The Investing Benefits (7 big perks)

Aug 23, 2025Read time - 4 minutes / Disclosure

Investing comes with perks like:

- Taking a month off.

- Leaving 9-5 life early.

- Pursuing your passions.

Unfortunately, society promotes investing for retirement not investing for "freedom".

Freedom vs Retirement

Investing for retirement often means:

- Time away from family.

- Working fulltime 40 years.

- Counting down the decades.

As a former banker, I watched a lot of people play this game.

Hell, I played it too.

It's a game of planning to live a better life at some point in the future.

To sleep in.

To go on that trip.

To finally start doing that thing you've always wanted to do.

But I also saw people playing a different game.

Instead of investing for retirement.

They were investing for "freedom".

To sleep in.

To go on that trip.

To finally start doing that thing they've always wanted to do this decade (not in 40 years).

And it really resonated.

True wealth is not:

— JOHN HENRY (@thejohn_henry_) February 17, 2024

• Big yachts.

• Private planes.

• Red Lamborghinis.

True wealth is:

• Going on a hike at 9am on Wednesday.

• Seeing a movie at 12pm on Friday.

• Sleeping in any day you want.

Finding ways to save and invest more money earlier in life is a short cut.

A short cut to live the life you want sooner rather than later.

At least, that's how I saw it.

After starting down that path.

I began to notice all of the different perks of building a larger investment account earlier in life.

Things I hadn't thought much about.

The Investing Benefits

Here's 7 perks I discovered when building my $1M investment portfolio from scratch (hope it's useful).

Let's dive in:

1. The Growth

Stocks average 10% growth per year in the U.S.

Sometimes faster.

Sometimes slower.

But overall, the 500 largest companies have been long time money-makers.

On the other hand, inflation has been a long time money-stealer.

Source: U.S. Bureau of Labor Statistics

The 500 largest companies have been growing faster than inflation (good news for investors).

2. The Ownership

Becoming an owner has never been easier or cheaper.

Many investment accounts allow you to start investing with just $5.

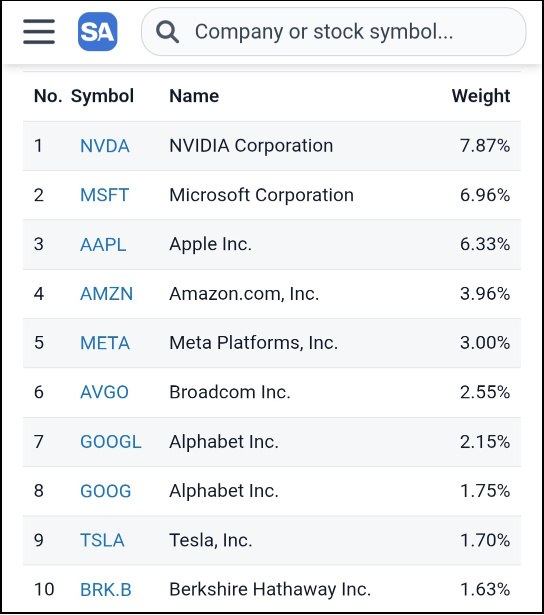

And owning a stock fund like:

- Vanguard S&P500 (VOO)

OR

- iShares Core S&P 500 (IVV)

...means owning a small slice of the 500 largest companies in America (pretty cool for just $5).

Becoming an owner has never been easier and beats a 2%-3% yearly raise.

3. The Clarity

Investments bring more peace of mind.

The further my investments grew from $0.

The more peace of mind it brought when unexpected things happened like:

- A large medical bill.

- The car stops working.

- Insurance prices double.

Savings and investments act as a stress buffer for life's little surprises.

4. The Optionality

A large investment account earlier in life means more options.

Options like:

- Taking a year off.

- Just working part time.

- Or, leaving the 9-5 altogether to do your own thing (my current state).

I've found stocks to be the most passive investment vs real estate.

Watching from the sidelines without getting your hands dirty is hard to beat.

10 largest businesses listed on the stock market as of 2025:

Source: stockanalysis

A healthy investment account can mean more options earlier in life.

5. The Family

Investing creates more time.

Time to do the things that get put off or delayed.

Because—

The boss needs that report.

Or a coworker called in sick.

Or the deadline is this week.

Being able to take more time off, or work part time, or leave the 9-5 to do your own thing means more family time.

6. The Memories

Investing helps create more memories.

After leaving my 9-5, I traveled for a year in 2022.

A time with friends and family I'll never forget.

Something I never could have done without focusing more on investing.

A few of the places I was so darn lucky to visit:

Paris, London, Brussels, Jordan, Egypt, Amsterdam, Victoria BC, The Cotswolds, The Caribbean.

Investing can allow the funds (and the time) to make new memories.

7. The Legacy

Money isn't everything.

As Naval Ravikant says:

"Money won't solve all your problems, but it will solve all your money problems."

Knowing a spouse, kid, or a significant other is taken care of is an amazing gift one can leave behind if desired.

An investment portfolio can help ensure loved ones are cared for.

The bottom line

Life is short.

Although retirement may feel miles away.

Investing for freedom can be a cheat code.

A way to experience freedom sooner rather than later.

Although the normal path is:

- Working 8 hours a day to enjoy 5 hours in the evening.

- Working 5 days a week to enjoy 2 days on the weekend.

- Working 50 weeks a year to enjoy 2 weeks of PTO.

- Working 45 years to enjoy 10-15 years in retirement

It doesn't have to be that way.

I figured, why invest for 40 years when I have the option to tweak my finances now and plan early?

It sure isn't easy.

But starting from scratch and watching your investments grow from $0 - to $100 - to $1,000 - to $5,000 - to $10,000 - to $25,000 - to $50,000 - to $100,000+ is so darn worth it.

That's all for today.

See you next Saturday.