The Investing Game (aka compound interest)

Aug 02, 2025Read time - 3 minutes / Disclosure

Compound interest can:

- Grow your assets.

- Build your wealth.

- Make 9-5 life optional.

Unfortunately, it can be a confusing thing.

The Math

Making sense of compound interest terms like:

- Principle amount

- Compounding rate

- Total maturity value

...can sound like jibberish to a beginner investor.

It did to me at first.

Which can lead to not investing.

But that means missing out on stock market growth.

40 years of the stock market

Like it was last week, I remember opening my first investment account.

I had no clue what I was doing.

But I knew investing could be a way out of 9-5 life early.

Little did I know it would lead to a $1M portfolio of stocks and real estate in my 30s.

And I'm no genius (far from it).

Mostly a B or C student that was unceremoniously fired twice near the beginning of my career.

But focusing hard on investing has given me more options.

Options like—

No alarm clock.

Working part time.

Seeing family more.

The goal never was to not work.

The goal was to become work optional a few decades early.

Two big things that helped near the beginning of my journey:

1. Remembering famous investor Warren Buffett's quote:

"The goal of non-professionals shouldn't be to pick winners, rather to own businesses bound to do well, a low-cost S&P 500 index fund will achieve this goal."

So I invested in an S&P500 Fund like "VOO" (the top 500 companies in America).

2. Figuring out how compound interest works.

So I ran a bunch of little experiments (an investing game of sorts).

After discovering the stock market has been growing 11% per year on average the past 40 years.

I imagined I was starting from scratch with investing 40 years ago (to see how much money I'd have today).

And it blew my mind..

Here's 3 examples, let's dive in:

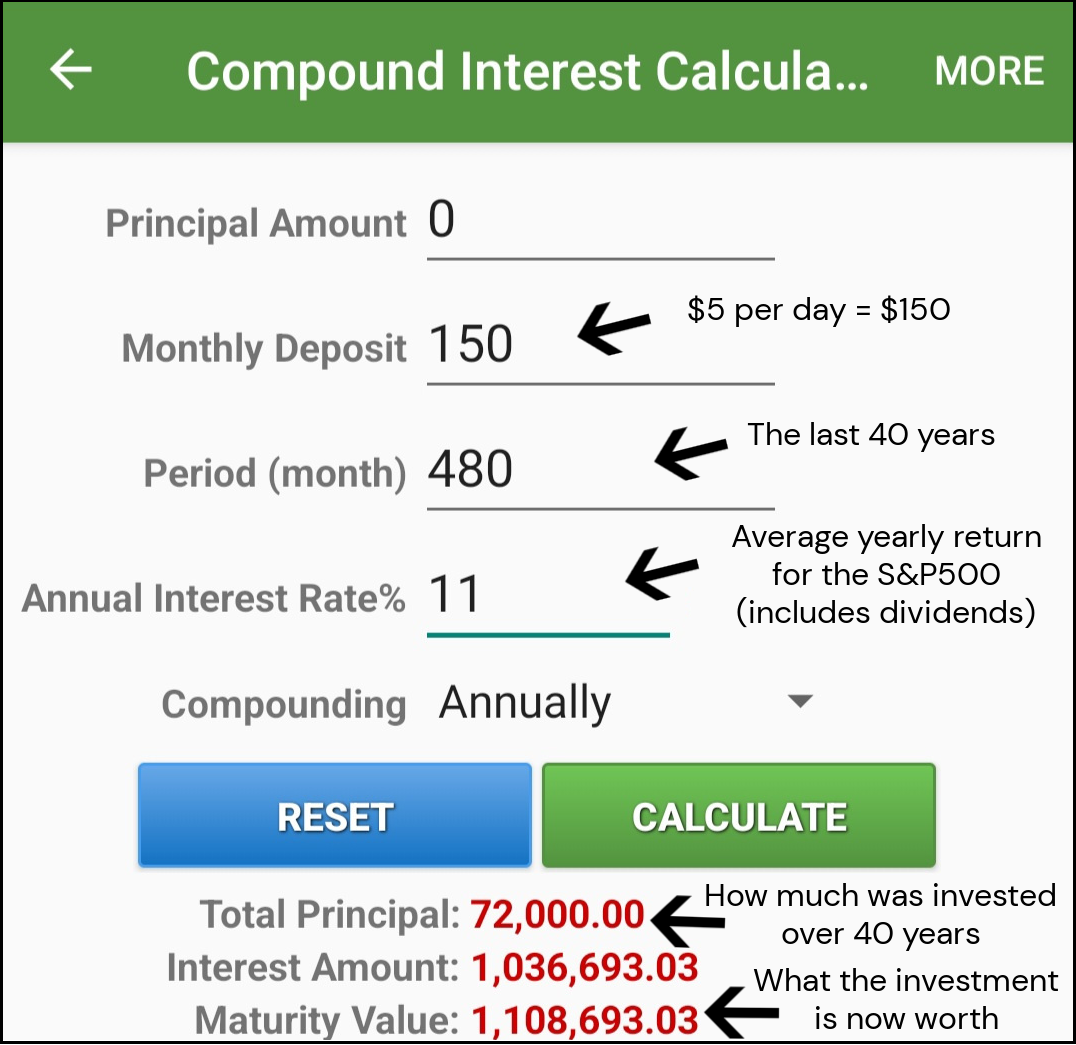

1. The $5 Experiment

Saving $5 per day meant:

- $150 invested per month

- Into the S&P500

- The last 40yrs

And it looked like this:

Investing $150 per month ($5 per day) into the S&P500 the last 40 years = $1,108,693

2. The $10 Experiment

Saving $10 per day meant:

- $300 invested per month

- Into the S&P500

- The last 40yrs

And it looked like this:

Investing $300 per month ($10 per day) into the S&P500 the last 40 years = $2,217,386

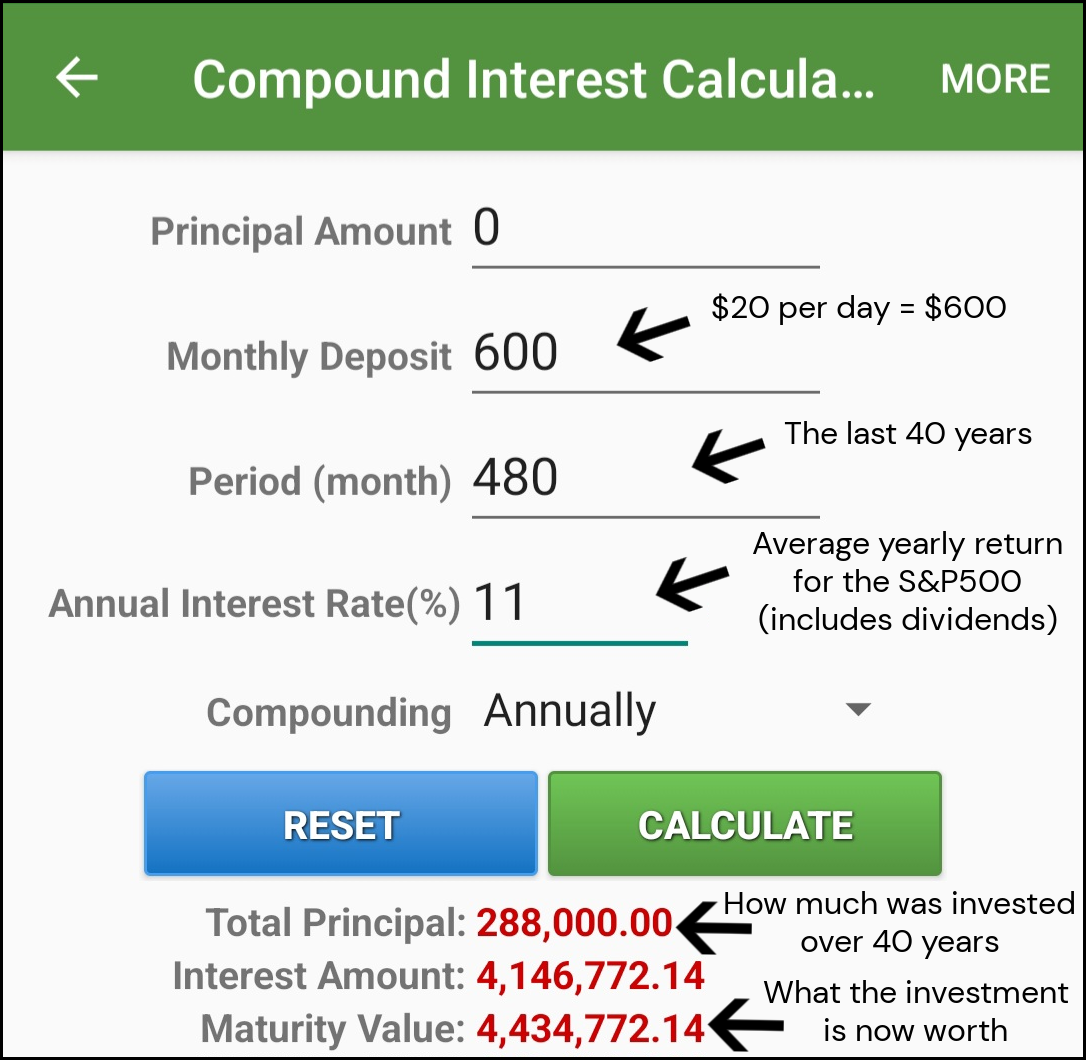

3. The $20 Experiment

Saving $20 per day meant:

- $600 invested per month

- Into the S&P500

- The last 40yrs

And it looked like this:

Investing $600 per month ($20 per day) into the S&P500 the last 40 years = $4,434,772

The bottom line

Running these little experiments helped motivate me as a beginner investor.

I didn't have a lot of money to invest starting off.

But seeing the stock market had grown 11% per year on average the last 40 years motivated me to get started.

Although there's no guarantees it will do the same over the next 40 years.

I figured—

If the population keeps growing.

If people keep making money.

If people keep buying stuff.

America (and the top 500 companies) would likely do well.

So I started investing $100-$200 per month and increased it each year as I made more money.

Imagining what I'd do if I didn't have to trade 40 hours of my life each week for a paycheck helped motivate me — to keep investing.

What would you do with an extra 40 hours per week?

Here's a link to the free compound interest calculator above if you want to run your own experiments:

Hope this little compound interest tutorial is useful.

That's all for today.

See you next Saturday.