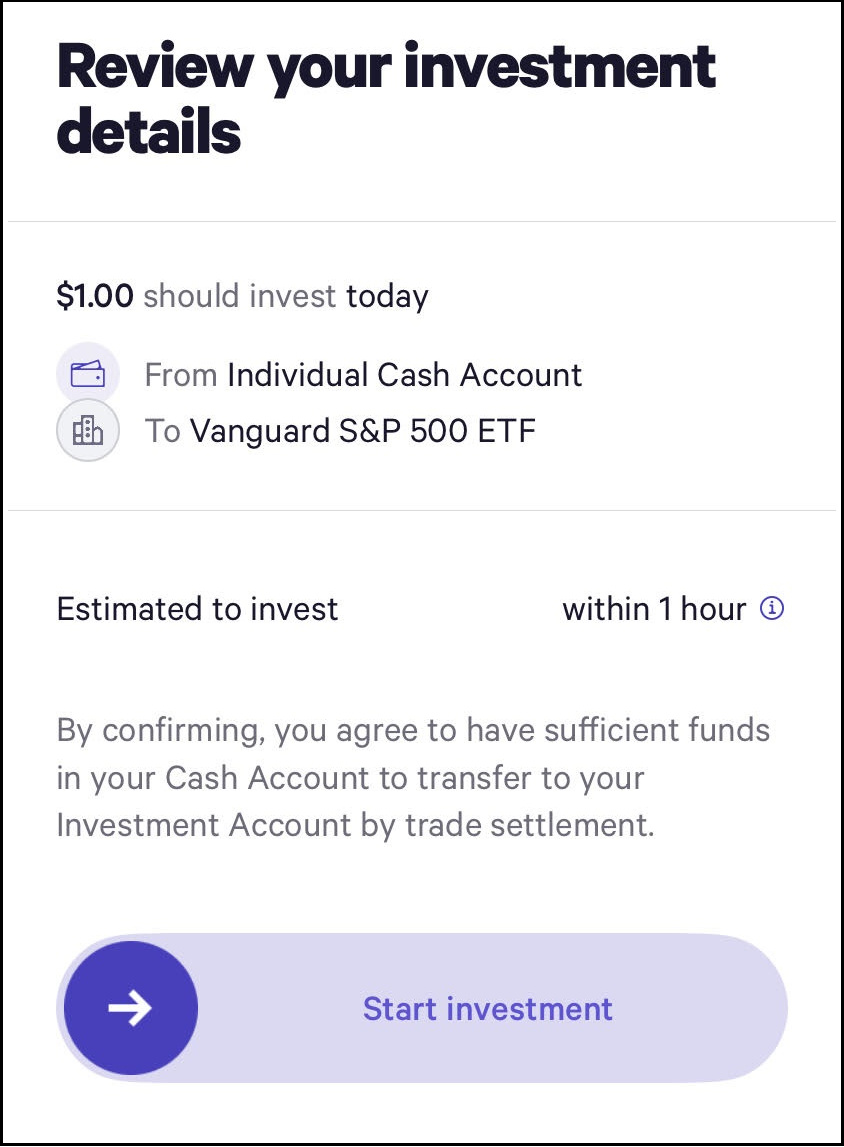

Step 6: The Review

Confirm the details.

Make sure everything looks correct before submitting your order.

In this example-

We're moving $1 from the cash account (aka savings account).

To The Vanguard S&P 500 ETF (the investment).

Example photo

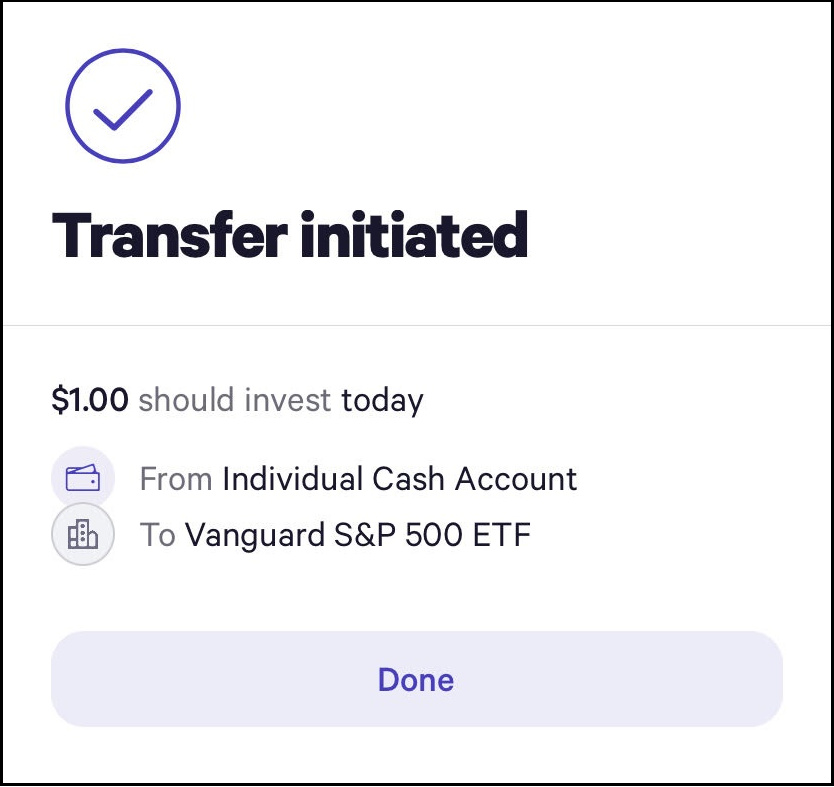

Step 7: The Confirmation

Confirm the outcome.

Check to make sure your order went through.

The company you have your investment account with usually sends you a confirmation email (for the stock or ETF you bought).

Example photo

The bottom line

Buying stock or a fund (like an ETF) can be confusing at first.

But the "what the heck am I doing" feeling goes away quickly.

Especially when you can test things out and learn with just $1.

Not all investment companies allow $1 trades.

So it's important to check first before opening an account if you want to invest smaller amounts.

I hope this little cheat sheet is helpful.

That's all for today.

See you next Saturday.