The House Payment (4 ways to save money)

Nov 01, 2025Read time - 4 minutes / Disclosure

A less expensive house payment can:

- Lower your bills.

- Reduce your stress.

- Give you extra money.

Unfortunately, finding ways to lower your house payment isn't common knowledge.

Owning A Home

Getting a loan to buy a home means focusing on:

- The neighborhood.

- The school district.

- The commute to work.

It's easy to think less about the house payment until that first bill arrives.

Most people pay it.

And life goes on.

But as time passes, there's different ways to lower that monthly payment.

Which means there's more money for other things. Like investing.

Why invest a lot of money

— JOHN HENRY (@thejohnhenry_) October 27, 2025

in the 20s, 30s, 40s?

Because needing to work a 9-5

at 70 sounds exhausting.

My first house payment was double the cost of my rent payment.

It scared the heck out of me.

So I had a friend move into the second small bedroom in that tiny home.

The rent they paid me each month helped make the house payment feel less scary.

And with each house payment I made, the loan balance went down a little bit every month and the value of that tiny home slowly went up.

The home loan bill didn't make much sense to me, but I kept paying it.

Several years later.

I found myself sitting in a cubicle at a bank doing loans for other people.

That's when real estate investing without much money became my weird obsession.

And I sure didn't have much money to begin with.

Little did I know this journey would lead me to get 6 more loans to own 2 condos and 4 more houses.

Figuring out how to keep my monthly home loan payment as low as possible.

Along with the monthly payments of the rental properties became a necessity.

The House Payment "Reducers"

Here's 4 ways I've learned to keep your home loan payment as low as possible (hope it's helpful).

Let's dive in:

1. The PMI

PMI means:

Private Mortgage Insurance

When you get a loan to buy a home.

And you don't put a lot of money down (less than 20% of the purchase price).

PMI is an extra charge that's usually added to your monthly payment.

It can cost you anywhere from $100 to $300 per month on average.

PMI is "extra insurance" that protects the company making your loan.

But the good news..

You can get rid of it.

Most people don't know (or forget) they can usually get rid of their monthly PMI payment.

There's different ways to do it.

For example.

Dave's home is worth $500,000.

As soon as his loan is $400,000 or less.

(80% of the value of his home or less)

He can ask his home loan lender if they'll remove his monthly PMI payment.

Proactively calling your lender to remove PMI can help lower your monthly home loan payment.

2. The Refinance

Refinancing a home loan means starting over with a new home loan.

People do it for different reasons but the most common reasons are:

- To get a lower interest rate so you have a lower monthly payment.

- To get rid of PMI (some loan types have PMI forever unless you refinance).

Refinancing a home loan can be really expensive.

Or it can be done at no cost.

But most people don't know about the no cost option.

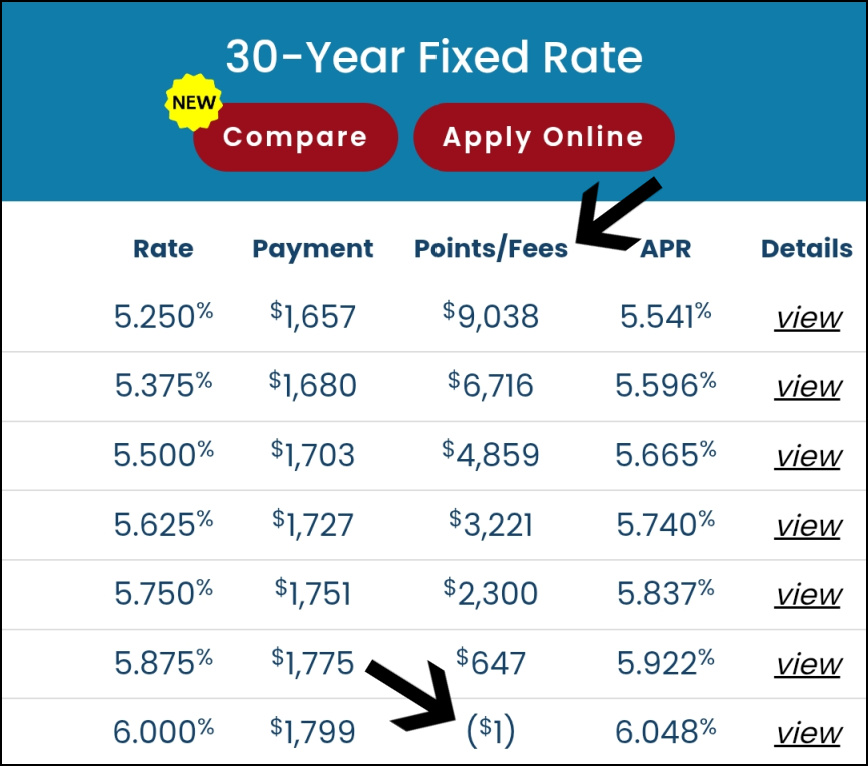

See the "Points/Fees" section below?

Home loan refinance example

In this hypothetical example, if refinancing your home loan and the new interest rate is 6%, it would be considered a no cost refinance.

Most home loan lender's fees are based off the interest rate you take.

So if Dave has a $400,000 home loan with an interest rate of 7%.

Refinancing his loan and taking a 6% rate could save him a few hundred bucks every month.

A "no cost" refinance to a lower interest rate can help lower your monthly home loan payment.

3. The Insurance

Most people quickly set up their home insurance policy.

And never think about it again.

But shopping around once in a while can be a big money-saver.

There's 2 ways to go about it.

Way 1:

Shopping around yourself.

Or

Way 2 (my favorite way):

Using an insurance broker.

Insurance broker example

Most insurance brokers have access to 30+ different insurance companies.

That means they can easily cancel your insurance policy with one company.

And switch you to another company if it's less expensive and makes sense to switch.

If you google "insurance broker + your city" you'll find a bunch of them.

Shopping insurance regularly or using an insurance broker can help lower your monthly home loan payment.

4. The Recast

Deciding how much money to put down when buying a home is tough.

Here's 2 ways to think about it.

Way 1:

Putting down whatever amount of money you're comfortable with.

And paying extra money every month (if you want).

A $400,00 home loan at 6% over 30yrs

— JOHN HENRY (@thejohnhenry_) October 22, 2025

= $863,352 in total payments

Double the cost.

Paying an extra $50 per week:

- Saves you $138,554 in interest

Paying an extra $150 per week:

- Saves you $210,949 in interest

Adds up quick.

But doing this won't change the monthly home loan payment.

It will just pay off the loan faster.

Or

Way 2:

Putting down whatever amount you're comfortable with.

And remembering you can always do a free "recast" later.

For example.

Dave has a $400,000 home loan.

At some point in the future.

He comes into a big chunk of money.

Maybe it's $10k, $50k, $100k+.

Dave can call his home loan lender.

Tell them he has a big chunk of money.

And he wants to put it towards his home loan and do a "recast".

His lender says OK and tells him what his new monthly payment will be if he sends over the money.

Doing a free "recast" can lower your monthly home loan payment if you come into a large sum of money in the future (a good problem to have).

The bottom line

Learning different ways to keep my home loan payment down has been helpful.

These ways were a complete mystery to me in the beginning.

But using these different ways can mean more money to:

- Fix things in your home.

- Buy things for your home.

- Have a cushion of money for life's little surprises.

And life sure is full of 'em.

That's all for today.

See you next Saturday.