The Autopilot Investor (7 big perks)

Sep 27, 2025Read time - 4 minutes / Disclosure

The autopilot investor has:

- Low stress.

- Many stocks.

- A simple plan.

Unfortunately, investing is viewed as a complicated thing.

Keeping It Simple

Most people think becoming a successful investor means:

- Making big bets.

- Taking lots of risk.

- Being a stock guru.

Heck, I thought this too at first.

But trying to do these things can take up a lot of time.

And can cost you a lot of money (if making the wrong decisions).

After working in banking for 10 years.

And watching average people go from $0 to $1M+.

I noticed one big thing..

They keep it simple.

Saving $7 a day

— JOHN HENRY (@thejohn_henry_) June 25, 2025

= $210 per month

Investing $210 per month

In the stock market

Averaging 10% per year

= $43,917 in 10 years

= $157,829 in 20 years

= $453,285 in 30 years

= $1,219,624 in 40 years

Small habits. Massive outcome.

But what do they invest in?

The closer I looked.

The more obvious it became.

Most invest in..

Large American companies.

How exactly?

An S&P500 fund.

The S&P500 Fund Cheat Sheet

After seeing many self made millionaires invest in a simple S&P500 stock fund.

It became my main stock market investment too.

One of the largest stock funds is The Vanguard S&P500 ETF (it's also called: VOO).

Here's 7 big perks of investing in an S&P500 stock fund instead of trying to pick your own stocks (hope it's helpful).

Let's dive in:

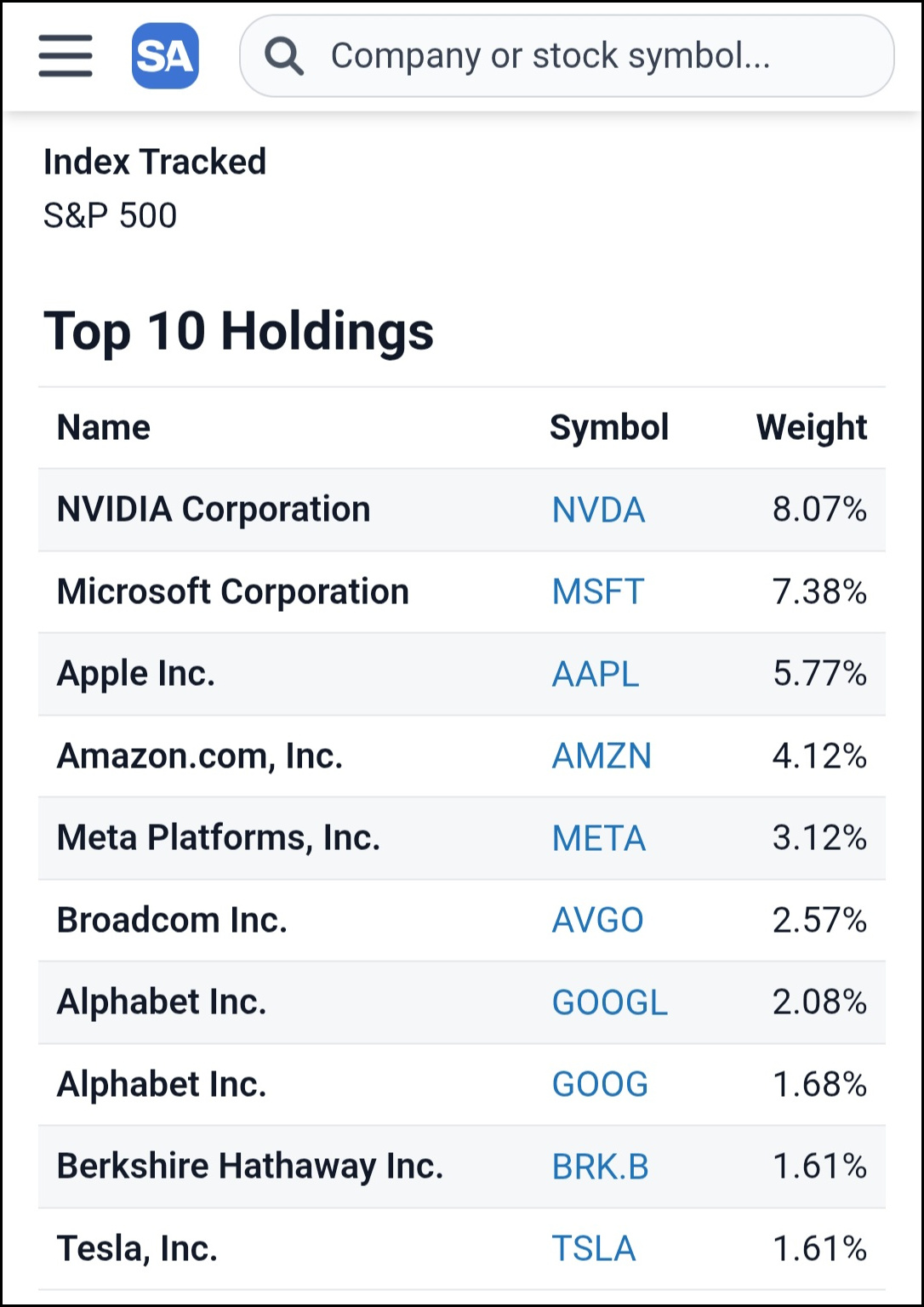

1. The 500 Companies

An S&P500 fund includes:

500 of the largest companies listed on the U.S. stock market.

If you look up the S&P500, you'll see the 10 largest companies plus the other 490 companies that make up the S&P500.

Stock Analysis (dot com)

A quick google search of "S&P500" or using free tools like Stock Analysis will show you 500 of the largest companies listed on the stock market.

2. The Quarterly Updates

Every 3 months the S&P500 changes.

Changes include things like:

A new company is added.

OR

An existing company is removed.

Changes happen for different reasons like:

Removing a struggling company.

OR

Adding a fast growing company.

And the best part..

These changes happen automatically.

The 500 companies that make up the S&P500 is updated 4 times every year.

3. The Low Price

Investing in the S&P500 doesn't take hundreds or thousands of dollars.

Many investment accounts let you start investing in the S&P500 with just $5.

New investors can own part of America's largest companies without spending a lot of money.

4. The Time Savings

Picking an individual company to invest in means researching:

- It's finances.

- It's business model.

- It's management team.

But investing in an S&P500 fund today means:

Every $100 invested = owning

$8.07 of NVIDIA stock

$7.38 of Microsoft stock

$5.77 of Apple stock

$4.12 of Amazon stock

$3.76 of Google stock

+ 495 other companies

S&P500 investors don't need to spend a lot of time deciding which stocks to buy.

5. The Easy Access

An S&P500 fund is available almost everywhere.

Most jobs offering a retirement account like a 401k, also offer an S&P500 fund as an investment option inside your retirement account.

Other investment accounts offer S&P500 funds too like:

- The IRA.

- The Roth IRA.

- The Brokerage Account.

S&P500 funds are common and easy to access no matter where you open your investment account or which type of account you have.

6. The Auto-Invest Option

Remembering to invest every month can be a pain.

Fortunately, auto-invest tools make it easy.

Turning on auto-invest inside a retirement account at work means:

- Part of your check every month automatically invests into the S&P500 (or whatever investment you pick).

Turning on auto-invest inside another investment account you open means:

- Money from your checking or savings account transfers every month to your investment account and automatically invests into the S&P500 (or whatever investment you pick).

Using auto-invest tools helps you remember to invest every month.

7. The Average Growth

Over the past 30 years, money invested in the S&P500 has grown 10% per year on average.

Some years investments grow slower, and other years investments grow faster.

What investors expect every year:

— JOHN HENRY (@thejohn_henry_) August 12, 2025

+ 10%

+ 10%

+ 10%

+ 10%

+ 10%

Last 5yrs of the stock market:

+ 18%

+ 28%

- 18%

+ 26%

+ 25%

Wild.

$100 invested in the S&P500 has doubled every 8 years on average for the past 30 years.

The bottom line

As a new investor.

I thought I needed to:

- Learn all of the shortcuts and hacks.

- Spend hours studying the stock market.

- Buy and sell my stocks at the perfect time.

But over time I realized none of these things are necessary.

Deciding:

- What stock to buy.

- How much to buy.

- When to buy it.

- What stock to sell.

- How much to sell.

- When to sell it.

...can take up a lot of time.

Time that could be spent doing other things.

S&P500 funds help simplify investing for people that like to invest on easy mode every month.

That's all for today.

See you next Saturday.