The Money Game (aka building wealth)

Oct 25, 2025Read time - 4 minutes / Disclosure

Figuring out money can:

- Lower your bills.

- Reduce your stress.

- Give you more freedom.

Unfortunately, it can be a confusing thing.

The Problem

Making sense of money terms like:

- Total equity.

- Portfolio value.

- Compounding rate.

...can sound like mumbo-jumbo to a beginner investor.

It did to me at first.

Which can lead to not investing.

But that can mean missing out on future money growth.

The math of investing just 5%

— JOHN HENRY (@thejohnhenry_) October 20, 2025

of a $75,000 salary:

If a job matches the 5%—

Here’s how it's looked the last

30 years in stocks (S&P500):

- $371k in 15 years

- $491k in 20 years

- $1.4M in 30 years

Wild.

Like it was yesterday, I remember using my first money tracker.

It confused the hell out of me.

But I knew watching my money closely could be a way out of 9-5 life early.

Little did I know it would lead to $1M of investments in just over 10 years.

And I'm no math whiz (far from it).

Mostly a C math student before going on to selling cell phones in a mall for 10 years before working in finance.

But focusing hard on money and investing has given me more options.

Options like—

No alarm clock.

Working part time.

Seeing family more.

The goal never was to not work.

The goal was to be work optional a few decades early.

Two important things that helped near the beginning of my journey:

1. Finding an easy way to track my money.

2. Finding ways to come up with more money to invest.

I tried a bunch of different tools.

But none of them seemed just right.

So I created my own little tool.

The Cash Flow Guide

Here's how to use it in 4 easy steps (and where to download it for free if you're interested).

Let's dive in:

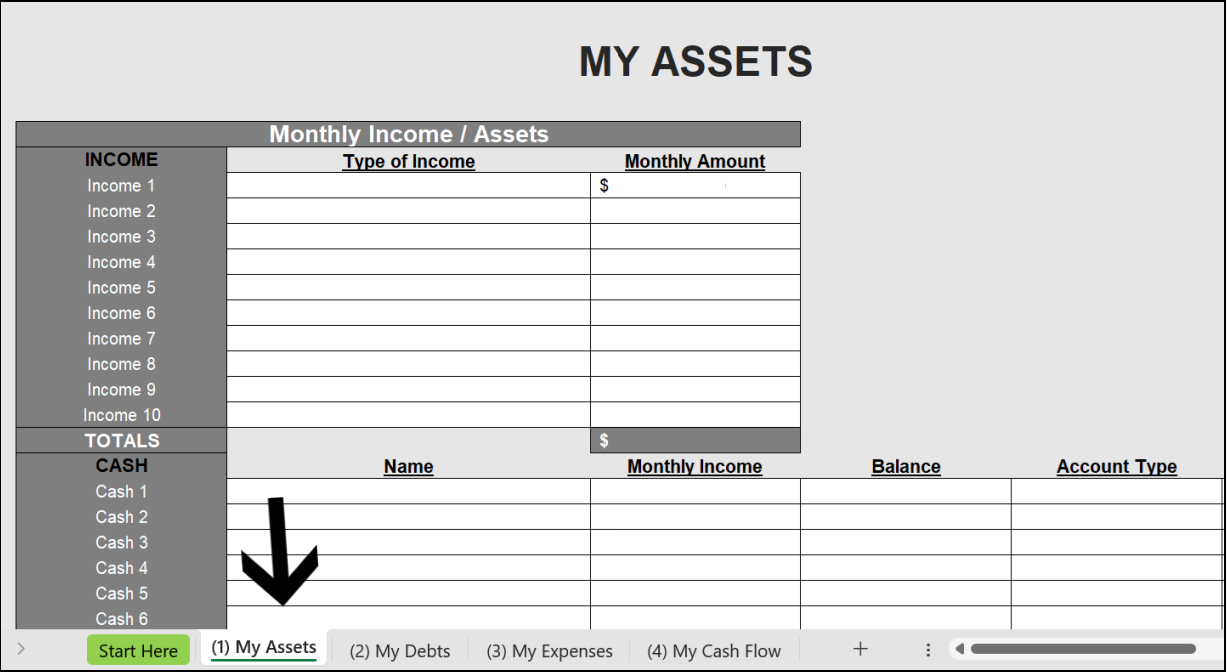

1. My Assets

We'll use Mike as an example.

After downloading the cash flow guide on a regular computer (it works better than a cell phone).

Mike clicks a tab at the bottom of the screen called:

- My Assets

He finds "Type of Income".

And types in: JOB

To the right he clicks on the cell under "Monthly Amount".

And types in how much money is deposited into his account every month from his job.

Further down he types in his checking account info from Mountain Bank and his savings account info from Golden Credit Union.

He notices an "Investment" and a "Retirement" section further down.

But he leaves those blank since he's just getting started on his investing journey.

(Take 5-10 minutes to fill out "My Assets")

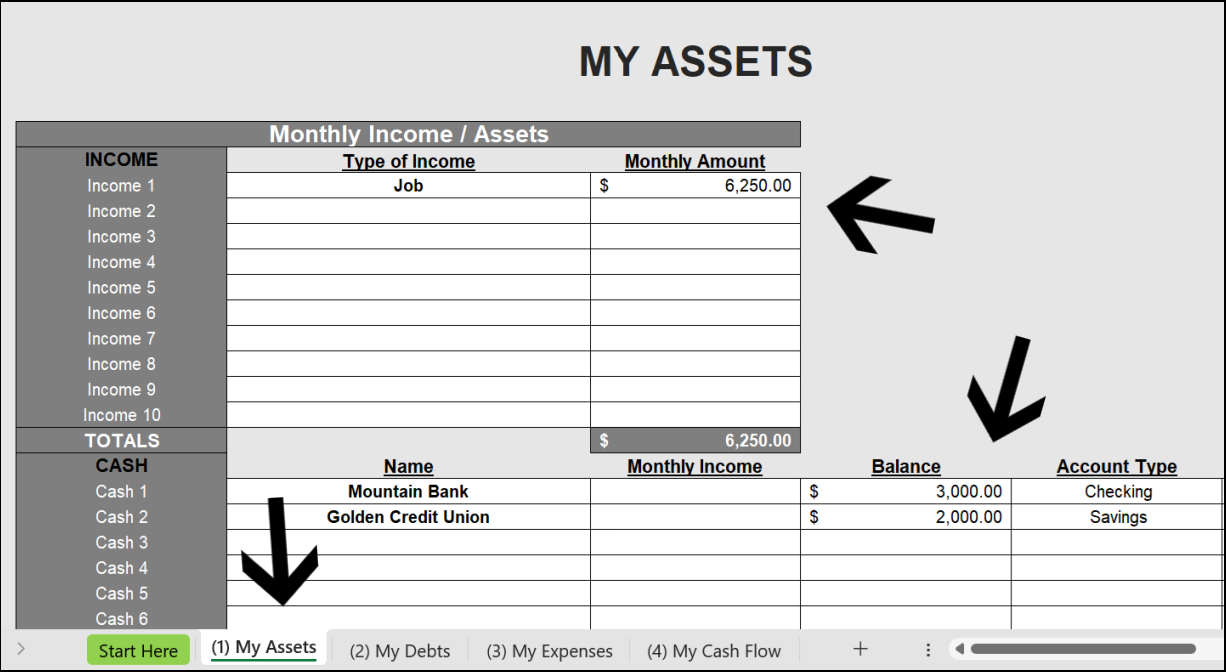

2. My Debts

Next he clicks a tab at the bottom of the screen called:

- My Debts

Under the "Lines of Credit" section he types in his student loan from Cal Bank.

Under the "Auto Loans" section he types in his auto loan from MM Bank.

He notices a "Mortgage Debt" section.

And a "Credit Card" and "Other Debt" section further down.

But doesn't have anything to put there so he leaves them blank.

(Take 5-10 minutes to fill out "My Debts")

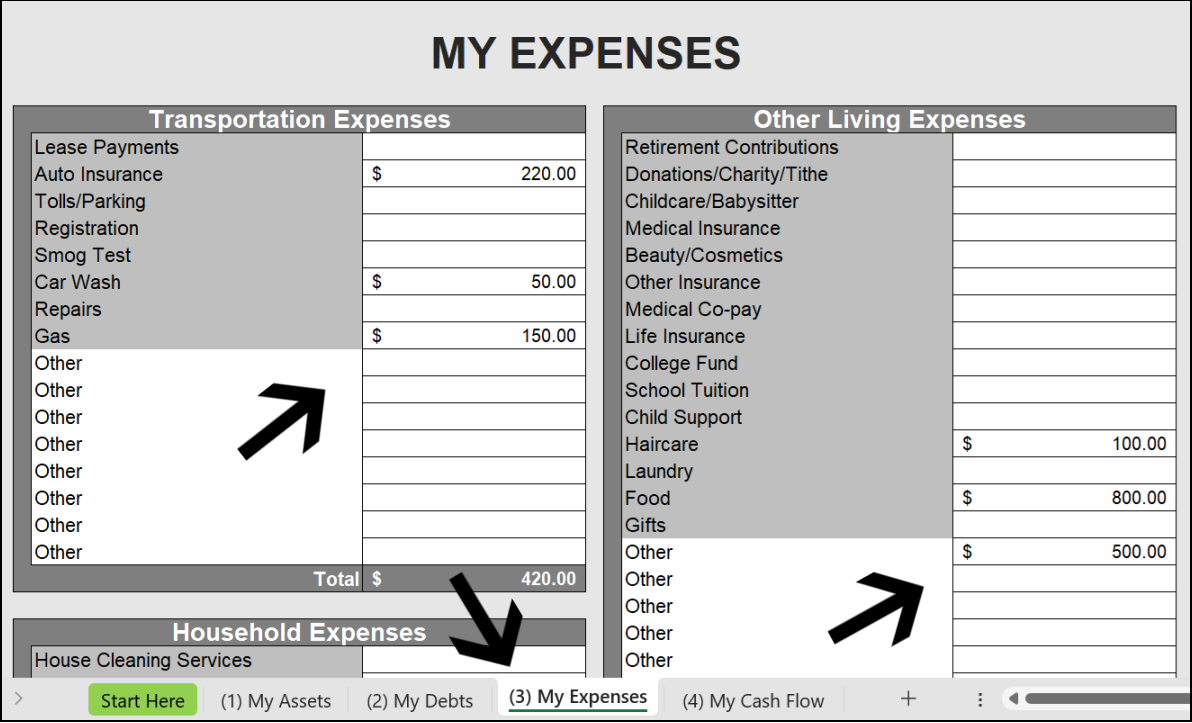

3. My Expenses

Next he clicks a tab at the bottom of the screen called:

- My Expenses

Under "Transportation Expenses" and "Other Living Expenses" he types in his monthly costs.

Some of them he knows exactly, and others he estimates.

He makes sure not to list any monthly expenses that already come out of his paycheck like:

- Medical insurance.

- Retirement contributions (he plans to start this soon).

In the "Other" section he adds $500 to be on the safe side (since life is unpredictable).

And he notices there's a "Household Expenses" section further down.

He fills that out too which includes his monthly rent payment.

(Take 5-10 minutes to fill out "My Expenses")

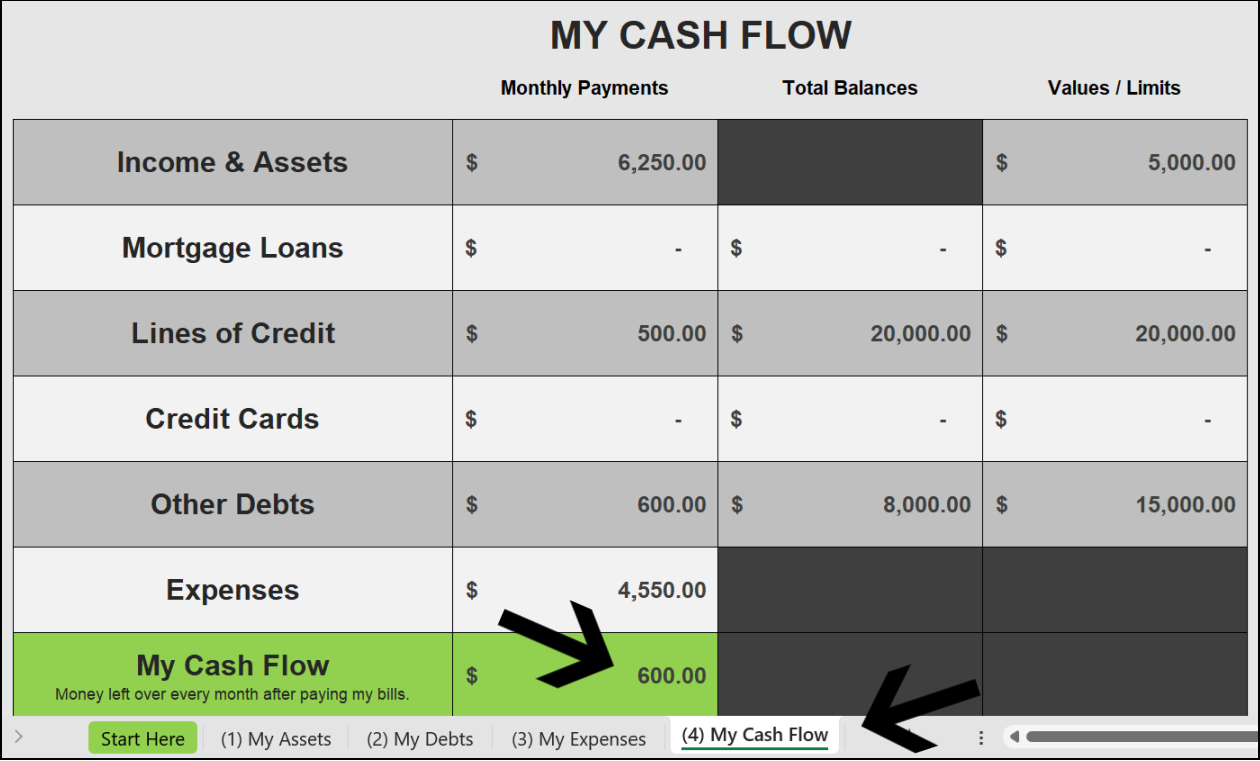

4. My Cash Flow

Last he clicks a tab at the bottom of the screen called:

- My Cash Flow

He notices all of the info he typed into the first 3 steps:

(1) My Assets

(2) My Debts

(3) My Expenses

...automatically show up on the My Cash Flow tab.

Which is great because he's not a fan of doing math.

In the green section Mike sees he has $600 left over every month after paying his bills.

Mike knows the $600 is a rough estimate (because life is full of surprises).

But he decides to send:

- $300 every month to a new investment account to build up his assets.

- $300 every month towards his car payment to pay it off early.

His "My Cash Flow" number will then become $1,200 every month instead of $600 after his car is paid off early.

At that point he plans to send $600 every month towards his investments and $600 extra towards his student loan.

After that is paid off early his "My Cash Flow" number will become $1,700 every month instead of $1,200.

How does your "My Cash Flow" number look?

The bottom line

The first time I did something like this.

My cash flow number was -$400.

Loosing money every month..

It was like a punch in the gut.

After using a money tracker for 10+ years.

Here's two things I've learned:

1. The numbers don't need to be perfect.

In the beginning I stressed over getting all of the numbers "just right". But eventually realized that's impossible because life isn't perfect and things happen like:

- The car needs a new tire because of an unexpected nail.

- The dog has an infection and the vet wants to pull 3 teeth.

- A quick visit to the doctor turns into some expensive lab tests.

So I spend just 30 minutes a month tinkering with the cash flow guide and call it a day (once in a while I forget to do it).

2. Viewing it as a game works well.

The goal with this tool is to get the green "My Cash Flow" number as high as possible so you have more money left over every month (more money to invest ideally).

I've found viewing it as a game makes the whole thing feel less intimidating.

Three ways to increase your "My Cash Flow" number are:

1. Making more money.

2. Saving on expenses.

3. Paying off debts.

Fiddling around with this tool every month for 30 minutes.

And thinking of ways to fix my -$400 monthly cash flow number.

Eventually moved that -$400 every month to positive $500 - than positive $1,000 - than positive $2,000 - than positive $3,000+

It didn't happen overnight.

And it wasn't easy.

But those 30 minutes of focus every month sure made a massive impact in the long run.

If you're interested, you can download The Cash Flow Guide here free.

This cheat sheet might be useful too if you're looking for ways to save more money:

That's all for today.

See you next Saturday.