The Simple Investor (and 5 big threats)

Feb 13, 2026Read time - 4 minutes / Disclosure

Simple investing can:

- Save you money.

- Make you money.

- Help you avoid mistakes.

Unfortunately, there's many investing threats.

Losing Money

Many people who put off investing are afraid of:

- Making a big mistake.

- Doing the wrong thing.

- Picking a bad investment.

So they put off investing.

They hope someday they'll feel ready.

They'll know just enough to finally get started.

And they'll avoid making any mistakes.

But as they wait..

The cost of food doubles.

The cost of insurance doubles.

The cost of buying a home doubles.

5 to 10 years pass and they're still planning to invest "someday."

Do what most people don't.

— JOHN HENRY (@thejohnhenry_) February 9, 2026

- Study money.

- Save every month.

- Invest every month.

- Keep at it long term.

- Escape 9-5 life early.

- Create your ideal life.

Patience pays in a world

full of distractions.

I was scared of losing money too when I started investing.

The thought of making a bad decision and losing $100, $200 or $500 made my stomach turn.

Money I'd worked hard for.

Money I'd never see again.

But I knew doing nothing would also be a big mistake.

Because I didn't want to spend 4 decades of my life working a 9-5 job.

Feeling stuck living the same day over and over again.

Daydreaming of the day I'd finally quit.

And start living the life I truly wanted.

Having total control of my time.

"If you don't find a way to make money while you sleep, you will work until you die."

— Warren Buffett

Working in banking was the most exciting job I ever had.

To the average person, it might sound boring.

But to me, looking through self-made millionaires tax returns, bank statements and credit reports was a cheat code.

A way to learn exactly what they did to make their money.

Stuff I could do too.

And most of the time it was:

- Stocks.

OR

- Real estate.

So I doubled down on both.

But instead of picking individual stocks which scared the hell out of me in the beginning.

What if I picked the wrong company?

So I invested in a S&P500 stock fund instead.

Which includes 500 of the largest companies in America.

For example:

One of the largest S&P500 stock funds is VOO (the Vanguard S&P500 fund).

And I doubled down on buying real estate using the real estate investing playbook I'd learned from smarter investors to get up to $30,000 when buying a home.

Being a simple investor and doing just those two things..

A boring S&P500 stock fund and real estate.

Took my investments from $0 to $1M in just over a decade.

But there were many threats along the way.

And I made lots of mistakes too.

Beginner Investor Threats

Here's 5 investor threats I wish I knew as a beginner investor.

Hope they're helpful.

Let's dive in.

1. The Impatience

Everyone wants to build wealth fast.

To quit their 9-5 this year.

To tell their boss "sayonara"...I don't need this job anymore.

And I thought a lot about that too.

But most of millionaires I looked up to in my banking job didn't go from $0 to $1M+ in:

- 2 years.

- 5 years.

- 7 years.

It took most of them at least 10 years.

10 years can feel like forever.

But I figured it was better than having to sit under florescent lights at work for the next 40 years.

“There are no get-rich-quick schemes. That's just someone else getting rich off you.” - @naval pic.twitter.com/WGXyYi9fnR

— Brian Feroldi (@BrianFeroldi) December 31, 2025

"Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years." — Warren Buffett

2. The Distractions

There's always a hot new investment.

Investments that can easily become a new obsession.

Past examples:

- NFTs.

- Dogecoin.

- High flying stocks.

And new ideas can be easy to fall in love with.

Ideas that might double, triple or quadrouple an investment account.

Ideas that have taken over my mind before too.

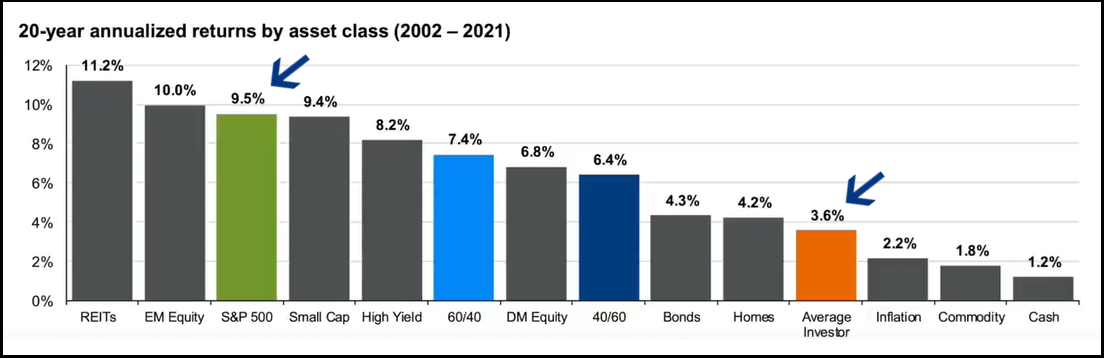

But according to JPM Asset Management..

The average investor trying to pick their own investments over the long term.

Does worse than the average investor simplying buying an S&P500 stock fund.

Source: JPM Asset Management

"One should only invest in what they know. Do not listen to hot stock tips." — Jim Rogers

3. The Judgement

Everyone has an opinion about your money.

A few things friends and family have said to me in the past:

"I heard the stock market is crashing, maybe you should get out of stocks."

"I read real estate is in trouble, maybe you should get rid of your rentals?"

And the truth is..

Most of the time friends or family say these things out of love.

Out of concern.

But I've realized most people offering this advice.

Haven't built the kind of life I want to live.

"Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves." — Peter Lynch

4. The Emotions

Listening to the news can be dangerous.

"Stocks are crashing."

"The economy is crashing."

"A major recession seems evident."

Hearing things like this can scare the hell out of any investor.

And cause them to do things they hadn't planned on doing with their investments.

Things they may later regret.

Things I've also regretted doing.

And people saying these things can be very convincing.

And sound really smart.

But the truth is..

No one knows exactly what the economy is going to do in the next:

- 1 month.

- 6 months.

- 12 months.

"The big money is not in the buying and the selling...it's in the waiting." — Charlie Munger

5. The Discipline

Life gets wild sometimes.

It can sting when the unexpected happens like:

- The big hospital bill.

- The unexpected pay cut.

- The layoff you didn't see coming.

I'll never forget losing a job I'd had for 7 years before working in finance.

And racking up a ton of credit card debt in the meantime.

Getting out from under that was painful.

But as they say..

"If you're going through hell, keep going."

— Winston Churchill

Y’all forgot the turtle won the race. Stay Consistent. Stay Focused.

— 🥷🏿 (@_bobbyw) October 29, 2024

"People think making money is about luck. It's not. It's about becoming the kind of person that makes money." — Naval Ravikant

The bottom line

Figuring out money and investing is a wild journey.

A journey full of:

- Impatience.

- Distractions.

- Judgement.

- Emotions

And

- Discipline.

A journey I thought would look like this:

But looked more like this:

A slow and steady few years, followed by..

"my god I've messed this up"

Followed by..

"almost back on track"

Followed by..

"thank god I didn't give up"

If you're in the slow and steady phase.

Or maybe the "my god I've messed this up" phase.

I've been there too my friend.

I'm rooting for you.

If you're in the $100,000+ phase of investments.

That's amazing!

I hope this little investor threats cheat sheet helps you avoid some of the mistakes I've made.

That's all for today.

See you next Saturday.