The Investor Cheat Sheet (10 terms to know)

Oct 04, 2025Read time - 5 minutes / Disclosure

Learning the language of investing can:

- Boost your confidence.

- Expand your knowledge.

- Grow your portfolio faster.

Unfortunately, investing terms can be confusing.

Breaking It Down

Not feeling comfortable with investing can mean:

- Putting it off.

- Avoiding it completely.

- Not saving for retirement.

But finding the info you need is becoming easier.

And most people these days want freedom sooner than later.

The old American retirement plan:

— JOHN HENRY (@thejohn_henry_) September 16, 2025

20s: No plan

30s: No plan

40s: No plan

50s: Panic

60s: Panic

70s: Panic

The new American retirement plan:

20s: Invest a lot

30s: Invest a lot

40s: Invest a lot

50s: Enjoy

60s: Enjoy

70s: Enjoy

As an arrogant young guy in my 20s.

I told my mom I'd be a millionaire in my 30s.

She laughed and said "good luck".

The truth is—

I had no idea how.

My family struggled with money.

And I didn't know any millionaires.

But I was determined to figure out how an average person working a 9-5 could go from $0 to $1M quickly.

To leave 9-5 life decades early.

To create a more ideal life.

To have more free time.

To do enjoyable work.

I became obsessed with figuring it out.

Reading books, taking courses, studying successful people all pointed me to the same answer...

Investing.

The Investor Cheat Sheet

Learning everything I could about investing helped me build a $1M portfolio in just over a decade.

I made a lot of mistakes along the way like:

- Maxing out my credit cards.

- Almost filing bankrupcty.

- Getting fired (twice).

But the more I learned about investing.

The better I got with my money.

Here's 10 investing terms worth knowing (hope it's helpful).

Let's dive in:

1. The Stock

A business offers stock to raise money.

When you buy stock, you own a small piece of a business.

Your stock can go up or down in price for different reasons like:

- The business makes a lot of money.

- The business loses a lot of money.

Buying stock means you share in the upside or the downside of a company.

2. The Fund

Funds invest in many different things.

When you invest in a fund, you own part of many different businesses.

For example:

The Vanguard S&P500 Exchange Traded Fund (VOO) invests in 500 of the largest businesses listed on the U.S. stock market.

Different Investing Options

Investing in a fund means you share in the outcome of many different companies.

3. The Index

A stock index tracks a group of stocks.

Popular indexes include:

- The Nasdaq Composite.

This index tracks 2,500+ U.S. and Non-U.S. stocks.

Over 50% of them are technology stocks like Apple, Amazon, and Microsoft.

- The Down Jones Industrial Average.

This index tracks 30 U.S. stocks.

These stocks are the largest most influential companies like Visa, Nike, and Walmart.

A stock index shows how a certain group of companies are doing within the stock market.

4. The Market

A common investing phrase is: How's the market doing?

An easy way to check this is to google "The S&P500".

This tracks the 500 largest businesses listed on the U.S. stock market.

Looks like the stocks of these 500 businesses went up 100% (doubled in the last 5 years).

Money invested in the S&P500 5 years ago is now worth double today.

The "market" is often viewed as good or bad based on how the 500 largest U.S. companies on the stock market are doing.

5. The Broker

A stock broker is the key to the stock market.

Just like a real estate broker helps you buy a home.

And a mortgage broker helps you get a home loan.

Stock brokers connect you to the stock market.

There's thousands of stock brokers (different companies) to choose from when opening your investment accounts.

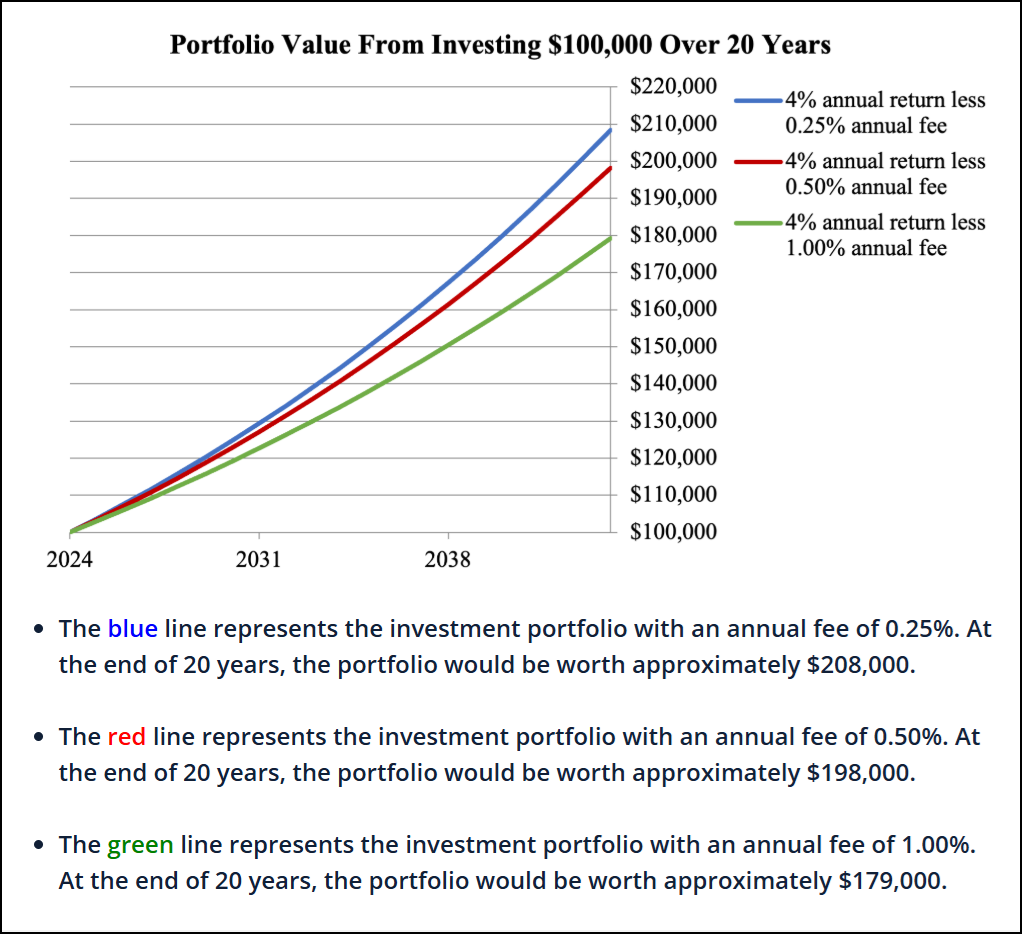

6. The Fees

Annual fees can eat away at your investments.

Two common fees to watch out for are:

1. Broker fees

Some investment companies (stock brokers) charge annual fees.

The fee could be:

- $0

- $50

- $1,000+

Always check a company's fees before opening your account.

2. Fund fees

Most investments (funds you invest in) charge annual fees.

The fee is usually a percent of your total investments.

Here's an example from investor dot gov.

Fees add up over the long term.

Most fees are taken out of your investments automatically.

Keeping broker fees and fund fees low can save you $20,000+ over the long run.

7. The Account

The 3 most popular investing accounts are:

- The 401k.

- The Roth IRA.

- The Traditional IRA.

The 401k is a retirement account many jobs offer to their employees.

The Roth IRA and The Traditional IRA are retirement accounts you can open on your own.

The most popular non-retirement investing account is:

- The Self Directed Brokerage.

This account is great for people that want to leave 9-5 life early.

You can take money out of this account anytime you want without a penalty since it's not a retirement account.

Retirement and non-retirement accounts are great tools to build your investing portfolio.

8. The Portfolio

A portfolio means "your investments".

It includes anything of value that you own like:

- Cash

- Stocks

- Real Estate

Your portfolio is all of the different assets you own combined (example: "he/she has a $100k portfolio").

9. The Allocation

Allocation means how much you have of each asset.

For example, maybe your portfolio is:

- 10% Cash

- 50% Stocks

- 40% Real Estate

(100% Total)

Example

Asset allocation is a way to better understand how all of your money is invested.

10. The Return

Return means how much your investments change.

For example:

The S&P500 (largest 500 companies in the stock market) returned 25% in 2024.

That means:

$100 invested

times 25%

= $125

$100 invested became $125 in 1 year.

2024 was wild.

The S&P500 returns 10% per year on average.

Investment returns help you figure out how much your investments change every year.

The bottom line

Investing can feel like learning a new language.

Especially in the beginning.

Like learning Spanish in high school (or maybe French).

It can be intimidating.

But like most new things.

You eventually figure it out.

Maybe not today.

Maybe not next week.

But slowly over time.

And taking the time to learn investing to build a freer life, is so darn worth it.

That's all for today.

See you next Saturday.