The Game of Money (4 steps to win)

Jan 31, 2026Read time - 4 minutes / Disclosure

Learning the game of money can:

- Grow your savings.

- Boost your investments.

- Help you leave 9-5 life early.

Unfortunately, it can be a confusing thing.

Feeling Behind

Most people feeling behind with their money:

- Work more hours.

- Take less vacations.

- Try to save extra money.

But getting ahead can feel impossible.

Like running a marathon that never ends.

Chasing an outcome that seems so far away.

Hoping to finally get ahead someday.

Many people playing this game run the money marathon their entire life.

"The more your money works for you, the less you have to work for money."

— Idowu Koyenikan

In my late 20s, I remember finding myself in $50,000 of credit card debt.

I lost my job and didn't work for 9 months.

It was a painful time in my life.

Trying to pay the bills.

Trying not to fall further behind.

Hoping for a miracle.

I'll never forget the feeling of being stressed over money every single day.

It was terrible.

But everything changed when I started working in finance.

Watching what wealthy people did with their money.

Learning better money habits.

Building those habits into my life.

And watching hundreds of other people work hard to go from $20k, $50k, or $100k+ in debt.

To $20k, $50k, or $100k+ in investments.

The Money U-Turn

Here's 4 steps I learned most people work through as they go from deep in debt to investing every month.

The steps that also helped me go from $50,000 in credit card debt to $1M in investments.

Hope it's useful.

Let's dive in.

Step 1: The Pay Yourself First Rule

Most people plan to save and invest when they have "extra money".

Sounds logical.

But I've watched many people make:

- $50,000

- $75,000

- $100,000+

...per year and still not have any "extra money".

Hell, I've been there too.

The pay yourself first rule says:

"Save a percentage of each paycheck automatically before paying your bills."

For example:

Turning on a retirement account at work to save 5% of each paycheck automatically.

If an employer matches money going into that account (many do), even better!

Most people's spending habits automatically adjust to this change.

"Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this."

— Dave Ramsey

Saving money in a retirement account was a huge part of my investing journey.

The pay yourself first rule helps you save and invest automatically through life's ups and downs.

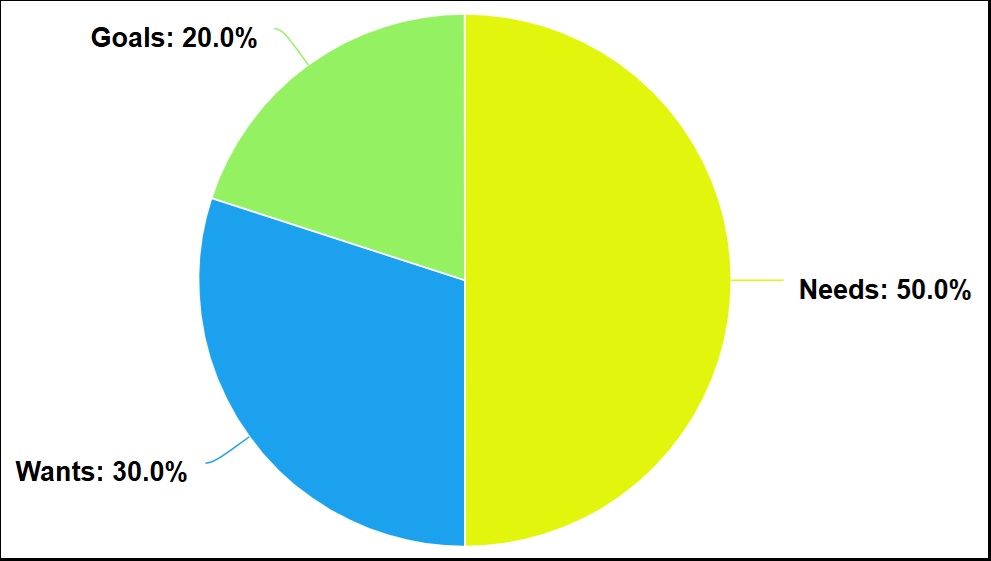

Step 2: The 50/30/20 Rule

Most people guess if they can afford:

- The new car.

- The fancy apartment.

- The international vacation.

I "guesstimated" if I could afford these things too in the beginning.

But the 50/30/20 rule helps remove the guess-work.

This money rule says to think of your monthly spending like this:

- 50% Needs (food, rent, etc)

- 30% Wants (vacations, new cars, etc)

- 20% Goals (investing, debt payoff, etc)

Monthly spending

The part of this rule I found most useful..

Was to think of my spending as different "categories".

Working in finance.

I noticed many banks would not give people loans.

If they spent too much money in a certain category.

For example:

Many banks won't give people a home loan.

If they're spending more than 50% of their monthly income on their monthly housing costs.

Plus their minimum monthly payments due that show up on their credit report.

So if Dave makes $6,000 a month.

50% of that is $3,000.

If he spends more than $3,000 every month.

On his rent payment + other minimum monthly payments due showing on his credit report.

Getting a home loan is harder.

The 50/30/20 rule helps you not overspend in certain categories each month.

Step 3: The Envelope System

Most people under estimate their monthly spending.

How much we think we're going to spend.

VS

What we actually spend.

Is often very different.

I've been guilty of this too.

The envelope system is a tool to help you cut back on certain expenses.

For example:

Mike loves eating out.

One day he looks to see how much money he spent eating out over the last month.

He sees he spent $1,000.

He's shocked by that number.

So he decides to use the envelope system to help cut back his eating out addiction.

He puts $500 in an envelope on the 1st of the month.

And declares it's his "eating out money" for the next 30 days.

Once he runs out of eating out money.

He must eat all of his meals at home.

When the 1st of the next month rolls around.

He puts another $500 in the envelope and starts the game over again.

When I first discovered the envelope system.

I used it in the exact same way..

To help cut back my eating out addiction.

It seems silly. But works.

The envelope system is a helpful tool to spend less money every month on your guilty pleasures (like eating out, buying clothes, etc).

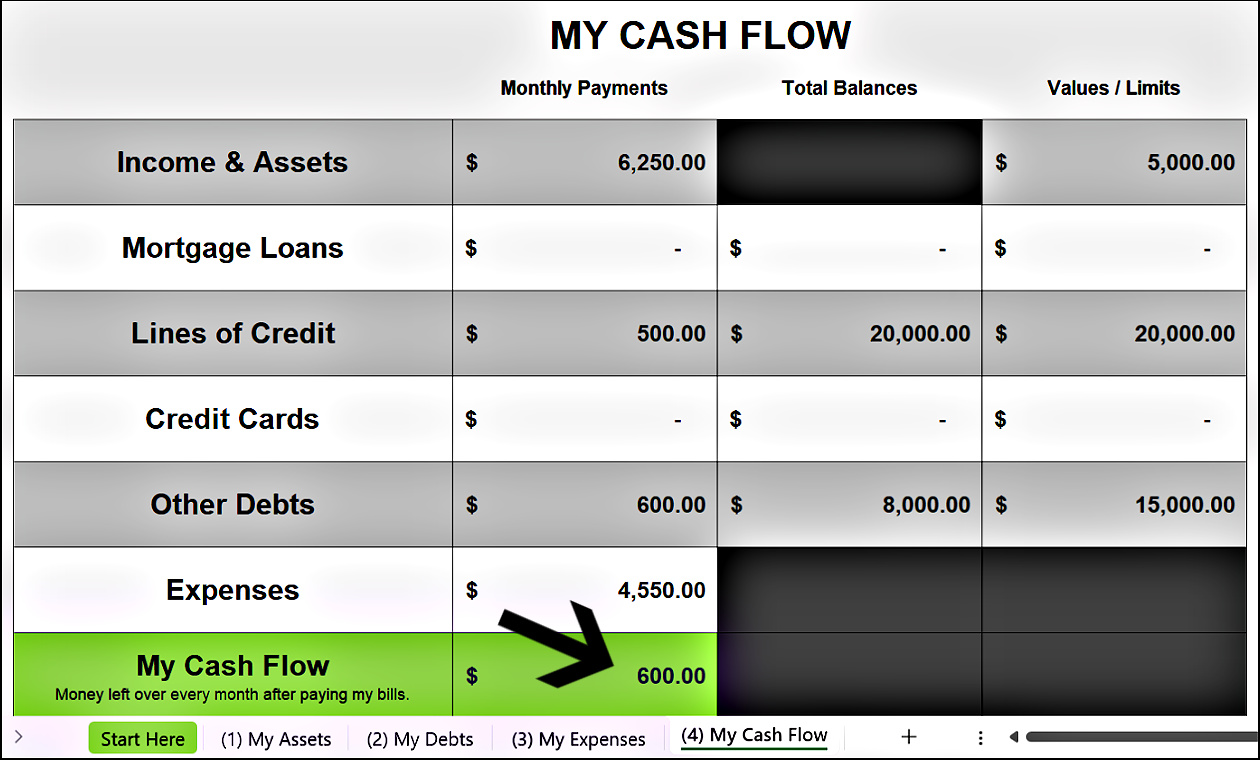

Step 4: The Zero Based Budget

Most people don't use a money system.

They didn't learn how in school.

And their parents likely didn't learn how either.

I sure didn't.

But a money system can change everything.

It can help you:

- Save more money.

- Invest more money.

- Make more money.

It can make your finances do a 180 in a few short months.

My favorite money system to use is called the zero based budget.

It gives every dollar you earn a purpose.

And every dollar goes towards your:

- Assets.

- Debts.

Or

- Expenses.

The cash flow guide is my favorite zero based budget system I've used for 10+ years.

Example

It looks scary at first.

But it's pretty easy to use.

Money in the green section goes towards:

- Getting rid of debt every month.

And

- Investing every month.

(my free 4-step cash flow guide)

It's not an exciting thing to do.

But spending 30 minutes a month on it to leave 9-5 life early.

Beats spending 40 years working for someone else in my humble opinion.

5 things worth doing:

— JOHN HENRY (@thejohnhenry_) January 8, 2026

1. Studying money.

2. Investing every month.

3. Sticking with it long term.

4. Escaping the rat race early.

5. Creating & living your ideal life.

It's not easy. But worth it.

The zero based budget helps you save, invest, and leave 9-5 life early (if you want).

The bottom line

In my 20s I was searching for the secret to get rich.

The one thing I needed:

- To do.

- To learn.

- To take action on.

After working in finance in my 30s.

And looking at bank statements, credit reports, and tax returns of people worth $1M, $5M, $10M+.

People I looked up to.

People I wanted to learn from.

People that started from scratch.

The 4 habits I noticed most were these boring things:

1. They paid themself first.

2. They watched their costs.

3. They cut out the extras.

4. They tracked their money.

And with the money they saved.

They invested it every month.

Not a lot of money at first.

But more and more over time.

In stocks.

In real estate.

In a business.

They were really good at motivating themselves to do these things consistently.

Habits that eventually led them to become millionaires.

After sitting in a bank for years watching people do these boring things.

I realized the secret to getting rich isn't:

- Luck.

Or

- Timing.

It's having the ability to motivate yourself.

To do the things that need to be done even when you don't feel like doing them.

So I started thinking more about how I could better motivate myself.

And found my best source of motivation to be...

Remembering what I don't want in life.

Things like:

- Having to ask for time off.

- Sitting in a cubicle for decades.

- Feeling like I was missing out on life.

- Not having total control of my time to do what I want until my 60s.

Thinking about these things helped motivate me to spend 30 minutes a month on my finances.

And it completely changed everything.

So let me ask you.

Have you thought about what motivates you?

The thing that drives you to do the stuff you don't feel like doing.

The thing that can help change everything.

It's a powerful feeling.

That's all for today.

See you next Saturday.