2026 Money Boosting Guide (7 steps to grow your money)

Jan 10, 2026Read time - 6 minutes / Disclosure

Investing and growing your money means:

- Less stress.

- More freedom.

- No anxiety when an unexpected bill pops up.

Unfortunately, most millennials didn't learn about money in school.

The Problem

School systems teach people to become life-long employees.

Not budgeters, savers, or investors.

When asked about money, most people feel:

- Stressed.

- Confused.

- Like most financial advice is for people that already have money.

The truth is..

Most people are just winging it.

Living paycheck to paycheck.

Trying to get by.

Hoping they'll be able to retire and live the life they truly want "someday".

I know this because..

I was one of them.

Feeling stuck in my 9-5 job.

Wondering if there was a better way.

A faster way to leave 9-5 life early to build my ideal life.

View on Threads

Like it was last month, I remember getting fired from my job at 29 years old.

I didn't work for 9 months.

And had $55,000 in credit card debt.

I was feeling pretty crummy about myself.

That's when I got my first job in finance.

Learning more about money and investing became my new obsession.

Watching wealthy bank clients manage their money was so damn interesting.

Seeing what they invested in.

How they thought about money.

What they did differently than most people.

And building those habits into my new life changed everything.

My credit card debt went from $55,000 to $0.

I was investing more money every month.

I finally felt confident about where my finances were headed.

And I kept at it until my stock and real estate investments hit $1M in my mid 30s.

It sure wasn't easy.

There were highs.

And there were lows.

Lows like losing thousands of dollars on an investment near the beginning of my journey.

That was super painful.

But learning more about money and investing changed my life.

"Money's greatest intrinsic value and this can't be overstated — is its ability to give you control over your time."

— Morgan Housel

How to Start Building Wealth

Here's the 7 steps I'd follow to boost my finances in 2026 if I was starting over from scratch with $55,000 on my credit cards.

Hope it's useful.

Let's dive in:

Step 1: The Tax Refund

According to the IRS, the average tax refund is around $3,000.

Since we're near the beginning of the year.

Instead of spending tax refund money on:

- New clothes.

- A new iphone.

- A cross country trip.

I'd open a high-yield savings account.

And save that money for life's little surprises.

(and life is full of 'em)

Having a few thousand dollars tucked away in a high yield savings account helps bring peace of mind.

Step 2: The Retirement Match

According to Fidelity the average retirement account match is around 5% per year.

I'd check to see if my job offered a retirement account.

And if they match any money I put into the retirement account.

The math of investing just 5%

— JOHN HENRY (@thejohnhenry_) October 20, 2025

of a $75,000 salary:

If a job matches the 5%—

Here’s how it's looked the last

30 years in stocks (S&P500):

- $371k in 15 years

- $491k in 20 years

- $1.4M in 30 years

Wild.

A retirement match can help grow an investment account to 6 or 7-figures over the long term.

Step 3: The Money Guide

"Becoming a millionaire doesn't happen by accident, unless you inherit money or win the lottery."

— Anonymous

I've never been lucky with the lottery.

And there's no big inheritance coming my way.

So using a money guide is the next best thing in my opinion.

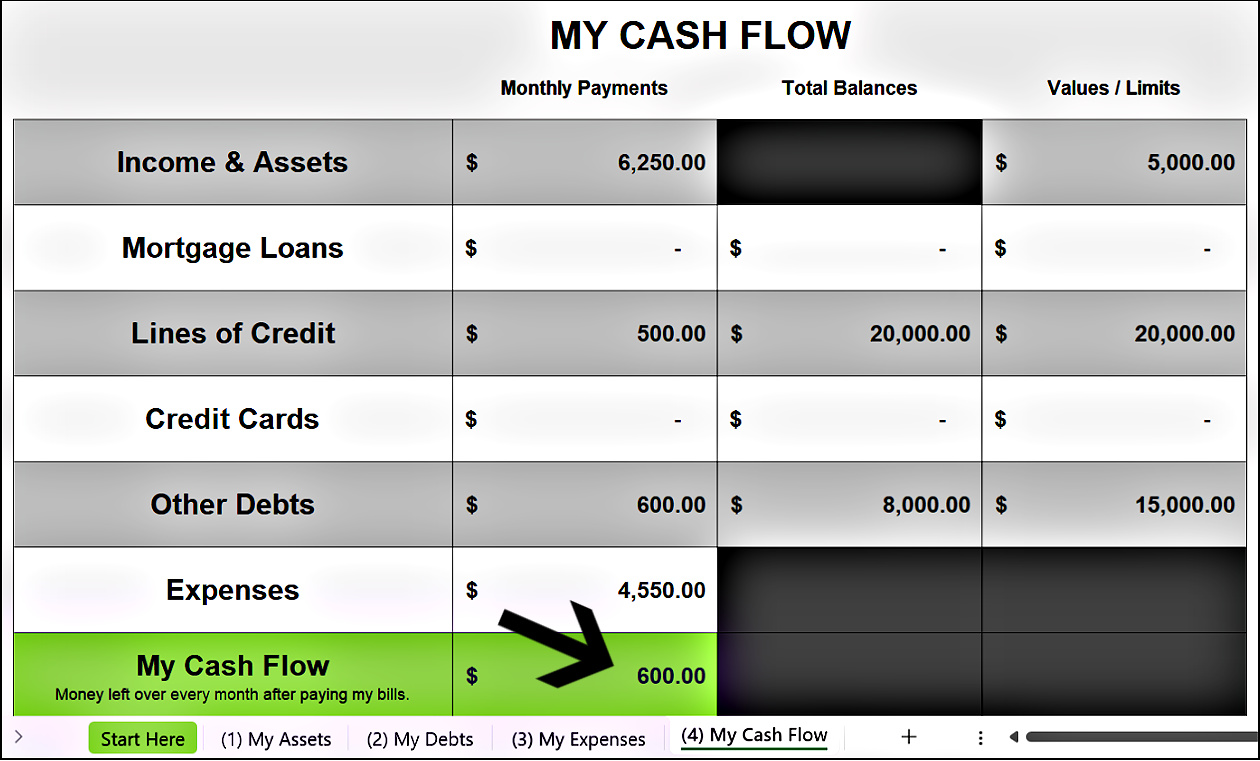

Most of the millionaire clients I looked up to in banking use a simple tool like this to track their money and investments:

Money guide example

Tools like this can feel intimidating at first.

But here's one I think is pretty easy:

Money guides help you build wealth faster so you can leave 9-5 life sooner to build your ideal life (if you want).

Step 4: The Money Game

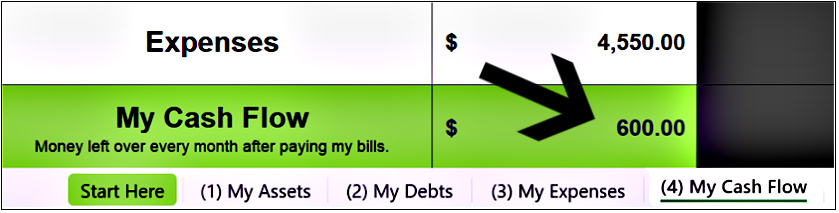

I've found money guides work best when turning them into a game.

A game of trying to get your "my cash flow" number to go higher and higher.

Example

3 ways to make that happen is to either:

1. Pay off bills.

2. Save more money.

3. Make more money.

(#3 is my favorite)

Spending just 30 minutes a month on a money guide can turn your finances around fast.

Step 5: The Cashflow Tweaks

There's many ways to boost your monthly cashflow.

I like to think of them as little "tweaks".

A few tweaks here and there can make a huge difference.

Tweaks like:

- Asking for a raise.

- Changing insurance.

- Getting a different job.

- Refinancing an auto loan.

- Refinancing a student loan.

A few minor tweaks can mean having:

$200 more per month.

$500 more per month.

$1,000+ more per month.

(my free cheat sheet with 7 money boosting tips)

Finding ways to make and save more money means having peace of mind (and more money to invest).

Step 6: The Motivation Method

The one harsh truth about personal finance..

It's bloody boring.

Finding ways to motivate yourself to do these things.

Is just as important as knowing what to do.

The thing that kept me going.

Was taping pictures of the places I was going to visit on my bathroom mirror.

Places I wanted to see after quitting my 9-5 job to do my own thing.

Why?

Because nobody springs out of bed in the morning.

Excited to check their money guide.

(nobody I've met at least)

Seeing these pictures every morning reminded me that I didn't want to sit under florescent lights working a 9-5 job for 40 years of my life.

After leaving my finance job in 2020 I traveled for 6 weeks before starting this little online education business.

- To Africa.

- To Europe.

- To the Caribbean.

- To the Middle East.

Riding a camel in Cairo, Egypt

Finding the motivation to spend just 30 minutes a month looking at your money guide and making little "tweaks" can change everything in the long run.

Step 7: The Blueprint

Here's an example of how the above steps might look.

Nick's Money Story

Nick has a good job making $75,000 per year.

But he feels like he's drowning in debt and can't get ahead.

Step 1:

Since it's the beginning of the year.

Nick files his tax return and gets back $2,500.

Instead of buying something fancy.

He opens a high yield savings account paying him 3.50% in interest.

And stashes his money in the new account.

Having an extra $2,500 for emergencies gives him peace of mind.

Step 2:

Nick looks into his retirement benefits at work.

And sees his company offers a 5% retirement match.

He doesn't want to miss out on any free retirement money.

So he has 5% of his paychecks go into his retirement account at work.

And his job matches that money (which doubles his money).

Step 3:

Nick doesn't use a money guide or a money tracker.

He just estimates how much money he makes every month.

And how much money he has in bills every month.

Nick realizes this isn't working very well.

He has:

- $30,000 in student loans

- $3,000 on a credit card.

- $5,000 on a 2nd credit card.

Nick doesn't want to work a 9-5 job his entire life.

He wants to start his own little online business.

And doing that seems impossible with his current money situation.

So he starts using a money guide.

To help him save, invest, and begin planning his early escape from 9-5 life.

Step 4:

Nick updates his new money guide with his monthly income and his monthly bills.

And see's he has around $100 left over every month after paying his living expenses.

This scares Nick..

He wants to have at least $1,000 left over every month after paying his living expenses.

So he feels like he has more breathing room with his money.

He commits to spending 30 minutes the 1st of every month tinkering with his new money guide.

He realizes it's unlikely he'll ever become a millionaire some day if he doesn't have a plan for his money.

Step 5:

Nick spends 30 minutes the 1st of every month tweaking his money guide.

His goal is to find ways to have more money left over every month after paying his bills.

Money he can invest.

He:

- Refinances his student loan to get a lower interest rate and a lower monthly payment and saves $150 per month.

- Changes insurance companies to get a better deal and saves $50 per month.

- Takes a different job at work and makes $500 more per month after taxes.

These changes give Nick $700 more per month.

Nick treats his money guide like a game.

A game of finding 2 or 3 ways to save and invest more money every month.

Step 6:

Nick fears he may skip doing his 30 minute money exercises.

Because life gets busy.

And things happen.

So he writes down a list of what he wants and doesn't want in life:

1. I don't want to work a 9-5 job for 40 years.

2. I want to start my own little part time online business and quit my job.

3. I want to invest in stocks and property and become a millionaire within 10 years.

He also finds a picture of Bali, a place he wants to visit after quitting his job.

He tapes the hand written note and the picture of Bali to a dresser in his room.

So he'll see it every day to help him stay motivated.

Step 7:

After 6 months of using the money guide.

And spending just 30 minutes a month on it.

Nick went from having $100 left over every month after paying his bills.

To having $1,100 left over every month.

Nick has been getting his full retirement match at work which is invested in the stock market.

He's paid off his credit cards.

And he's paying extra on his student loan.

Plus he opened up his own investing account and is dumping $500 a month into it.

The bottom line

I hope this short guide is helpful if you're feeling stressed about money and want to boost your finances in 2026.

Using a money guide consistently.

And making tweaks to my finances each month changed everything for me.

It helped me feel:

- Less stressed.

- More certain about my finances.

- Helped me find more money to invest.

This might be useful as well:

Stocks can make you a millionaire.

— JOHN HENRY (@thejohnhenry_) November 23, 2024

But 99% don’t know the basics.

Here’s 10 tips to get you started:

That's all for today.

See you next Saturday.