2026 Affordable Homebuyer Guide (7 steps to buy a home you love)

Jan 03, 2026Read time - 6 minutes / Disclosure

Buying an affordable home can:

- Grow your assets.

- Build your wealth.

- Help you create a comfortable retirement.

Unfortunately, the homebuying game has changed.

The New Way

Over the past few years:

- Home prices are higher.

- Interest rates are higher.

- Insurance prices are higher.

Many people are waiting for prices to drop.

For interest rates to fall.

For homebuying to become easier.

But the harsh truth..

The old way to buy a home doesn't work well anymore.

And while people continue to wait for prices to drop.

The cost to buy a home keeps going up.

Just like it has for decades.

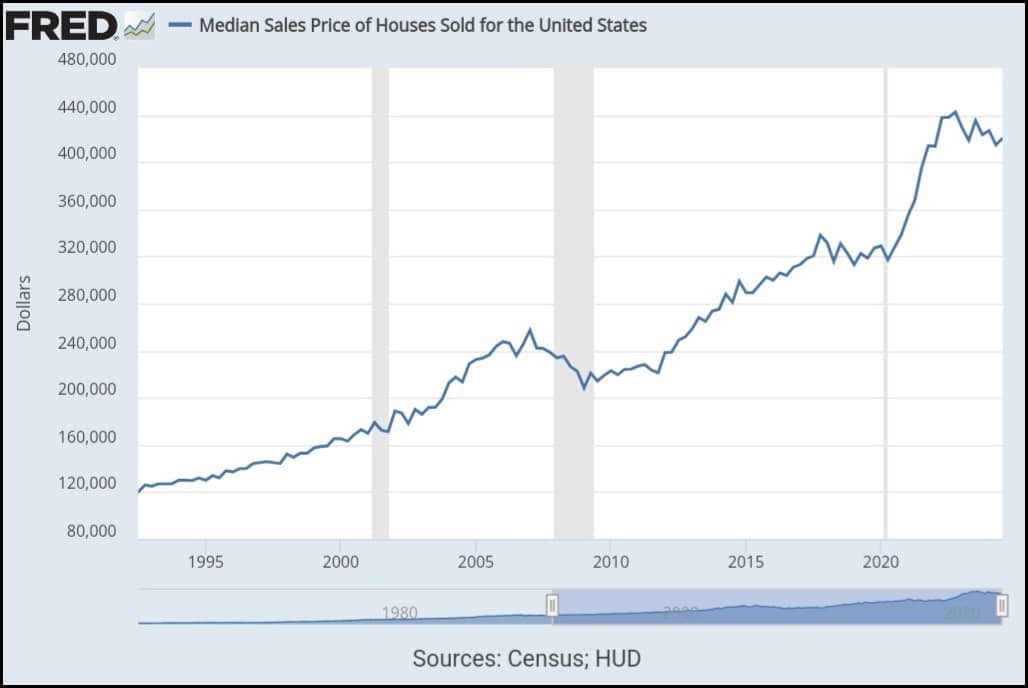

Home prices

Getting a loan to buy my first home was scary.

I didn't have much money saved.

And worried if:

My timing was right?

Interest rates were right?

If I should wait a bit longer?

Looking back.

I'm so glad I pushed past those fears.

Getting that first home loan led to much bigger things.

Things like..

Getting 6 more loans to buy 6 more properties.

Things like..

Working at a bank for 10 years helping 1,000+ other people buy their first home.

It feels weird to say.

But..

I became obsessed with real estate.

Obsessed with trying to figure out all the hacks and shortcuts to get a good deal on a home.

Things I wish I knew a decade ago when I was nervously signing the loan papers to buy my first home.

"If you do real estate the right way, your home will build outrageous wealth for you. Wealth that leaves a legacy for your kids, your grandkids, and their grandkids."

— Dave Ramsey

How to Buy an Affordable Home

Here's the 7 steps I'd follow to buy an affordable home in 2026 if I was starting over from scratch without a lot of money saved.

Hope it's helpful.

Let's dive in:

Step 1: The Special Program

Most people walk into a local bank or credit union to apply for their first home loan.

It seems like the obvious choice.

But I think the Fannie Mae website is a better place to start.

Fannie Mae works directly with the U.S. Government to make homebuying more affordable.

And there's over 2,000+ special first time homebuyer programs listed on the website.

Programs most banks and credit unions don't offer.

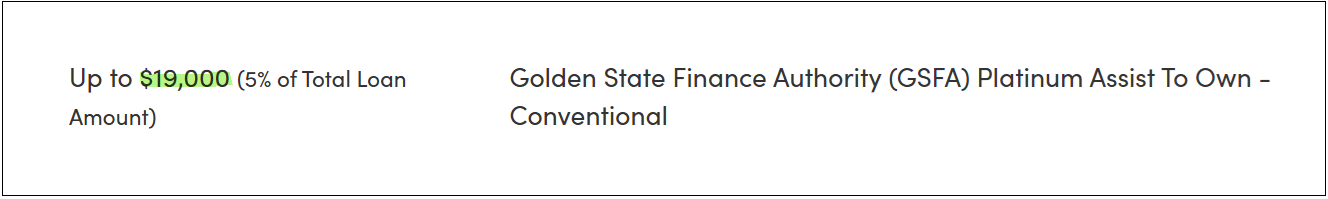

For example.

If you live in Los Angeles, California.

This program will give you up to $19,000 to buy a home.

It's an interest free loan.

With no monthly payments.

That you pay back when you sell your home or refinance your home loan.

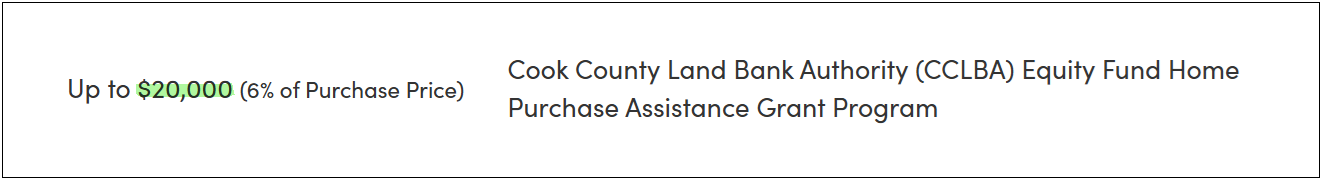

Another example.

If you live in Chicago, Illinois.

This program will give you up to $20,000 to buy a home.

It's an interest free loan.

With no monthly payments.

And if you own the home for at least 3 years.

You don't have to pay the money back.

There's tons of special homebuyer programs like these.

You just need to know how to find them.

(my free cheat sheet to find special homebuyer programs)

The Fannie Mae website is a goldmine to help you buy your first home.

Step 2: The Homebuyer Credit

Most people don't know they can get $10,000 or $20,000+ in homebuyer credits.

Homebuyer credits are different than special homebuyer programs mentioned above.

But you can use both of them together.

To get a lot of homebuyer money to help you buy your first home.

Homebuyer credits can come from:

- Your loan officer.

- Your real estate agent.

- The seller of the home you buy.

For example.

I got $30,000 in homebuyer credits when buying this California home:

Using a special homebuyer program.

Plus getting a lot of homebuyer credits.

Is my favorite way to buy a home without having to come up with a lot of my own money.

(my free cheat sheet to get a lot of homebuyer credits)

Special homebuyer programs and homebuyer credits can cover all or most of your homebuyer costs.

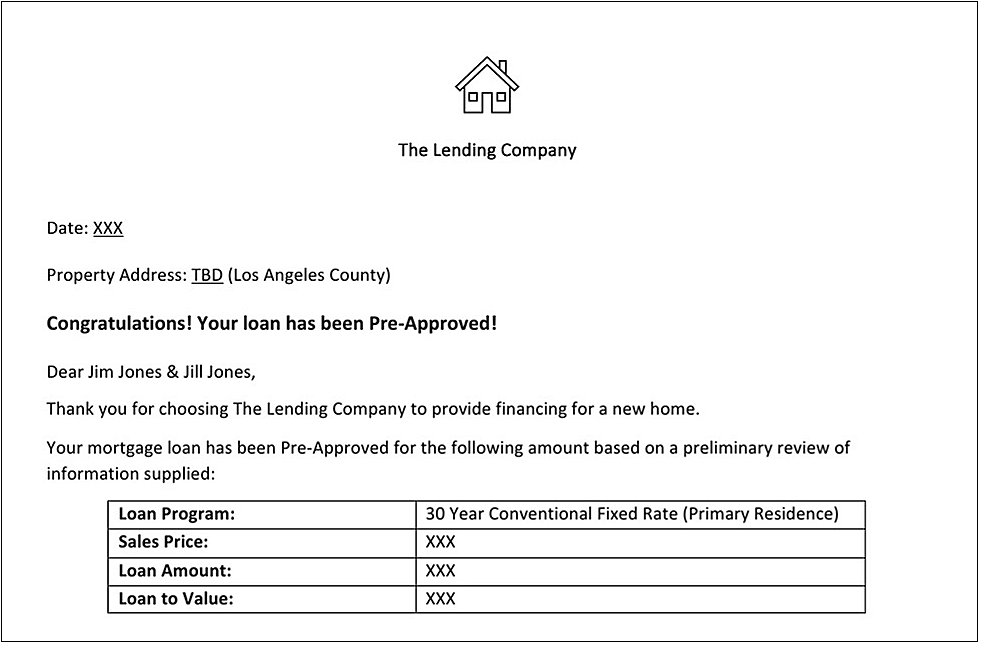

Step 3: The Loan Pre-Approval

After finding 2 special homebuyer programs on the Fannie Mae website mentioned in step 1.

I'd call the person listed as the contact for each program.

Ask them questions to make sure I understood how the program worked.

And tell them I was ready to get my home loan pre-approval so I'd know how much of a home loan I qualified for.

And if I qualified for their special homebuyer program.

Getting a home loan pre-approval from 2 different programs gives you more options.

It's like shopping at 2 different car dealerships when deciding to buy a car.

The more options. The better.

It's also important to tell the loan officers helping you about any homebuyer credits you plan on getting mentioned in step 2.

For example.

When I got my home loan pre-approval to buy the California home above.

I made sure to tell my loan officer I was planning to get at least $7,500 in homebuyer credits from the home seller.

So they could figure those numbers into my home loan pre-approval.

It's not possible to know exactly how many homebuyer credits you'll get before finding a home.

But it's important to talk to your loan officer about it.

Knowing you have a plan to get homebuyer credits.

Can help the loan officer qualify you for a larger home loan.

Getting 2 home loan pre-approvals from a special homebuyer program gives you several options before starting your home search.

Step 4: The Loan Homework

After doing a home loan pre-approval.

Some people are pre-approved for the loan amount they want.

Maybe it's a $300k loan.

Maybe it's a $500k loan.

And some people are pre-approved for less than they want.

Maybe they receive a $300k loan pre-approval.

But they want a $500k loan pre-approval.

If that happens.

The "what if game" is a good strategy to use.

Hell, I've used it many times.

It involves asking your loan officer "what if" questions.

Questions like:

- "What if I pay off some bills?"

- "What if I take a promotion at work?"

- "What if I refinance my student loans?"

- "What if I add grandma to the home loan?"

...then will I be pre-approved for the loan I want?

The truth is..

Sometimes home loans take work.

The key is to not give up.

Sometimes you have to tweak your finances to get the loan you want.

It can take:

- A week.

- A month.

- A few months.

Fortunately, lots of people in finance work on commission.

And many loan officers only get paid when you're approved for a home loan and buy a home.

So many are happy to help you figure things out.

Even if it takes months or longer.

After tweaking your finances if needed.

Your loan officer will give you a home loan pre-approval that looks something like this:

Example loan pre-approval

Example loan pre-approval

Some people get their home loan pre-approval right away and other people have to adjust their finances first, which is a normal thing.

Step 5: The Home Search

There's lots of tools to help you find your home.

- For sale signs.

- Real estate agents.

- Mobile phone apps.

I'm a big fan of mobile phone apps.

I can find lots of homes for sale using a free app like Redfin (my favorite).

Apps like Redfin help you:

- Research neighborhoods.

- Find open houses to attend.

- Notify you when new homes are for sale.

If you like to do your own research.

Mobile apps like Redfin are a great tool.

But you'll also need to find a real estate agent to help you write an offer on a home.

It's important to pick one with experience that you trust.

According to the National Association of Realtors, on average most people find a home they love in 2-3 months after getting their home loan pre-approval.

Step 6: The Monthly Payment

Finding the right home also means having an affordable monthly payment.

Here's my 2 favorite ways to lower my monthly payment.

Way 1:

Find a home that pays you.

For example.

This is the 2nd home I bought in Seattle, Washington using a home loan.

I lived downstairs and rented out the upstairs to help lower my monthly payment.

Split level home

Here's another example.

This is the 5th home I bought using a home loan.

The 2nd entrance is a separate living area that's rented out.

The garage was converted into a tiny living room plus a tiny kitchen.

Converted garage

Another option is to find a home that has a small rental unit in the back yard.

These units are called ADU's.

Short for accessory dwelling unit.

They're often rented out for $1,000+ per month.

And they're popular these days.

Home depot sells lots of them..

ADU sold at home depot

The 2nd way I like to lower my monthly payment.

Way 2:

Using homebuyer credits to buy down the interest rate.

For example.

Let's say the current interest rate on a home loan is 6%

But you don't want a 6% interest rate.

You can use any homebuyer credits you receive to buy down your interest rate.

To get a lower rate and have a lower monthly payment.

(my free cheat sheet to get a lower interest rate)

Finding a home with a separate rentable area can lower your monthly payment by 25%-40% every month and getting a lower interest rate can save you thousands of dollars.

Step 7: The Blueprint

Here's an example of how the above steps work together.

Mike's Homebuying Story

Mike wanted to buy his first home.

But he didn't have a bunch of money saved.

Step 1:

Mike finds 2 special homebuyer programs on the Fannie Mae website.

Each program offers to give him $10,000 to buy a home.

But he must pay the money back when he sells his home or refinances his home loan.

Mike writes down the contact information for each program.

Step 2:

Mike decides every time he makes an offer on a home.

He's going to ask the home seller to give him $7,500 in homebuyer credit.

Mike also decides he's going to use the redfin app to research homes for sale.

He's ok with doing a bit of work on his own.

And plans to ask his real estate agent for $2,500 in homebuyer credit.

Step 3:

Mike calls the 2 contacts he wrote down for the special homebuyer programs.

And he applies for each program.

He makes sure to tell the loan officers he plans to get a $7,500 homebuyer credit from the person he buys a home from.

And a $2,5000 homebuyer credit from his real estate agent.

Mike is approved for one of the programs which also gives him $10,000 towards the purchase of a home.

But they only approve him for a $200k home loan.

And Mike wants a $400k home loan.

Step 4:

Over the next 2 months Mike works with the loan officer that approved him for the $10,000 homebuyer credit and the $200k home loan.

And Mike...

- Pays off a credit card to get rid of the monthly payment.

- Refinances his auto loan so he has a lower monthly payment.

- Refinances his student loan so he has a lower monthly payment.

And Mike's loan officer is able to turn his $200k home loan pre-approval into a $400k home loan pre-approval.

Step 5:

Mike finds a real estate agent and gives them a copy of his home loan pre-approval.

Mike also tells the real estate agent every time he makes an offer on a home he wants to ask the home seller for a $7,500 homebuyer credit.

And he asks his real estate agent for a $2,500 homebuyer credit.

His real estate agent agrees to a $1,000 homebuyer credit.

And suggests each time Mike makes an offer on a home he asks the home seller to give him a $9,000 homebuyer credit instead of a $7,500 credit.

Mike agrees.

Step 6:

During his home search Mike finds a split level home.

The upstairs is the main part of the home.

And the home has a 2nd entrance downstairs which can be used as a separate living area.

Mike thinks the home is perfect.

He plans to live upstairs and rent out the downstairs area for $1,000 every month to help keep his monthly costs down.

He makes an offer to buy the home and also asks the seller to give him a $9,000 homebuyer credit.

The seller accepts his offer.

If you're wondering..

The $9,000 homebuyer credit comes out of the money the seller gets when they sell their home to Mike. They don't have to come up with the $9,000 until their home sells.

Step 7:

Mike will get the following to help him buy his new home:

- $10,000 from a special homebuyer program.

- $9,000 homebuyer credit from the home seller.

- $1,000 homebuyer credit from his real estate agent.

- $20,000 in total homebuyer money.

Mike's home loan will also help him buy the home plus any other money he may have saved to put towards his new home.

Mike also decides to use part of his homebuyer credits to get a lower interest rate.

Instead of getting a 6% interest rate.

He uses part of his homebuyer credits to buy down his interest rate.

So he has a 5.50% interest rate and a lower monthly payment.

The bottom line

I hope this short guide saves you time and money if you decide to buy a home in 2026.

And helps you avoid many of the silly homebuying mistakes I made early on.

Like not asking for homebuyer credits.

And not using them to get a lower interest rate.

A few more tips that might be useful:

If you want to buy a home

— JOHN HENRY (@thejohnhenry_) April 2, 2025

Here are 10 things to know

Plus: Down Payment Help

That's all for today.

See you next Saturday.