The Home Loan Game (how it actually works)

Nov 15, 2025Read time - 4 minutes / Disclosure

Getting approved for a home loan can:

- Help you buy sooner.

- Help you own property.

- Help your family build wealth.

Unfortunately, it can be a confusing thing.

The Journey

Making sense of home loan terms like:

- The pre-approval.

- The pre-qualification.

- The conditional approval.

...confuses 99% of first time homebuyers.

It did to me at first.

Which can lead to not buying a home.

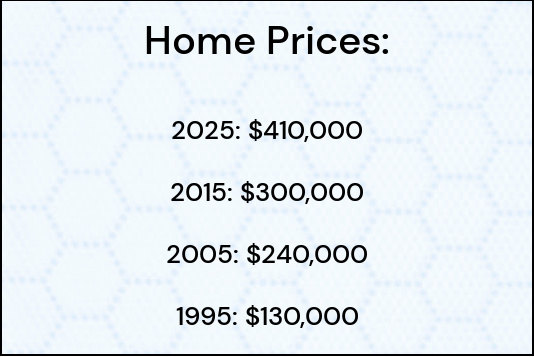

But that means missing out on future home price growth.

Federal Reserve: Median Home Price

Like it was last year, I remember meeting with Joe a loan officer in Seattle, Washington.

Joe helped me get my first home loan.

I didn't know squat about loans at the time.

And expected it to be complicated and expensive.

But Joe made it easy and helped me get a loan without coming up with a lot of money.

Two years later.

Joe helped me get another home loan.

Two years after that, Joe helped me get a 3rd home loan.

At that point I realized owning a home and a few rental properties was a way to build wealth faster and leave 9-5 life sooner.

To follow a different life path.

The outdated retirement plan:

— JOHN HENRY (@thejohnhenry_) November 10, 2025

20s: No plan

30s: No plan

40s: No plan

50s: Panic

60s: Panic

70s: Panic

The modern retirement plan:

20s: Invest a lot

30s: Invest a lot

40s: Invest a lot

50s: Enjoy

60s: Enjoy

70s: Enjoy

"If you do real estate the right way, your home will build outrageous wealth for you. Wealth that leaves a legacy for your kids, your grandkids, and their grandkids."

— Dave Ramsey

Watching Joe motivated me to start working in finance.

After spending a decade in banking and working on 1,000+ home loans.

I realized getting a home loan boils down to 4 things.

The "C.I.P.A." Checklist

Everyone's homebuying situation is unique.

But most home loan lenders check these 4 things when you ask them for a home loan:

- Your Credit.

- Your Income.

- Your Property.

- Your Assets.

Here's what that looks like step-by-step when you talk to a loan officer about getting a home loan (hope it's helpful).

Let's dive in:

1. Your Credit

First your home loan lender will pull your credit score.

Your credit score tells the lender what type of loan you may qualify for.

A high credit score means you have more loan options.

A low credit score means you have less loan options.

People with higher credit scores (720+) often get a lower interest rate on their home loan.

Your credit report also tells your home loan lender all of your monthly bills like:

- The car loan payment.

- The credit card payment.

- The student loan payment.

Checking your credit report before talking to a home loan lender is a good idea to make sure everything looks right.

2. Your Income

Next your home loan lender will figure out your monthly income.

To do this they will ask for things like:

- Your paystub.

- Your tax return.

And anything else that shows all of your monthly income.

Now that your lender knows all of your monthly income.

And they know all of your monthly bills.

They can estimate how much of a monthly home loan payment you may qualify for.

Maybe it's a $2,000 payment.

Or a $3,000 payment.

Or a $4,000 payment.

The more money you have leftover every month after paying your monthly bills, the larger the home loan payment you're likely to qualify for.

3. Your Property

Now your lender needs to figure out what type of home you're able to own with that monthly payment.

Condos often have the lowest monthly payment (a condo was my first home).

Larger homes like a duplex or a triplex often have higher monthly payments.

But they can be a good option if you want to own a home that has different areas you can rent out.

Redfin and Zillow are helpful apps to look up properties for sale and to estimate your monthly payment.

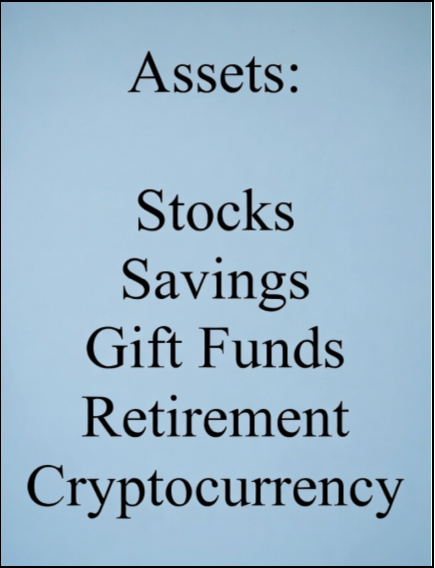

4. Your Assets

Last your home loan lender will figure out what type of home loan works best for you.

Some home loans need:

- a 5% down payment, Or

- a 3% down payment, Or

- a 0% down payment (no down payment)

I've owned 2 homes without coming up with a down payment.

And another home coming up with a 3% down payment.

How much money you put down when getting a loan to buy a home is a personal decision.

Some people are ok with no down payment or a small down payment.

And some people only want to buy a home if they have a large down payment.

Everyone's homebuying situation looks different.

Your lender will ask to see all of your assets that can be used towards your down payment.

Gift funds is money that comes from family (if an option).

Retirement funds is money that often comes from a retirement account at work (if available and you decide to use it).

Your lender will also want to see you have money for your closing costs which can be several thousand dollars.

Closing costs are due the day you close on your home and cover things like:

- The escrow company.

- Your home insurance.

- Your property taxes.

But there's many ways to get money for these things when buying a home (try this).

Homebuying doesn't always mean you need to have a lot of money saved.

The bottom line

Most people think getting approved for a home loan is a black and white thing.

"Yes you're approved."

OR

"No you're not approved."

I thought that too in the beginning.

But it doesn't usually work that way for most people.

For most people, it's a game.

A game of asking your loan officer "what if" questions.

Questions like:

- What if I refinance my car?

- What if I pay off my credit credit?

- What if I add my brother to the loan?

- What if I take that higher paying job?

...then will I qualify for the home loan that I want?

It's a game of tweaking your finances.

A game I've played many times myself.

Sometimes it takes a week.

Sometimes it takes a month.

Sometimes it takes a year.

And for some people it's not necessary at all.

Just remember..

If your finances need some tweaking.

Most loan officers work on commission.

And are happy to answer your questions.

Even if it takes weeks, months, or maybe a year.

So keep at it if you see homebuying in your future.

That's all for today.

See you next Saturday.